- Canada

- /

- Metals and Mining

- /

- TSX:CXB

Calibre Mining And Two More TSX Stocks That Investors Might Consider Undervalued

Reviewed by Simply Wall St

As the first half of 2024 concludes, Canadian markets have shown resilience with a solid performance, particularly benefiting from sectors like technology and utilities. Despite a more muted gain compared to the S&P 500 due to lesser exposure to high-growth tech stocks, the TSX has maintained steady growth. In this context, identifying undervalued stocks becomes crucial as they may present opportunities for investors looking for potential in areas that are not in the limelight but are poised for recovery or have been overlooked in broader market rallies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$41.71 | CA$80.18 | 48% |

| Calibre Mining (TSX:CXB) | CA$1.94 | CA$3.58 | 45.8% |

| Kinaxis (TSX:KXS) | CA$160.80 | CA$263.18 | 38.9% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Kraken Robotics (TSXV:PNG) | CA$1.15 | CA$2.21 | 48% |

| Endeavour Mining (TSX:EDV) | CA$30.17 | CA$52.33 | 42.3% |

| Green Thumb Industries (CNSX:GTII) | CA$15.71 | CA$28.03 | 43.9% |

| Jamieson Wellness (TSX:JWEL) | CA$29.10 | CA$50.47 | 42.3% |

| Kits Eyecare (TSX:KITS) | CA$8.85 | CA$15.45 | 42.7% |

| Capstone Copper (TSX:CS) | CA$10.23 | CA$17.50 | 41.5% |

Let's review some notable picks from our screened stocks

Calibre Mining (TSX:CXB)

Overview: Calibre Mining Corp. operates in the exploration, development, and mining of gold properties across Nicaragua, the United States, and Canada with a market capitalization of approximately CA$1.43 billion.

Operations: The company generates its revenue primarily from the refined gold segment, totaling CA$566.68 million.

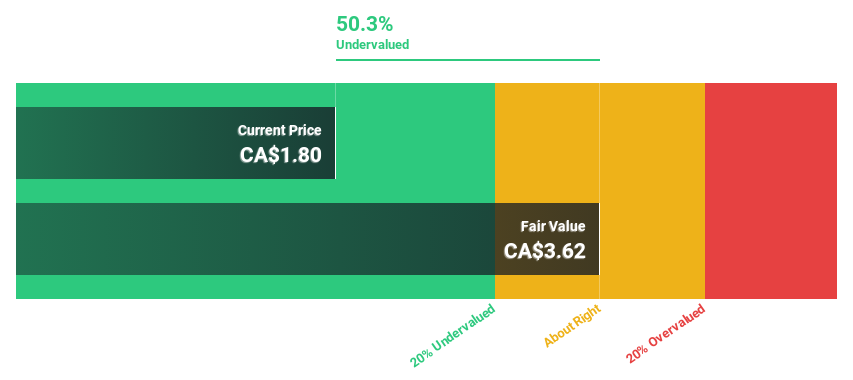

Estimated Discount To Fair Value: 45.8%

Calibre Mining, priced at CA$1.81, is significantly undervalued with its market price 49.8% below the estimated fair value of CA$3.61. Despite substantial insider selling recently, the company's financial outlook remains robust with earnings expected to grow by 45.22% annually, outpacing the Canadian market forecast of 14.6%. Revenue growth is also strong at 15.8% annually compared to the market's 7.3%, indicating potential underappreciation by the market despite recent executive board enhancements and index inclusions which could stabilize governance and increase exposure.

- Our earnings growth report unveils the potential for significant increases in Calibre Mining's future results.

- Dive into the specifics of Calibre Mining here with our thorough financial health report.

Energy Fuels (TSX:EFR)

Overview: Energy Fuels Inc. operates in the extraction, recovery, recycling, and sale of uranium mineral properties in the United States, with a market capitalization of approximately CA$1.33 billion.

Operations: The company generates revenue primarily from the metals and mining sector, totaling CA$43.74 million.

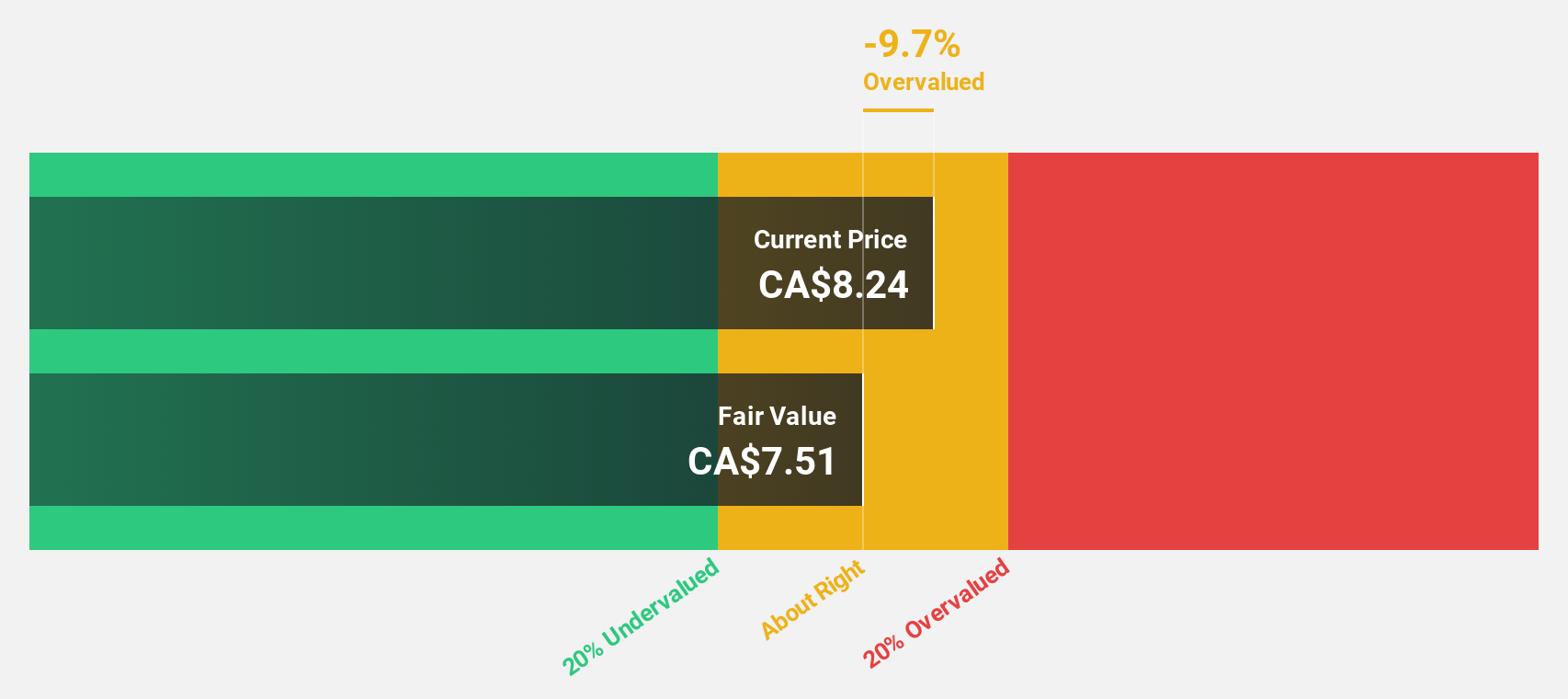

Estimated Discount To Fair Value: 24.9%

Energy Fuels, trading at CA$8.11, is positioned below its fair value of CA$10.93, marking a significant undervaluation based on cash flows. Despite recent index reclassifications reflecting a defensive rather than growth orientation, the company's strategic joint venture in Australia underscores its commitment to expanding rare earth element production—a key component in the clean energy sector. With an expected revenue increase of 40.8% annually and upcoming profitability within three years, Energy Fuels combines promising financial growth with strategic operational expansions.

- Insights from our recent growth report point to a promising forecast for Energy Fuels' business outlook.

- Get an in-depth perspective on Energy Fuels' balance sheet by reading our health report here.

TerrAscend (TSX:TSND)

Overview: TerrAscend Corp., with a market capitalization of CA$614.15 million, operates in the cultivation, processing, and sale of medical and adult-use cannabis across Canada and the United States.

Operations: The company generates revenue primarily through the cultivation and sale of cannabis, amounting to CA$328.56 million.

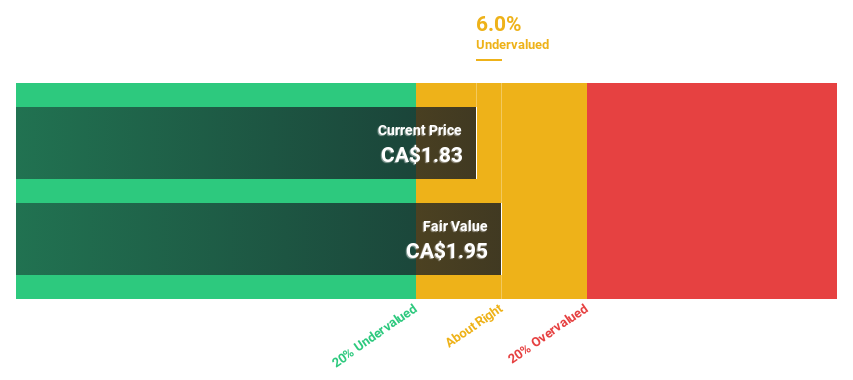

Estimated Discount To Fair Value: 5.9%

TerrAscend, priced at CA$1.73, is modestly undervalued with a fair value estimate of CA$1.95, reflecting a trading position 11.4% below its intrinsic value based on discounted cash flows. The company's revenue is projected to grow by 11.5% annually, slightly outpacing the Canadian market forecast of 7.3%. Although shareholder dilution occurred last year, TerrAscend's strategic expansion through new dispensaries in Maryland and Michigan enhances its retail footprint and consumer reach, promising improved financial health and market presence over the next three years.

- In light of our recent growth report, it seems possible that TerrAscend's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of TerrAscend stock in this financial health report.

Next Steps

- Navigate through the entire inventory of 26 Undervalued TSX Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CXB

Calibre Mining

Engages in the exploration, development, and mining of gold properties.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives