- Canada

- /

- Real Estate

- /

- TSX:CIGI

3 TSX Stocks Possibly Trading At Discounts Of Up To 49.4%

Reviewed by Simply Wall St

The market has been flat over the last week but is up 10% over the past year, with earnings forecast to grow by 15% annually. In this environment, identifying undervalued stocks can be crucial for investors looking to capitalize on potential gains and secure long-term growth.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Decisive Dividend (TSXV:DE) | CA$6.80 | CA$11.77 | 42.2% |

| Trisura Group (TSX:TSU) | CA$45.23 | CA$79.84 | 43.3% |

| Kraken Robotics (TSXV:PNG) | CA$1.21 | CA$2.24 | 46.1% |

| Colliers International Group (TSX:CIGI) | CA$189.70 | CA$374.98 | 49.4% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Amerigo Resources (TSX:ARG) | CA$1.55 | CA$2.74 | 43.4% |

| Green Thumb Industries (CNSX:GTII) | CA$15.54 | CA$30.31 | 48.7% |

| Hamilton Thorne (TSX:HTL) | CA$2.12 | CA$4.11 | 48.5% |

| Pan American Silver (TSX:PAAS) | CA$30.09 | CA$56.17 | 46.4% |

| Kits Eyecare (TSX:KITS) | CA$10.07 | CA$16.85 | 40.3% |

Let's review some notable picks from our screened stocks.

Green Thumb Industries (CNSX:GTII)

Overview: Green Thumb Industries Inc. manufactures, distributes, markets, and sells cannabis products for medical and adult use in the United States with a market cap of CA$3.66 billion.

Operations: Green Thumb Industries generates revenue through two primary segments: Retail ($806.38 million) and Consumer Packaged Goods ($583.78 million).

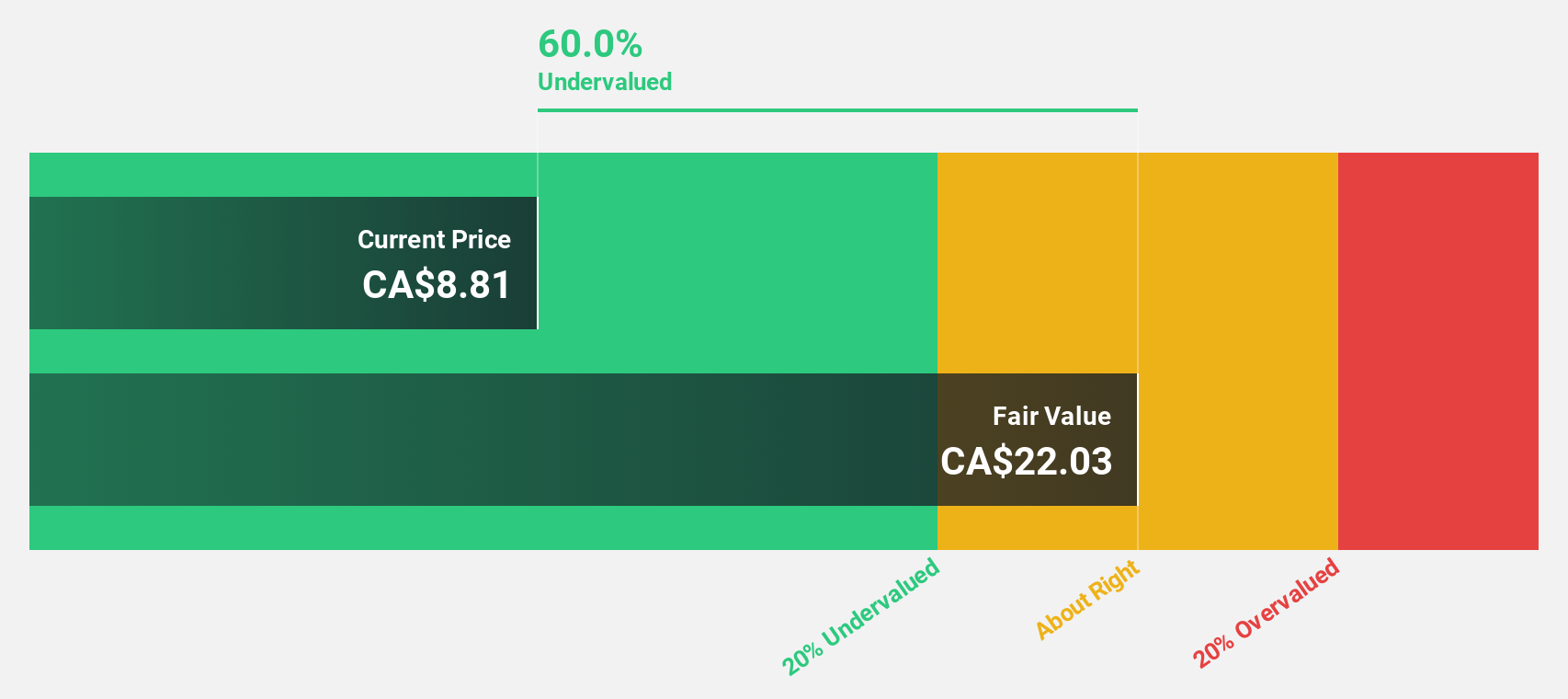

Estimated Discount To Fair Value: 48.7%

Green Thumb Industries (CA$15.54) trades at 48.7% below its estimated fair value of CA$30.31, suggesting significant undervaluation based on discounted cash flow analysis. The company has become profitable this year, with earnings expected to grow significantly at 27.86% annually over the next three years, outpacing the Canadian market's growth rate of 14.8%. However, its forecasted Return on Equity remains low at 10.2%. Recent expansions into New York and Florida further bolster revenue prospects.

- Our expertly prepared growth report on Green Thumb Industries implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Green Thumb Industries.

Colliers International Group (TSX:CIGI)

Overview: Colliers International Group Inc. (TSX:CIGI) offers commercial real estate professional and investment management services to corporate and institutional clients across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of CA$9.68 billion.

Operations: The company's revenue segments include $2.53 billion from the Americas, $616.58 million from Asia Pacific, $489.23 million from Investment Management, and $730.10 million from Europe, Middle East & Africa (EMEA).

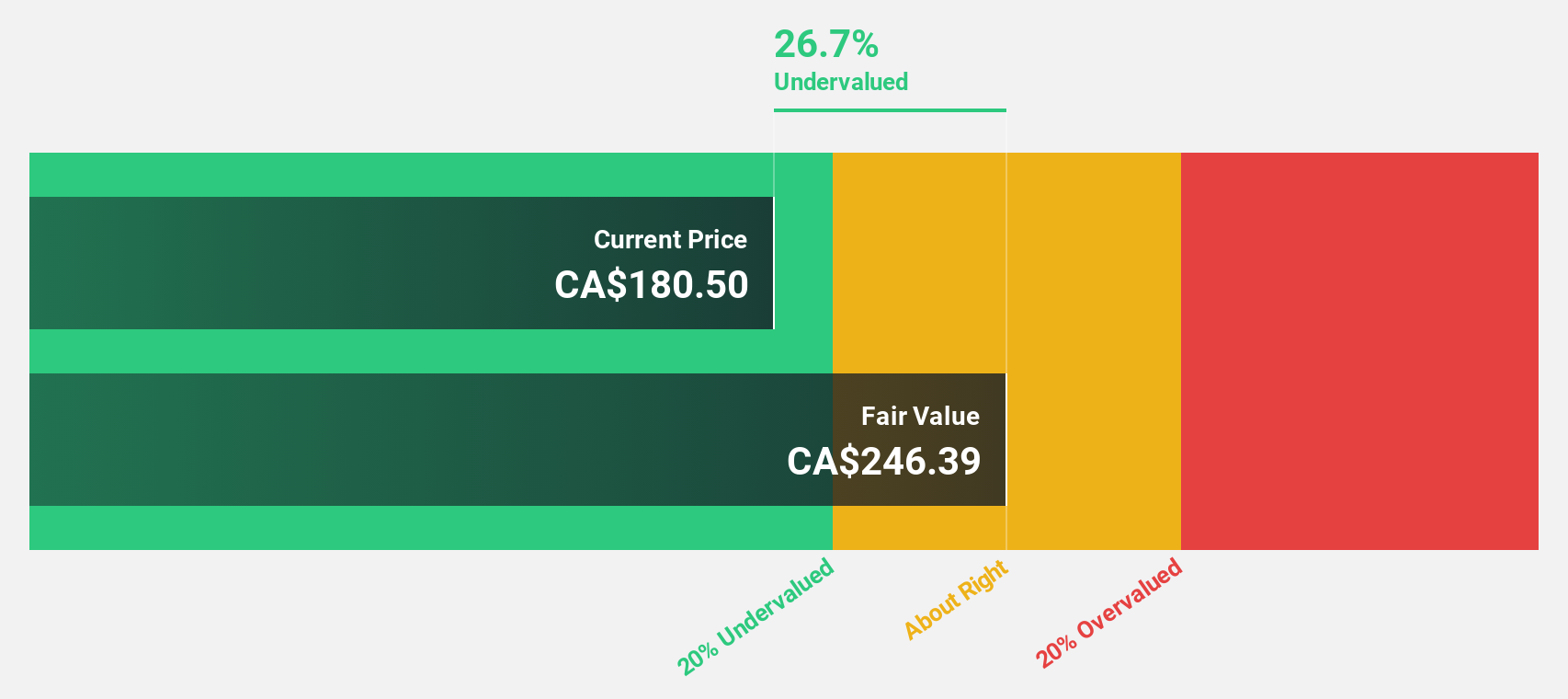

Estimated Discount To Fair Value: 49.4%

Colliers International Group (CA$189.7) appears significantly undervalued, trading at 49.4% below its estimated fair value of CA$374.98 based on discounted cash flow analysis. The company has shown strong earnings growth, with a 119.8% increase over the past year and forecasted annual profit growth of 38.34%. Recent strategic moves, including partnerships in Europe and marketing efforts for a casino resort in Mississippi, could further enhance revenue streams despite some insider selling and past shareholder dilution concerns.

- The analysis detailed in our Colliers International Group growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Colliers International Group.

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc., with a market cap of CA$94.76 billion, acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally.

Operations: Constellation Software Inc.'s revenue from the Software & Programming segment amounts to $8.84 billion.

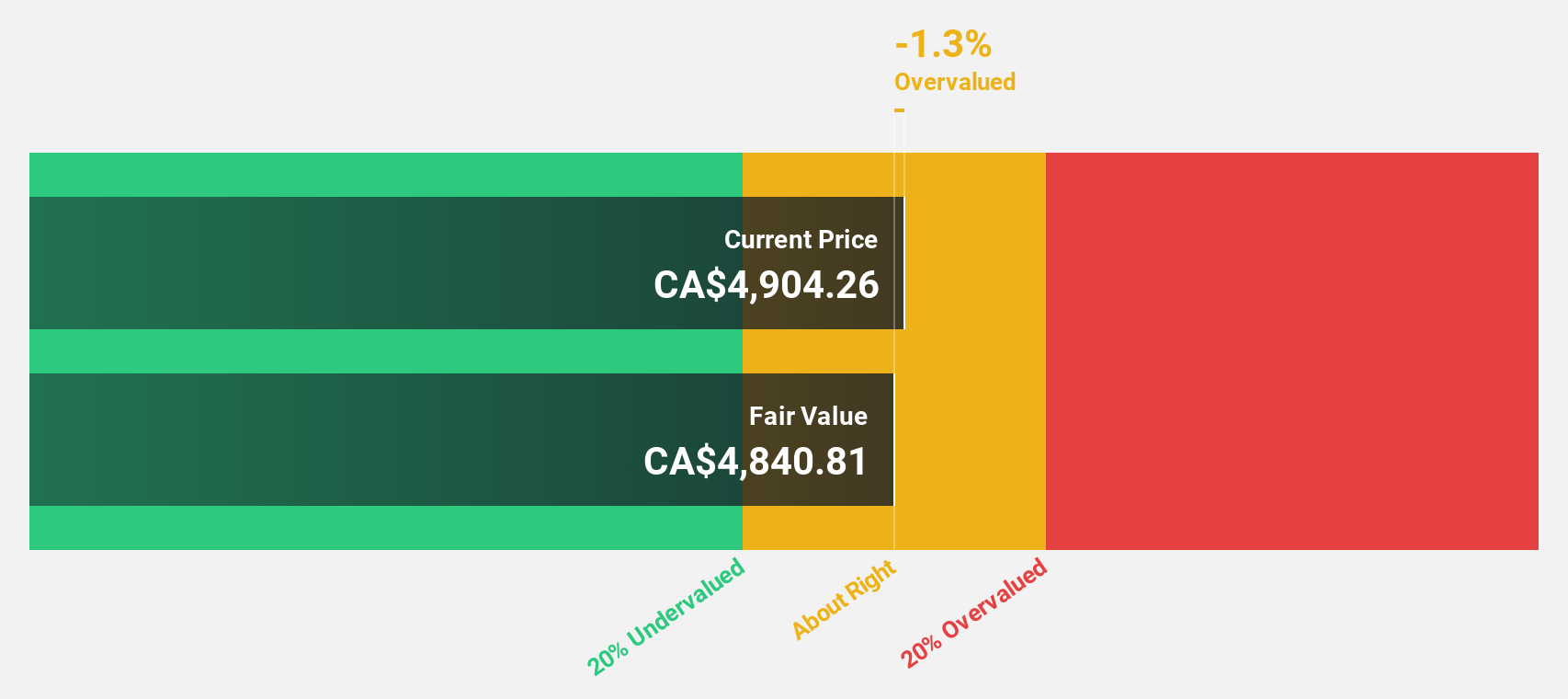

Estimated Discount To Fair Value: 32.2%

Constellation Software (CA$4349.25) is trading at 32.2% below its estimated fair value of CA$6419.38, based on discounted cash flow analysis, indicating it may be undervalued. Despite a high level of debt and significant insider selling over the past three months, earnings grew by 13.4% last year and are forecast to grow 23.6% annually over the next three years, outpacing the Canadian market's growth rate. Recent leadership changes and the launch of Omegro could further drive business expansion and capital deployment efficiency.

- The growth report we've compiled suggests that Constellation Software's future prospects could be on the up.

- Take a closer look at Constellation Software's balance sheet health here in our report.

Summing It All Up

- Get an in-depth perspective on all 26 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate to corporate and institutional clients in the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, India, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives