Market Cool On Valeo Pharma Inc.'s (TSE:VPH) Revenues Pushing Shares 31% Lower

To the annoyance of some shareholders, Valeo Pharma Inc. (TSE:VPH) shares are down a considerable 31% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 77% loss during that time.

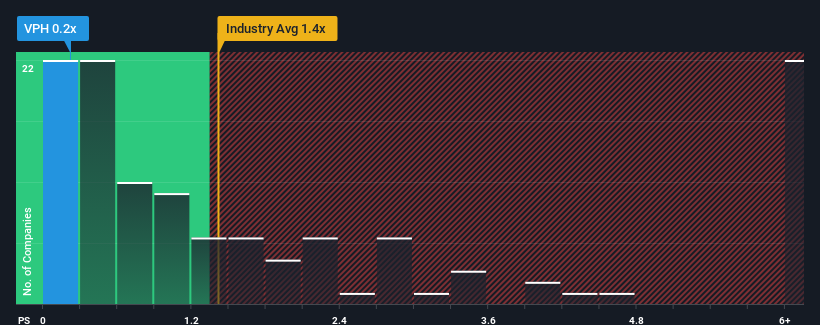

Following the heavy fall in price, given about half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Valeo Pharma as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Valeo Pharma

What Does Valeo Pharma's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Valeo Pharma has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Valeo Pharma will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Valeo Pharma's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 48%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 4.9%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Valeo Pharma's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Valeo Pharma's P/S?

Valeo Pharma's recently weak share price has pulled its P/S back below other Pharmaceuticals companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at Valeo Pharma's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 6 warning signs for Valeo Pharma (4 can't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Valeo Pharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:VPH

Valeo Pharma

A specialty pharmaceutical company, engages in the acquisition, in-licensing brands, and sale of pharmaceuticals and hospital specialty products for unmet medical needs in Canada.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives