- Canada

- /

- Consumer Finance

- /

- TSX:GSY

January 2025's Noteworthy Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a landscape of cooling inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks notably outperforming growth shares. This environment presents opportunities for discerning investors to identify stocks that may be trading below their intrinsic value, offering potential for future appreciation as market conditions evolve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Livero (TSE:9245) | ¥1558.00 | ¥3107.48 | 49.9% |

| Strike CompanyLimited (TSE:6196) | ¥3600.00 | ¥7189.65 | 49.9% |

| Solum (KOSE:A248070) | ₩18620.00 | ₩37219.83 | 50% |

| North Electro-OpticLtd (SHSE:600184) | CN¥10.81 | CN¥21.57 | 49.9% |

| EuroGroup Laminations (BIT:EGLA) | €2.54 | €5.06 | 49.8% |

| ASMPT (SEHK:522) | HK$75.15 | HK$150.17 | 50% |

| Shinko Electric Industries (TSE:6967) | ¥5849.00 | ¥11653.46 | 49.8% |

| Equifax (NYSE:EFX) | US$268.88 | US$535.98 | 49.8% |

| BATM Advanced Communications (LSE:BVC) | £0.19 | £0.38 | 49.8% |

| RXO (NYSE:RXO) | US$26.19 | US$52.36 | 50% |

Underneath we present a selection of stocks filtered out by our screen.

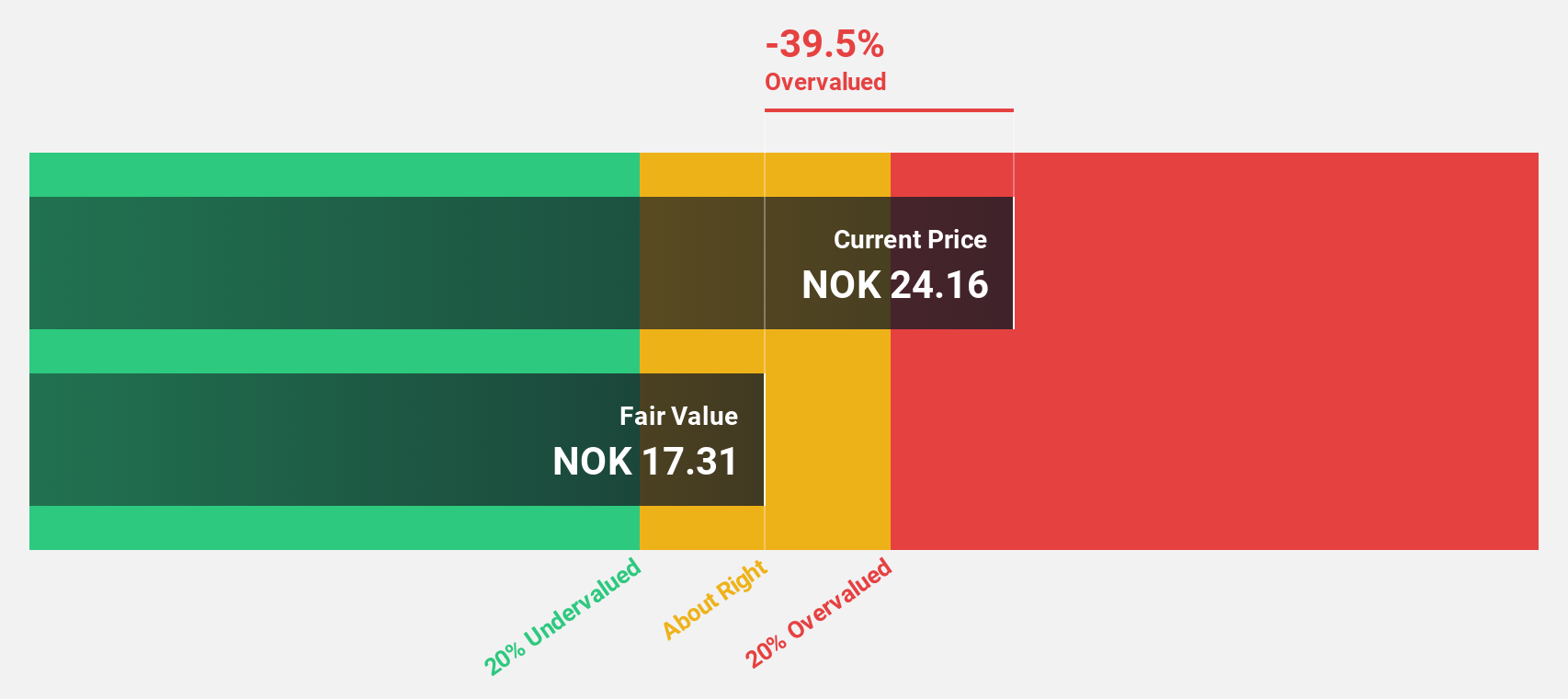

Elkem (OB:ELK)

Overview: Elkem ASA is a company that provides advanced material solutions globally, with a market capitalization of NOK12.43 billion.

