Shareholders in TerrAscend (TSE:TSND) have lost 90%, as stock drops 11% this past week

As every investor would know, not every swing hits the sweet spot. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of TerrAscend Corp. (TSE:TSND); the share price is down a whopping 90% in the last three years. That would be a disturbing experience. And more recent buyers are having a tough time too, with a drop of 76% in the last year. Furthermore, it's down 22% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Since TerrAscend has shed CA$18m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Because TerrAscend made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over three years, TerrAscend grew revenue at 16% per year. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 24% per year is due to the revenue. More likely, the market was spooked by the cost of that revenue. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

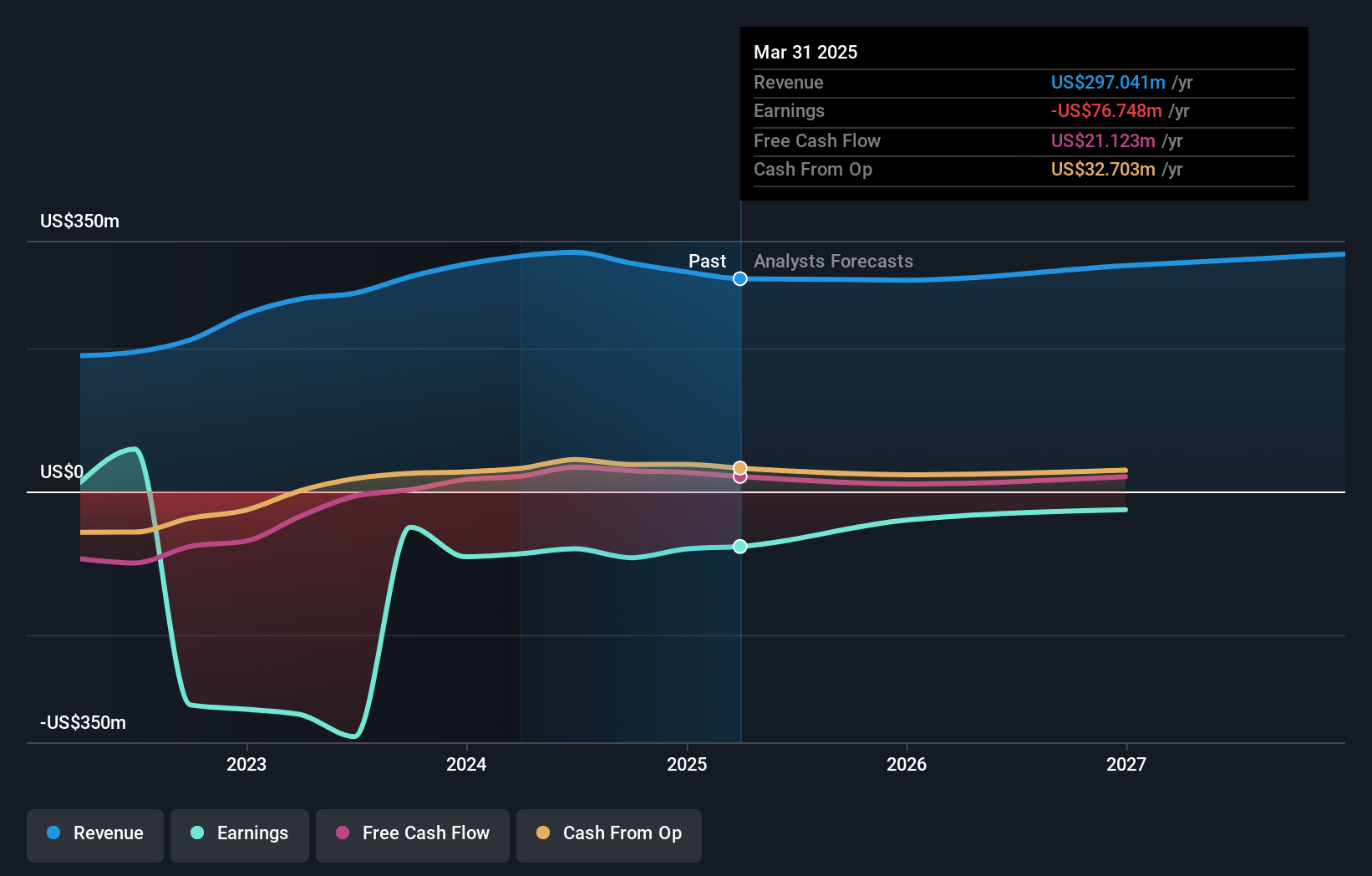

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think TerrAscend will earn in the future (free profit forecasts).

A Different Perspective

TerrAscend shareholders are down 76% for the year, but the market itself is up 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for TerrAscend that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if TerrAscend might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TSND

TerrAscend

TerrAscend Corp. cultivates, produces, and sells cannabis products in Canada and the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives