We're Keeping An Eye On Khiron Life Sciences' (CVE:KHRN) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether Khiron Life Sciences (CVE:KHRN) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Khiron Life Sciences

Does Khiron Life Sciences Have A Long Cash Runway?

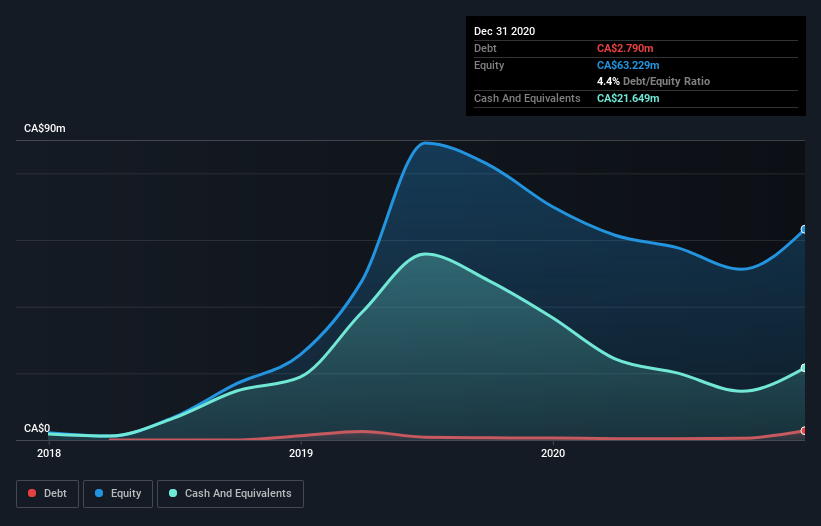

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. Khiron Life Sciences has such a small amount of debt that we'll set it aside, and focus on the CA$22m in cash it held at December 2020. In the last year, its cash burn was CA$27m. That means it had a cash runway of around 10 months as of December 2020. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Importantly, if we extrapolate recent cash burn trends, the cash runway would be a lot longer. You can see how its cash balance has changed over time in the image below.

How Well Is Khiron Life Sciences Growing?

We reckon the fact that Khiron Life Sciences managed to shrink its cash burn by 25% over the last year is rather encouraging. But the revenue dip of 16% in the same period was a bit concerning. In light of the data above, we're fairly sanguine about the business growth trajectory. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Khiron Life Sciences Raise Cash?

Given Khiron Life Sciences' revenue is receding, there's a considerable chance it will eventually need to raise more money to spend on driving growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Khiron Life Sciences' cash burn of CA$27m is about 32% of its CA$84m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Khiron Life Sciences' Cash Burn A Worry?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Khiron Life Sciences' cash burn reduction was relatively promising. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Khiron Life Sciences (1 is significant!) that you should be aware of before investing here.

Of course Khiron Life Sciences may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Khiron Life Sciences, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Khiron Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:KHRN.H

Khiron Life Sciences

Operates as an integrated medical and cannabis company in Latin America and Europe.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives