A Fresh Look at Canopy Growth (TSX:WEED) Valuation After DOJA Facility Shifts to Medical Cannabis

Reviewed by Kshitija Bhandaru

Canopy Growth (TSX:WEED) just revealed that its DOJA facility in Kelowna, British Columbia, has shifted exclusively to medical cultivation. The site will now provide small-batch craft cannabis tailored for Spectrum Therapeutics’ medical patient base, including Canadian veterans.

See our latest analysis for Canopy Growth.

After a volatile ride, Canopy Growth’s recent move toward medical cannabis crops comes amid renewed attention. Notably, the share price jumped 23% over the past 90 days, even as the one-year total shareholder return sits deep in negative territory. The latest pivot to craft cultivation for medical users hints at potential for a more stable foundation. However, long-term investors remain cautious given sharply negative five-year returns.

If this strategic shift got you curious, it might be a perfect moment to broaden your search and check out fast growing stocks with high insider ownership

With shares trading well below analyst price targets after years of steep declines, investors are left wondering: does Canopy Growth offer deep value right now, or has the market already factored in any turnaround potential?

Most Popular Narrative: 27.3% Undervalued

With Canopy Growth's most-followed narrative placing fair value noticeably above the current share price, market optimism lingers in the face of weak recent returns. The story fueling this valuation centers on international expansion and innovative, higher-value product efforts.

Accelerating international expansion, particularly in Germany and Poland, positions Canopy Growth to capture significant revenue upside as European cannabis markets grow. This is supported by ongoing regulatory reforms that are expanding the company's accessible addressable market and driving long-term top-line growth.

Curious what numbers justify this bullish stance? Analysts behind this narrative are projecting a transformation in both revenue and profit margin that’s anything but typical for the sector. Ready to uncover the key financial leaps built into this fair value?

Result: Fair Value of $2.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory shifts in key markets and persistent operating losses could quickly undermine the case for a meaningful turnaround at Canopy Growth.

Find out about the key risks to this Canopy Growth narrative.

Another View: Market Ratio Signals More Caution

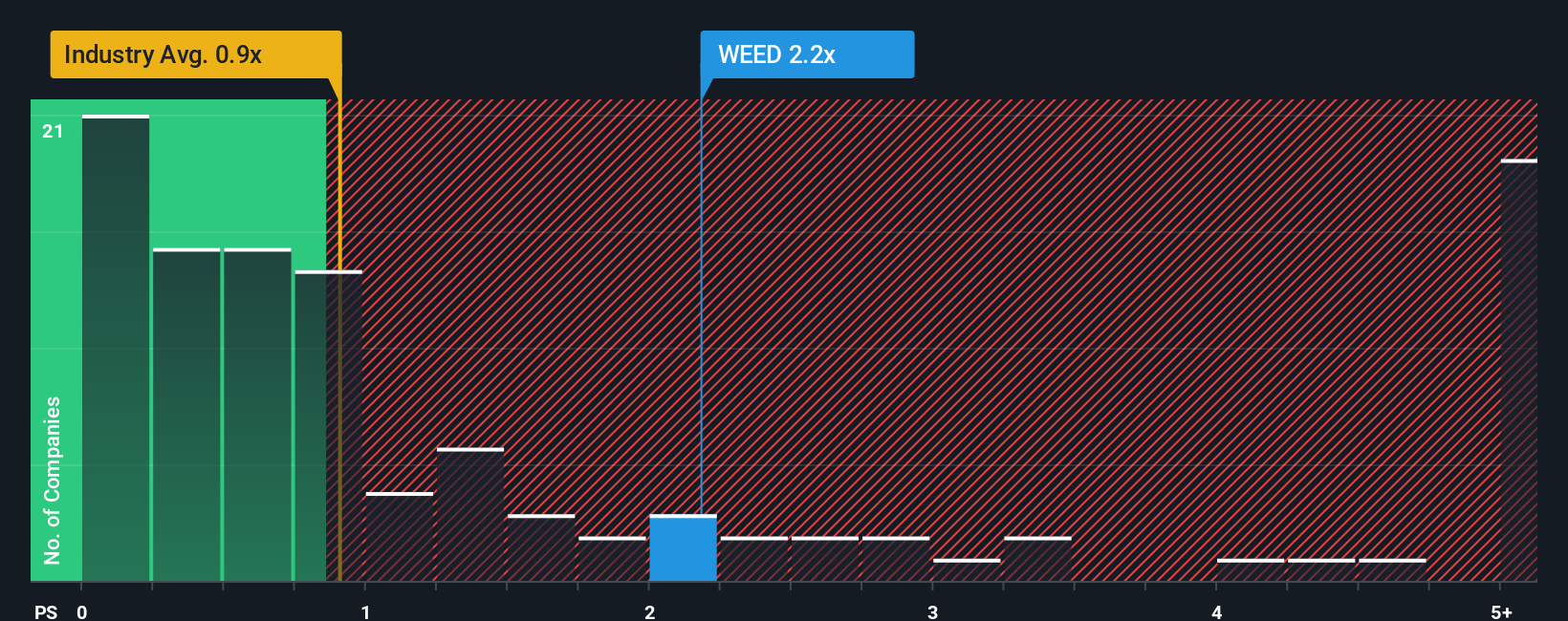

While the most-watched fair value places Canopy Growth’s shares as undervalued, the market’s chosen price-to-sales ratio tells a different story. At 2.2x, this multiple is much higher than the Canadian Pharmaceuticals industry average of 1x, the peer average of 0.9x, and even above the fair ratio of 1.2x. This implies the shares could face more downside if the market’s optimism fades. For investors, does this premium simply reflect recovery hopes, or a valuation risk waiting to be tested?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Canopy Growth Narrative

If you see things differently or want to dig into the numbers yourself, you can craft and share your own take in just a few minutes. Do it your way

A great starting point for your Canopy Growth research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors make the most of every market moment. Widen your opportunities by checking out these fast-moving sectors and companies you won’t want to overlook.

- Capitalize on undervalued gems by screening for companies that industry experts believe are trading below their true worth using these 898 undervalued stocks based on cash flows.

- Get ahead of healthcare innovation and spot potential game-changers among the companies reshaping medicine with the power of AI through these 33 healthcare AI stocks.

- Snap up dividend champions with consistent yields and strong fundamentals by browsing these 19 dividend stocks with yields > 3% before the competition catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WEED

Canopy Growth

Engages in the production, distribution, and sale of cannabis, hemp, and cannabis-related products in Canada, Germany, and Australia.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026