This article will reflect on the compensation paid to Barry Fishman who has served as CEO of VIVO Cannabis Inc. (TSE:VIVO) since 2017. This analysis will also assess whether VIVO Cannabis pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for VIVO Cannabis

How Does Total Compensation For Barry Fishman Compare With Other Companies In The Industry?

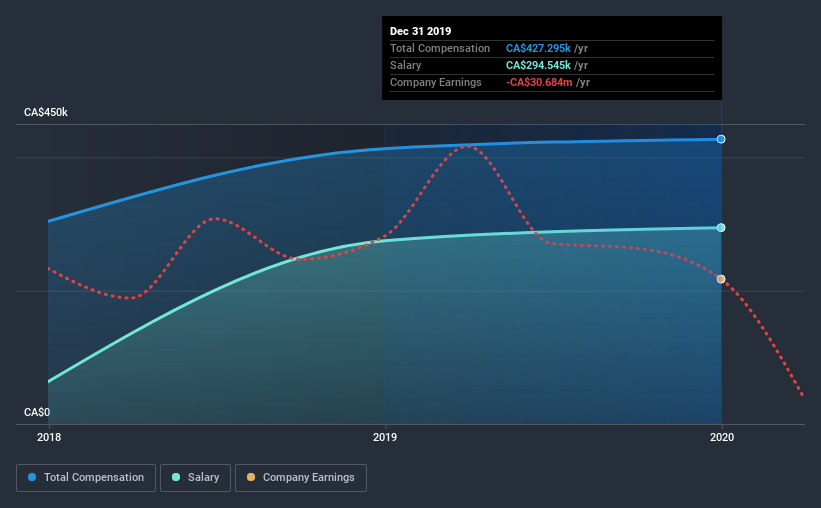

At the time of writing, our data shows that VIVO Cannabis Inc. has a market capitalization of CA$72m, and reported total annual CEO compensation of CA$427k for the year to December 2019. That's just a smallish increase of 3.5% on last year. Notably, the salary which is CA$294.5k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under CA$267m, the reported median total CEO compensation was CA$247k. Hence, we can conclude that Barry Fishman is remunerated higher than the industry median. Moreover, Barry Fishman also holds CA$411k worth of VIVO Cannabis stock directly under their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$295k | CA$275k | 69% |

| Other | CA$133k | CA$138k | 31% |

| Total Compensation | CA$427k | CA$413k | 100% |

On an industry level, around 77% of total compensation represents salary and 23% is other remuneration. VIVO Cannabis sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

VIVO Cannabis Inc.'s Growth

VIVO Cannabis Inc. has seen its earnings per share (EPS) increase by 28% a year over the past three years. In the last year, its revenue is up 85%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term earnings per share improvement certainly points to the kind of growth we like to see. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has VIVO Cannabis Inc. Been A Good Investment?

Given the total shareholder loss of 72% over three years, many shareholders in VIVO Cannabis Inc. are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As we touched on above, VIVO Cannabis Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, the earnings per share growth is certainly impressive, but we cannot say the same about the uninspiring shareholder returns (over the last three years). Considering overall performance, we can't say Barry is underpaid, in fact compensation is definitely on the higher side.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for VIVO Cannabis you should be aware of, and 2 of them are concerning.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading VIVO Cannabis or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade VIVO Cannabis, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:VIVO

VIVO Cannabis

VIVO Cannabis Inc. produces and sells cannabis products for the medical and adult-use markets in Canada, Germany, and Australia.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives