- Canada

- /

- Metals and Mining

- /

- TSXV:WML

TSX Penny Stock Highlights: Rubicon Organics And Two More Picks

Reviewed by Simply Wall St

As the Canadian market navigates a landscape shaped by evolving economic trends and strategic insights, investors are increasingly attentive to opportunities that align with their long-term financial goals. Penny stocks, though often seen as a relic of past market eras, continue to offer potential for growth when supported by robust financials and sound fundamentals. In this article, we explore several promising penny stocks in Canada that stand out for their financial strength and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.24 | CA$115M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$13.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.59 | CA$528.97M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.48M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$948.57M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$33.04M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$182.38M | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.64 | CA$302.67M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.92 | CA$108.95M | ★★★★☆☆ |

Click here to see the full list of 938 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Rubicon Organics (TSXV:ROMJ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rubicon Organics Inc. and its subsidiaries produce, process, and sell organic cannabis for recreational and medical use in Canada, with a market cap of CA$21.20 million.

Operations: The company's revenue is derived entirely from the production and sale of cannabis, totaling CA$44.49 million.

Market Cap: CA$21.2M

Rubicon Organics Inc. is navigating the challenges of being a penny stock with a market cap of CA$21.20 million and revenue of CA$44.49 million, though it remains unprofitable. The company has reduced its debt-to-equity ratio over five years and maintains more cash than total debt, indicating improved financial stability. Recent financing agreements have allowed Rubicon to refinance existing obligations, potentially easing financial pressures. Despite management's inexperience (average tenure under two years), the company forecasts modest revenue growth for 2024, supported by increased operating leverage while maintaining a stable cash runway beyond three years due to positive free cash flow trends.

- Click here to discover the nuances of Rubicon Organics with our detailed analytical financial health report.

- Evaluate Rubicon Organics' prospects by accessing our earnings growth report.

Wealth Minerals (TSXV:WML)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wealth Minerals Ltd. focuses on the acquisition, exploration, and development of mineral properties across Canada, Chile, Peru, and Mexico with a market cap of CA$15.12 million.

Operations: Wealth Minerals Ltd. has not reported any specific revenue segments.

Market Cap: CA$15.12M

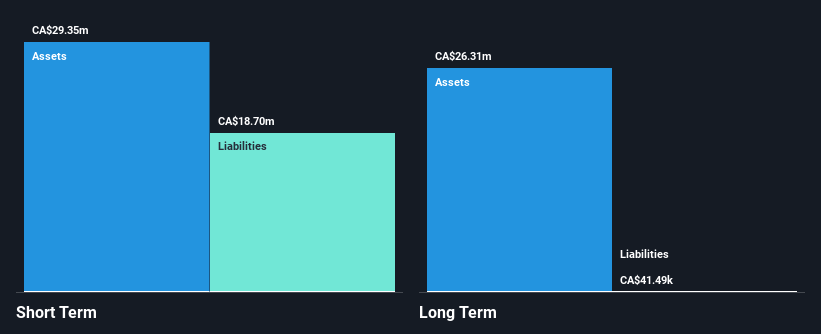

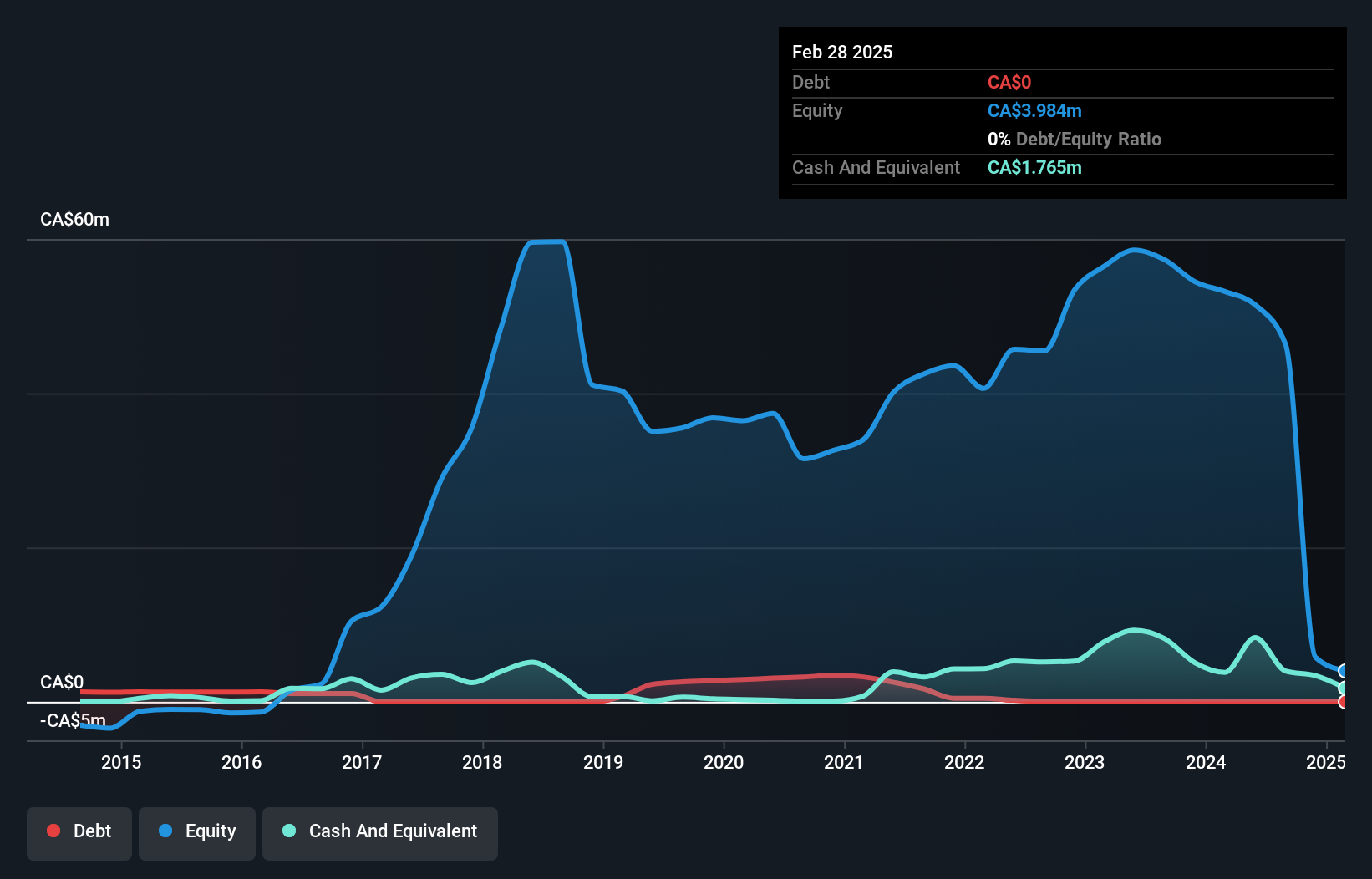

Wealth Minerals Ltd. is pre-revenue with a market cap of CA$15.12 million, focusing on lithium projects in Chile, notably the Kuska Project in Ollague Salar. The company is debt-free but has experienced shareholder dilution over the past year as shares outstanding increased by 3.1%. Despite having no long-term liabilities and short-term assets exceeding short-term liabilities, Wealth Minerals has less than a year of cash runway based on current free cash flow trends. Management and board members are seasoned with average tenures of 13.8 and 7.4 years respectively, providing experienced leadership amidst high share price volatility.

- Dive into the specifics of Wealth Minerals here with our thorough balance sheet health report.

- Assess Wealth Minerals' previous results with our detailed historical performance reports.

Western Energy Services (TSX:WRG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Western Energy Services Corp. is an oilfield service company operating in Canada and the United States with a market cap of CA$84.61 million.

Operations: The company generates revenue through its Contract Drilling segment, which accounts for CA$148.07 million, and its Production Services segment, contributing CA$71.89 million.

Market Cap: CA$84.61M

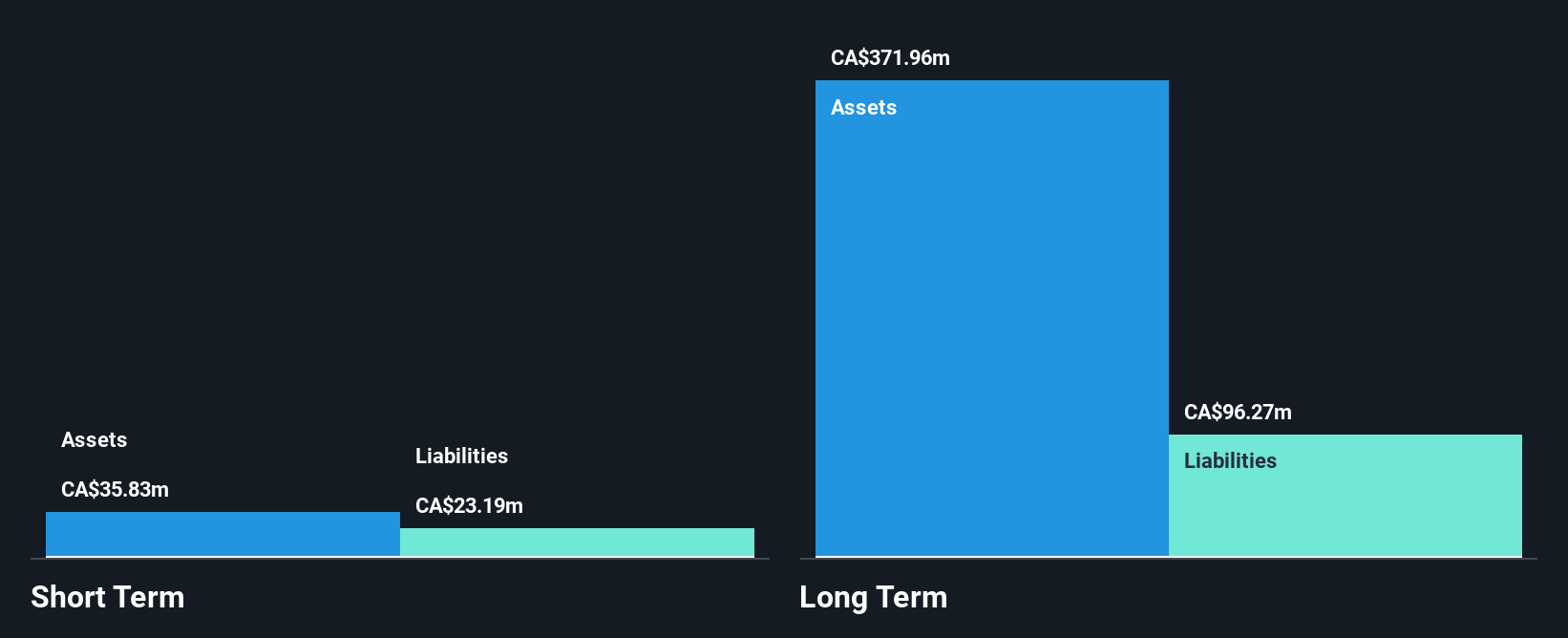

Western Energy Services Corp., with a market cap of CA$84.61 million, operates in the oilfield services sector and is currently unprofitable but has shown progress by reducing losses at 50.2% annually over five years. The company has a satisfactory net debt to equity ratio of 32.6% and maintains sufficient cash runway for over three years due to positive free cash flow growth of 1.2%. Recent earnings reports indicate stable revenue growth, with third-quarter sales reaching CA$58.34 million, slightly up from the previous year, though net losses remain consistent at CA$1.26 million compared to last year’s CA$1.36 million loss.

- Navigate through the intricacies of Western Energy Services with our comprehensive balance sheet health report here.

- Understand Western Energy Services' earnings outlook by examining our growth report.

Summing It All Up

- Get an in-depth perspective on all 938 TSX Penny Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wealth Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WML

Wealth Minerals

Engages in the acquisition, exploration, and development of mineral properties in Canada, Chile, Peru, and Mexico.

Adequate balance sheet slight.