- Canada

- /

- Real Estate

- /

- TSX:DRM

3 Undervalued Small Caps In Global With Recent Insider Buying

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and consumer spending concerns, small-cap stocks have faced notable challenges, with the S&P MidCap 400 and Russell 2000 indices both experiencing declines. Amid this backdrop of cautious sentiment and economic uncertainty, identifying promising small-cap opportunities requires a keen focus on fundamentals such as financial health and growth potential.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.8x | 5.0x | 23.03% | ★★★★★★ |

| 4imprint Group | 16.7x | 1.4x | 33.78% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 27.56% | ★★★★★☆ |

| Gamma Communications | 22.7x | 2.3x | 34.98% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 12.0x | 1.9x | 21.36% | ★★★★☆☆ |

| Franchise Brands | 39.1x | 2.0x | 25.14% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.01% | ★★★★☆☆ |

| Calfrac Well Services | 11.6x | 0.2x | -34.65% | ★★★☆☆☆ |

| CVS Group | 38.4x | 1.1x | 38.64% | ★★★☆☆☆ |

| Logistri Fastighets | 17.0x | 8.1x | 17.43% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

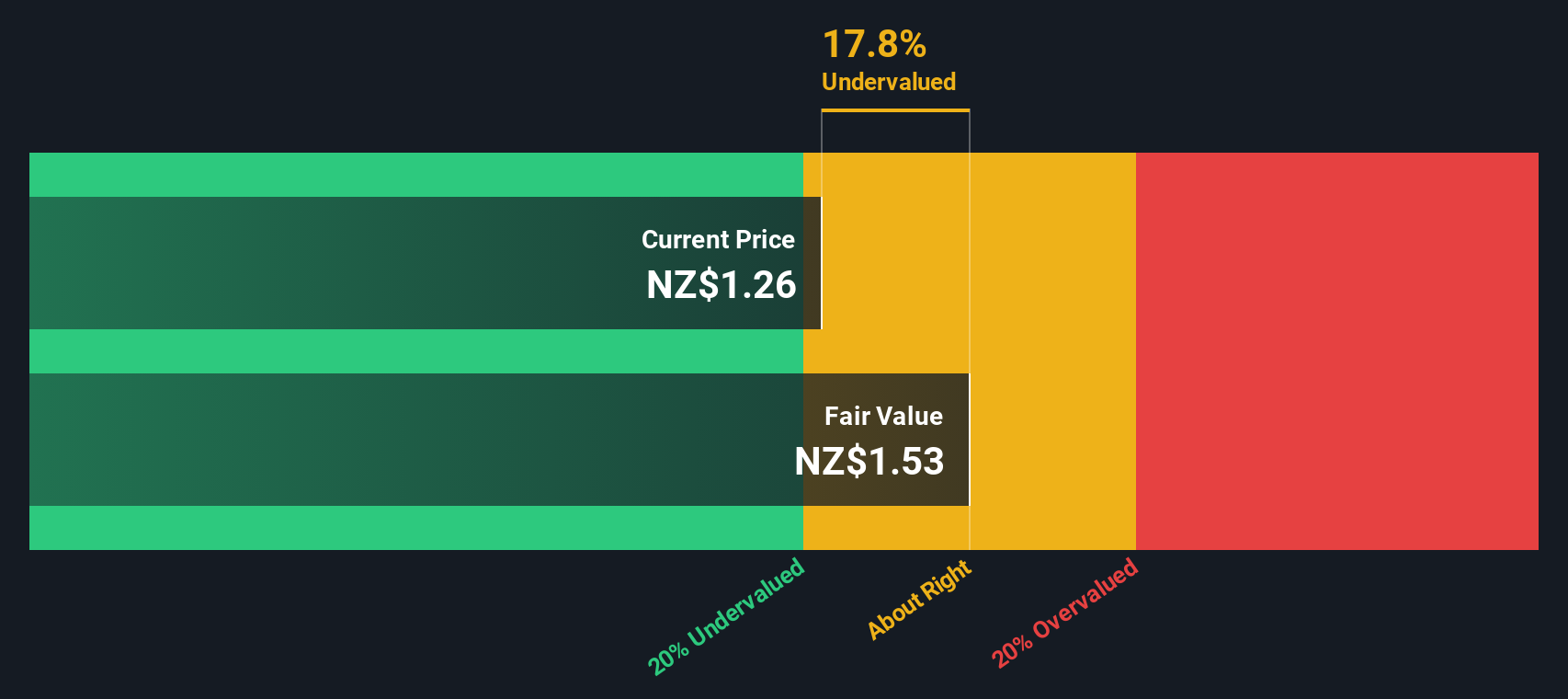

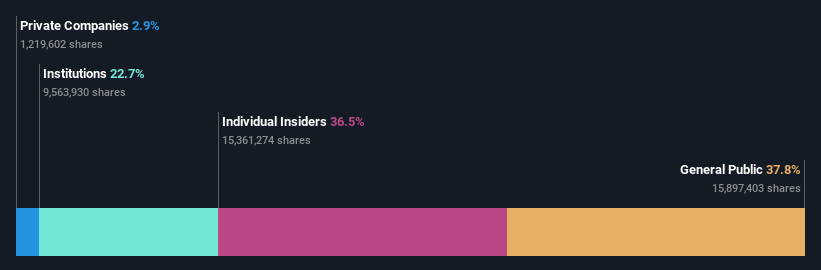

Precinct Properties NZ & Precinct Properties Investments (NZSE:PCT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Precinct Properties NZ & Precinct Properties Investments is a New Zealand-based real estate company specializing in flexible space, hotel and hospitality, investment management, and investment properties, with a market capitalization of approximately NZ$1.57 billion.

Operations: Precinct Properties NZ generates revenue primarily from its investment properties, contributing NZ$215.60 million, with additional income streams from flexible space, hotel and hospitality, and investment management services. The company has experienced fluctuations in its net income margin over time, reaching as high as 2.02% before declining to negative figures in recent periods. Operating expenses have varied but remained a significant component of the cost structure alongside non-operating expenses that have impacted profitability.

PE: -64.7x

Precinct Properties, a smaller player in the market, recently reported half-year sales of NZ$134.4 million, up from NZ$121 million the previous year. However, net income fell to NZ$9.2 million from NZ$15.3 million. Despite this dip in earnings and reliance on external borrowing for funding, insider confidence is evident with recent share purchases in early 2025. Earnings are projected to grow nearly 65% annually, suggesting potential for future value appreciation amidst current financial challenges.

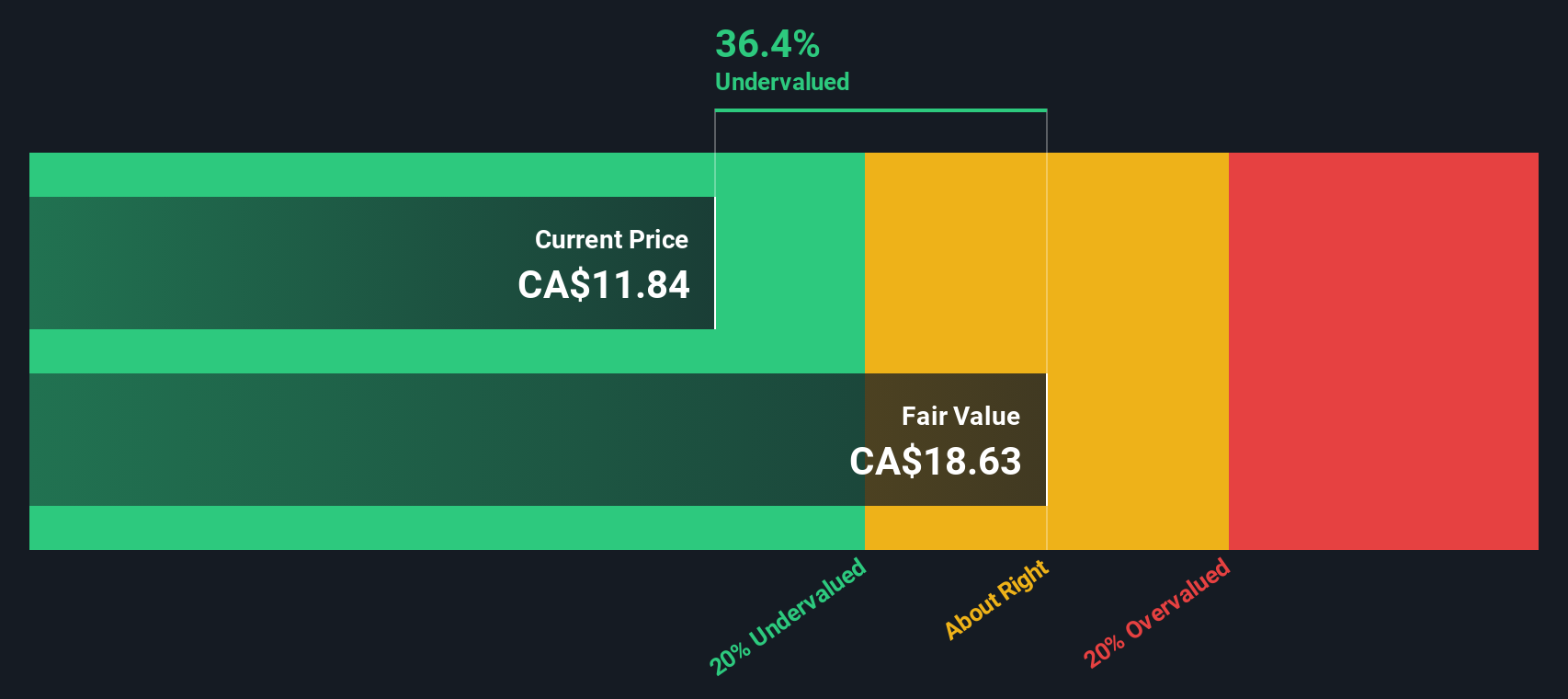

Dream Unlimited (TSX:DRM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dream Unlimited is a Canadian real estate company involved in development and recurring income operations, with a market cap of approximately CA$1.54 billion.

Operations: Dream Unlimited generates revenue primarily from its development and recurring income segments, with recent figures showing CA$403.27 million and CA$221.24 million, respectively. The company's gross profit margin has shown variability, reaching 32.29% in the latest period.

PE: 4.8x

Dream Unlimited, a company with a focus on Canadian multi-family properties, recently showcased insider confidence with share purchases in February 2025. Despite earnings forecasts predicting a decline over the next three years, Dream's strategic $2 billion joint venture aims to expand their rental property footprint across Canada. The firm reported significant financial recovery for 2024, turning CAD 187.86 million in net income from the previous year's loss. Additionally, they increased dividends and launched new institutional partnerships to bolster growth prospects.

- Get an in-depth perspective on Dream Unlimited's performance by reading our valuation report here.

Assess Dream Unlimited's past performance with our detailed historical performance reports.

H&R Real Estate Investment Trust (TSX:HR.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: H&R Real Estate Investment Trust operates a diversified portfolio with revenue segments in office, retail, industrial, and residential properties, and has a market capitalization of CA$3.74 billion.

Operations: The primary revenue streams are derived from office, retail, industrial, and residential segments. Over recent periods, the gross profit margin has shown fluctuations with a notable high of 82.57% in early 2020 before stabilizing around the mid-60s percentage range later on. Operating expenses have been relatively consistent but non-operating expenses have significantly impacted net income margins in several periods.

PE: -22.1x

H&R Real Estate Investment Trust, a smaller player in the real estate sector, recently reported a turnaround with Q4 net income of C$130.88 million against a loss last year. Despite this positive shift, annual sales declined to C$816.99 million from C$847.15 million previously. Insiders have shown confidence through recent share purchases, suggesting belief in future growth prospects despite reliance on external borrowing for funding and interest payments not being well covered by earnings.

Taking Advantage

- Dive into all 112 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DRM

Dream Unlimited

Dream Unlimited Corp. formerly known as Dundee Realty Corporation is a real estate investment firm.

Slight and fair value.

Market Insights

Community Narratives