Every investor in Valens GroWorks Corp. (CVE:VLNS) should be aware of the most powerful shareholder groups. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

With a market capitalization of CA$470m, Valens GroWorks is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutions don't own many shares in the company. Let's take a closer look to see what the different types of shareholder can tell us about Valens GroWorks.

See our latest analysis for Valens GroWorks

What Does The Institutional Ownership Tell Us About Valens GroWorks?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

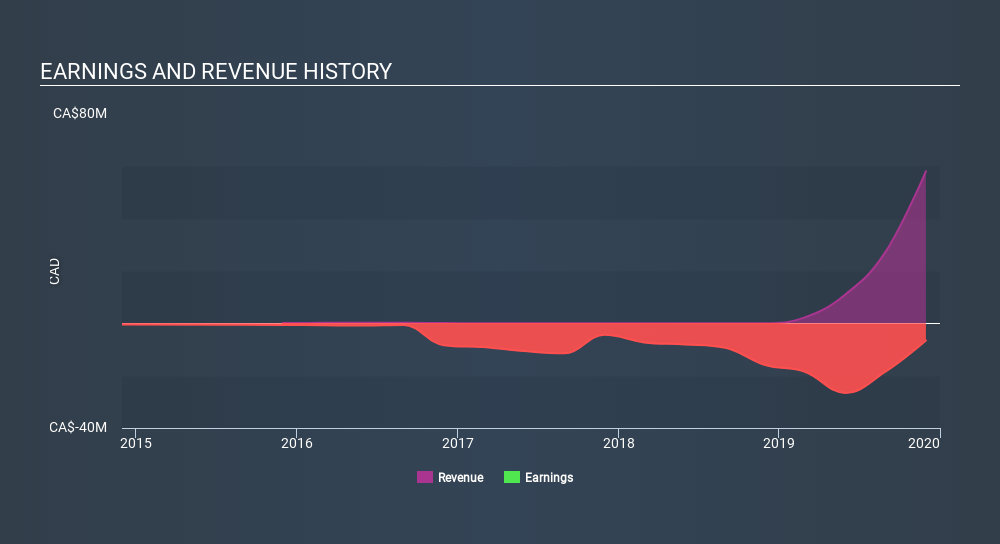

Institutions own less than 5% of Valens GroWorks. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. So if the company itself can improve over time, we may well see more institutional buyers in the future. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

We note that hedge funds don't have a meaningful investment in Valens GroWorks. Our data shows that 1009368 Bc Ltd. is the largest shareholder with 9.9% of shares outstanding. Next, we have Andrew Robson and Mirae Asset Global Investments Co., Ltd as the second and third largest shareholders, holding 4.0% and 1.7%, of the shares outstanding, respectively. Andrew Robson also happens to hold the title of Chief Executive Officer.

Our studies suggest that the top 25 shareholders collectively control less than 50% of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Valens GroWorks

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

I can report that insiders do own shares in Valens GroWorks Corp.. In their own names, insiders own CA$24m worth of stock in the CA$470m company. This shows at least some alignment. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public -- mostly retail investors -- own 81% of Valens GroWorks. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Private Company Ownership

Our data indicates that Private Companies hold 9.8%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Valens GroWorks better, we need to consider many other factors. For instance, we've identified 1 warning sign for Valens GroWorks that you should be aware of.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:VLNS

Valens

The Valens Company Inc., through its subsidiaries, develops, manufactures, and sells cannabinoid-based products in Canada, the United States, and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.