Operations: The company's revenue segments are comprised of Silicones at NOK14.33 billion, Silicon Products (including Foundry Products) at NOK15.05 billion, and Carbon Solutions at NOK3.63 billion.

Estimated Discount To Fair Value: 36.3%

Elkem is trading at NOK 19.6, significantly below its estimated fair value of NOK 30.76, indicating potential undervaluation based on cash flows. Despite forecasted earnings growth of over 81% annually, Elkem's return on equity is expected to remain low at 5.8%. Recent initiatives include a long-term power agreement and EU-funded projects aimed at reducing CO2 emissions in silicon production, which could enhance operational sustainability and potentially improve financial performance over time.

- Insights from our recent growth report point to a promising forecast for Elkem's business outlook.

- Dive into the specifics of Elkem here with our thorough financial health report.

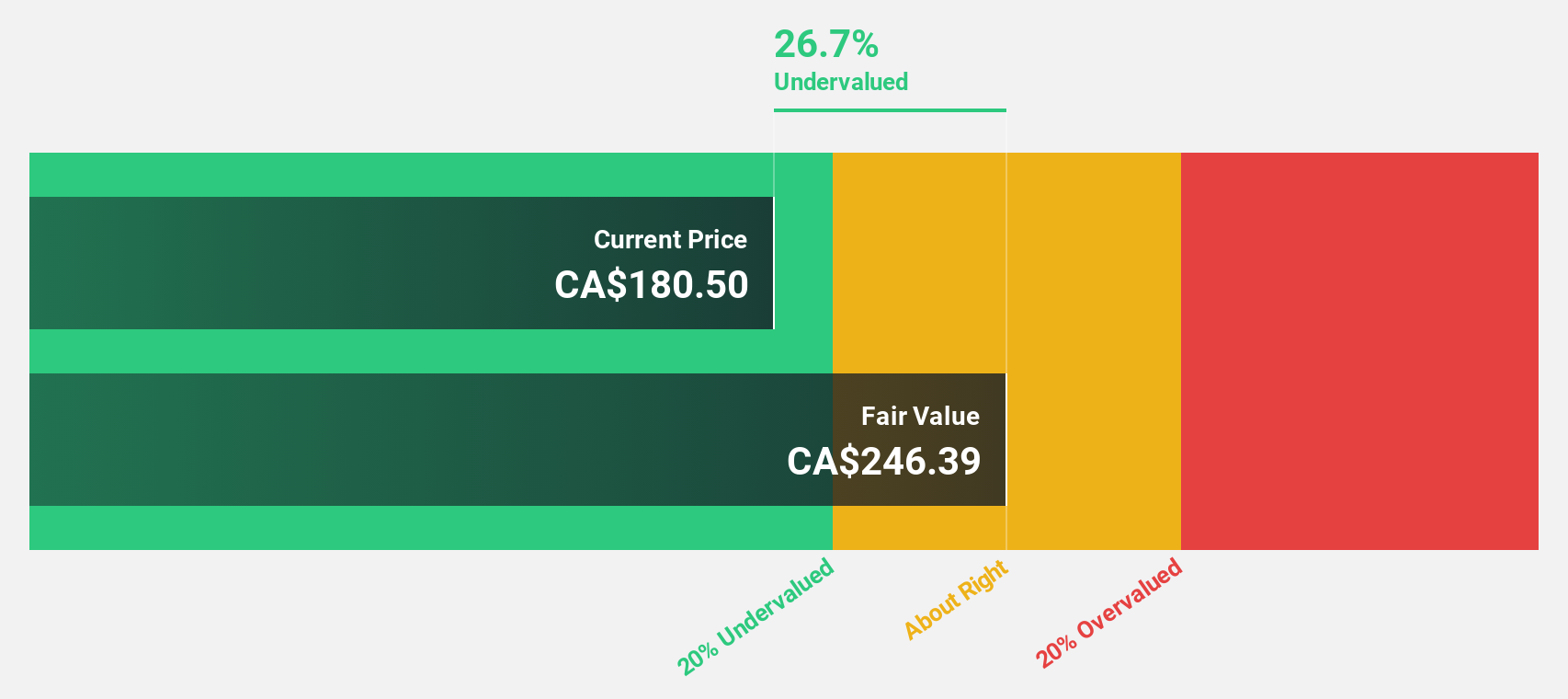

Colliers International Group (TSX:CIGI)

Overview: Colliers International Group Inc. offers commercial real estate and investment management services to corporate and institutional clients across various regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market cap of CA$10.20 billion.

Operations: The company's revenue segments consist of Investment Management services generating $505.11 million and a Segment Adjustment amounting to $4.05 billion.

