Canopy Growth Corporation (TSE:WEED) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

Canopy Growth Corporation (TSE:WEED) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.4% over the last year.

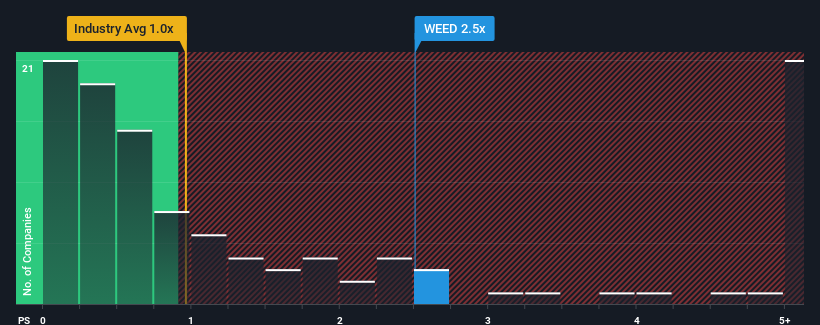

Following the firm bounce in price, given close to half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 1x, you may consider Canopy Growth as a stock to potentially avoid with its 2.5x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Canopy Growth

How Has Canopy Growth Performed Recently?

Canopy Growth could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Canopy Growth.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Canopy Growth's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.5%. The last three years don't look nice either as the company has shrunk revenue by 50% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 6.3% each year as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% per year, which is noticeably more attractive.

With this information, we find it concerning that Canopy Growth is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Canopy Growth's P/S Mean For Investors?

The large bounce in Canopy Growth's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Canopy Growth, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Canopy Growth, and understanding them should be part of your investment process.

If you're unsure about the strength of Canopy Growth's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:WEED

Canopy Growth

Engages in the production, distribution, and sale of cannabis, hemp, and cannabis-related products in Canada, Germany, and Australia.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives