The Canadian market is navigating a period of uncertainty, with looming tariffs and political shifts contributing to a cautious investment climate. Despite these challenges, opportunities remain for investors willing to explore lesser-known areas of the market. Penny stocks, though an older term, still represent potential growth avenues in smaller or newer companies when backed by solid financial health. In this article, we'll examine three such penny stocks that stand out for their financial strength and potential long-term promise amidst current market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.60 | CA$168.17M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.80 | CA$450.76M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$2.05 | CA$86.42M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.64 | CA$586.49M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.08 | CA$39.87M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.92 | CA$79.37M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.15 | CA$3.28B | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

Click here to see the full list of 936 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

TerrAscend (TSX:TSND)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TerrAscend Corp. is involved in the cultivation, processing, and sale of medical and adult-use cannabis across Canada and the United States, with a market cap of CA$248.75 million.

Operations: There are no specific revenue segments reported for this company.

Market Cap: CA$248.75M

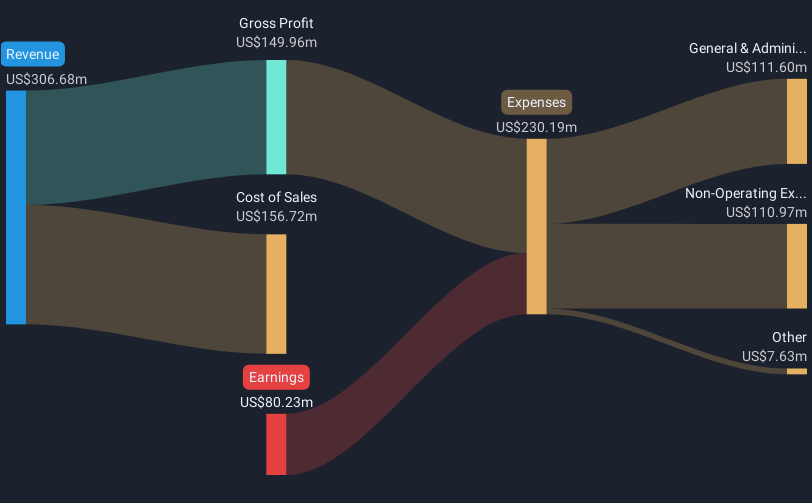

TerrAscend Corp., with a market cap of CA$248.75 million, reported sales of US$306.68 million for 2024, showing a slight decrease from the previous year. Despite being unprofitable with a net loss of US$80.23 million, the company has managed to reduce its losses over five years by 3.1% annually and maintains sufficient cash runway for more than three years due to positive free cash flow growth. The stock trades at a significant discount to its estimated fair value and peers, though it faces challenges such as high debt levels and volatility in share price stability.

- Take a closer look at TerrAscend's potential here in our financial health report.

- Examine TerrAscend's earnings growth report to understand how analysts expect it to perform.

Rock Tech Lithium (TSXV:RCK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rock Tech Lithium Inc. is involved in the exploration and development of lithium properties, with a market cap of CA$117.63 million.

Operations: Rock Tech Lithium Inc. has not reported any revenue segments.

Market Cap: CA$117.63M

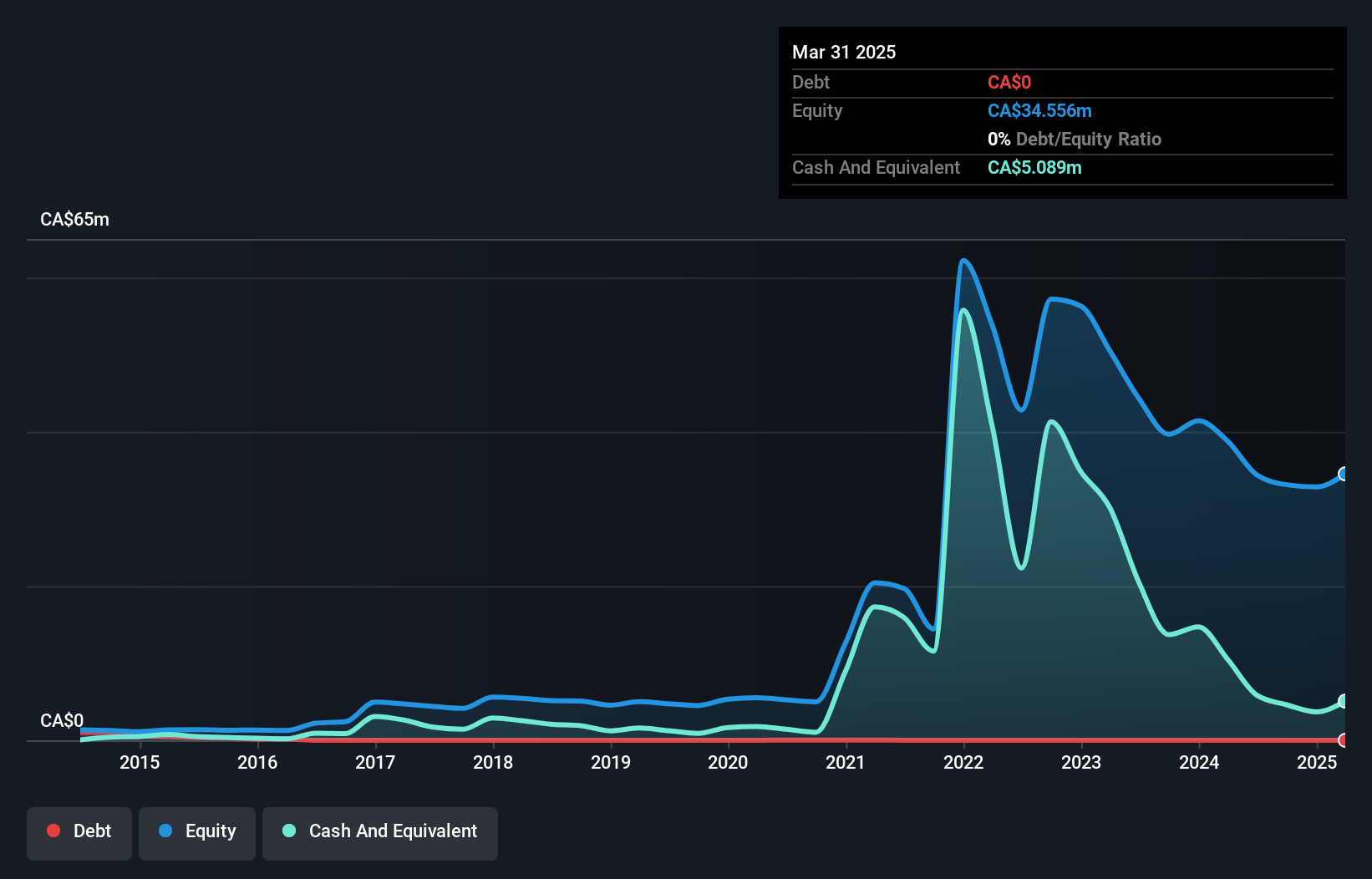

Rock Tech Lithium Inc., with a market cap of CA$117.63 million, remains pre-revenue and unprofitable, facing increased losses over the past five years. Despite this, it benefits from being debt-free and has raised additional capital to extend its cash runway beyond the initial three months projected by free cash flow estimates. The company's short-term assets surpass both its short-term and long-term liabilities, providing some financial stability amidst high share price volatility. Recent participation in key industry conferences highlights its strategic focus on critical materials for EVs and batteries, potentially positioning it for future opportunities in these sectors.

- Unlock comprehensive insights into our analysis of Rock Tech Lithium stock in this financial health report.

- Gain insights into Rock Tech Lithium's outlook and expected performance with our report on the company's earnings estimates.

Silver Tiger Metals (TSXV:SLVR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Silver Tiger Metals Inc. is involved in the exploration and evaluation of mineral properties in Mexico, with a market cap of CA$120.47 million.

Operations: Silver Tiger Metals Inc. does not report any revenue segments.

Market Cap: CA$120.47M

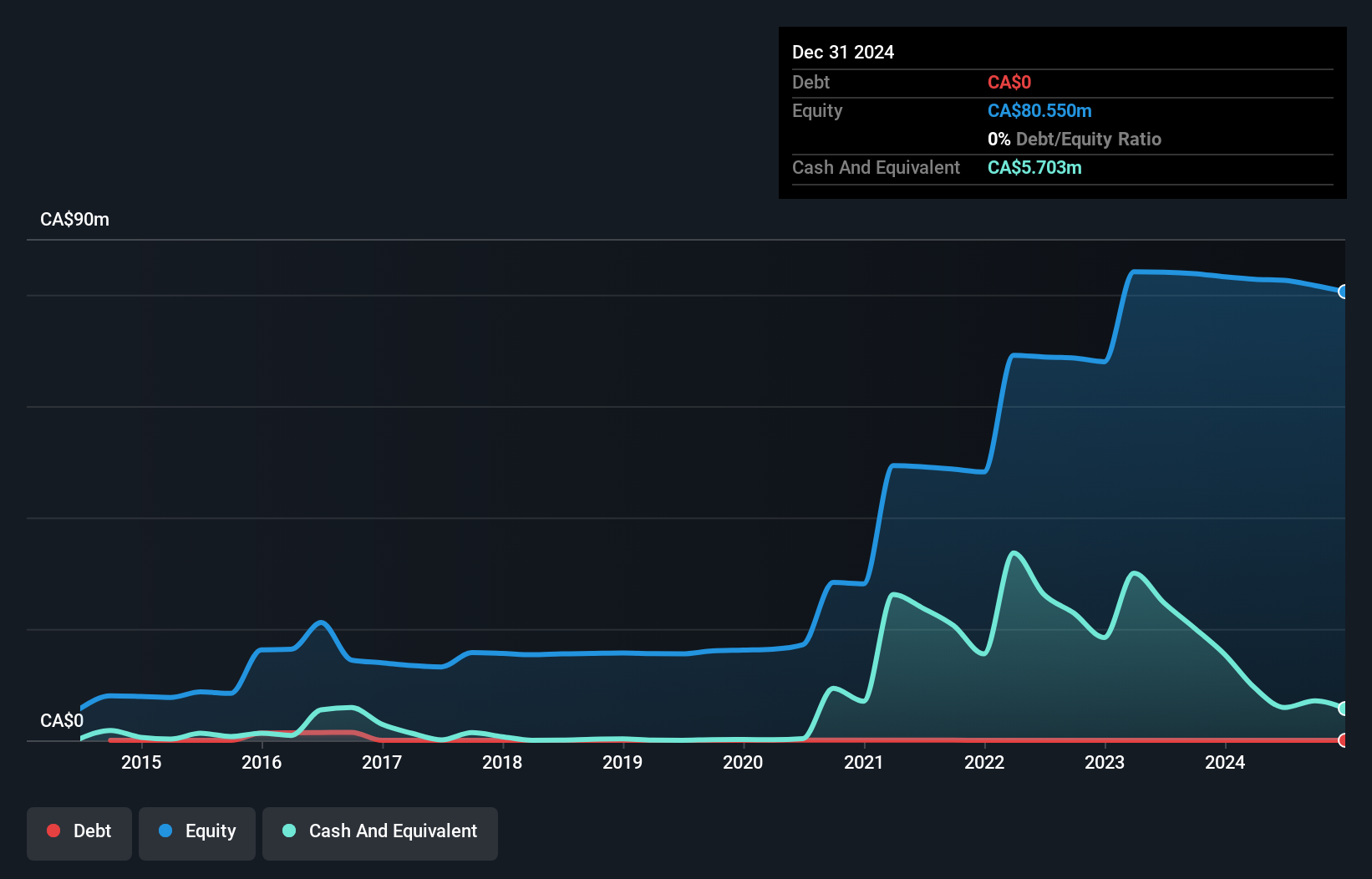

Silver Tiger Metals Inc., with a market cap of CA$120.47 million, is pre-revenue and unprofitable, experiencing increasing losses over the past five years. Despite having no debt and covering short-term liabilities with assets of CA$6.4 million, it faces less than a year of cash runway if current cash flow trends continue. Recent drilling results from its El Tigre Project in Mexico showed promising high-grade silver-gold mineralization, which could enhance future resource estimates. The management team is experienced, and the company actively engages in industry conferences to bolster its strategic positioning within the mining sector.

- Click to explore a detailed breakdown of our findings in Silver Tiger Metals' financial health report.

- Gain insights into Silver Tiger Metals' future direction by reviewing our growth report.

Make It Happen

- Access the full spectrum of 936 TSX Penny Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TerrAscend might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TSND

TerrAscend

TerrAscend Corp. cultivates, processes, and sells medical and adult use cannabis in Canada and the United States.

Undervalued with adequate balance sheet.