Estimated Discount To Fair Value: 31.2%

Colliers International Group, trading at CA$204.11, is undervalued based on cash flows with an estimated fair value of CA$296.81. Despite significant insider selling recently, the company's earnings are expected to grow annually by 24.1%, outpacing the Canadian market's 15.5%. However, debt coverage by operating cash flow remains a concern. The recent expansion of its credit facility to US$2.25 billion enhances financial flexibility for growth initiatives and strategic investments.

- According our earnings growth report, there's an indication that Colliers International Group might be ready to expand.

- Take a closer look at Colliers International Group's balance sheet health here in our report.

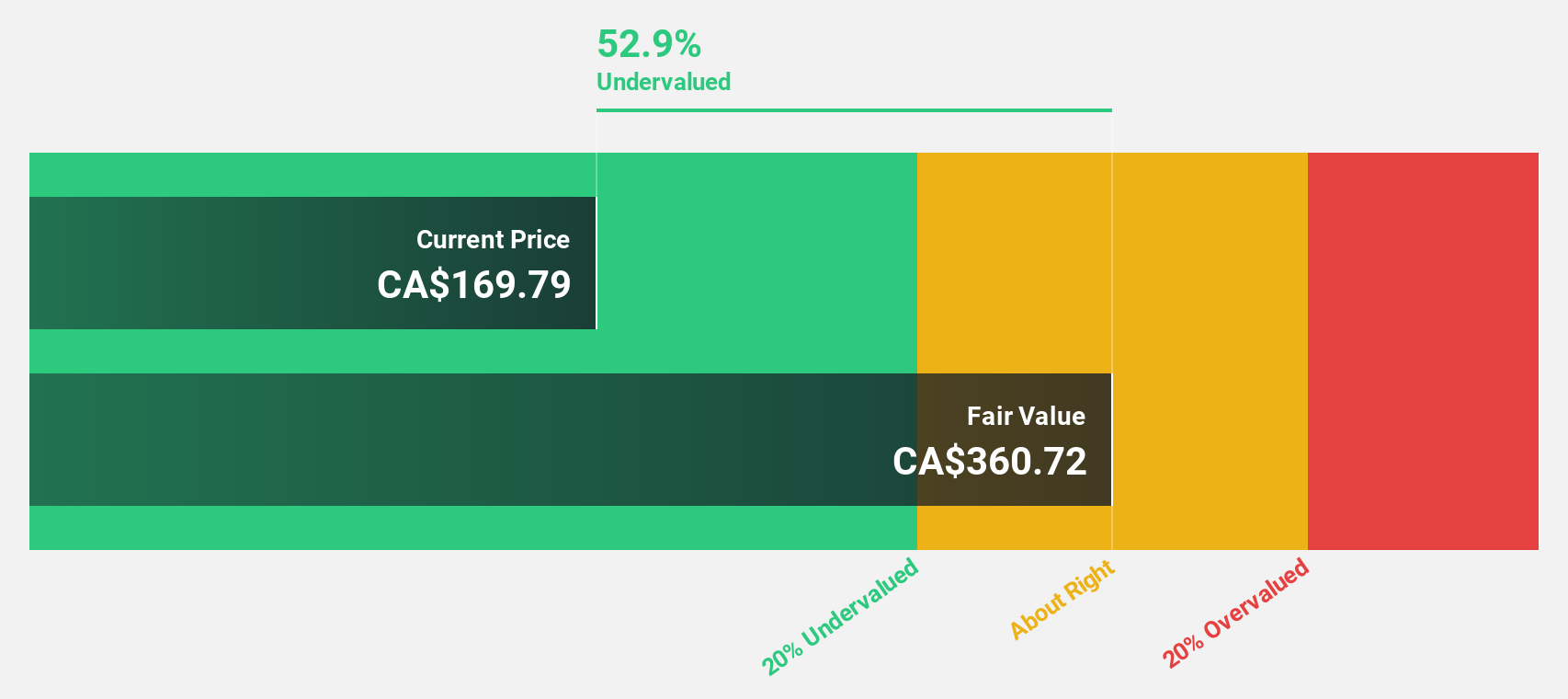

goeasy (TSX:GSY)

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands, with a market cap of CA$3.08 billion.

Operations: The company's revenue segments consist of CA$153.68 million from Easyhome and CA$1.30 billion from Easyfinancial.

Estimated Discount To Fair Value: 48.8%

goeasy, trading at CA$190.85, is significantly undervalued with a fair value estimate of CA$372.94. Despite high debt not well covered by operating cash flow, earnings and revenue are projected to grow annually by 15% and 24.1%, respectively—outpacing the Canadian market in revenue growth. The company announced a share repurchase program for up to 7.73% of its shares, potentially enhancing shareholder value despite recent insider selling and interim CEO changes.

- In light of our recent growth report, it seems possible that goeasy's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of goeasy.

Turning Ideas Into Actions

- Access the full spectrum of 878 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Exceptional growth potential, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion