Little Excitement Around Charlotte's Web Holdings, Inc.'s (TSE:CWEB) Revenues As Shares Take 26% Pounding

The Charlotte's Web Holdings, Inc. (TSE:CWEB) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

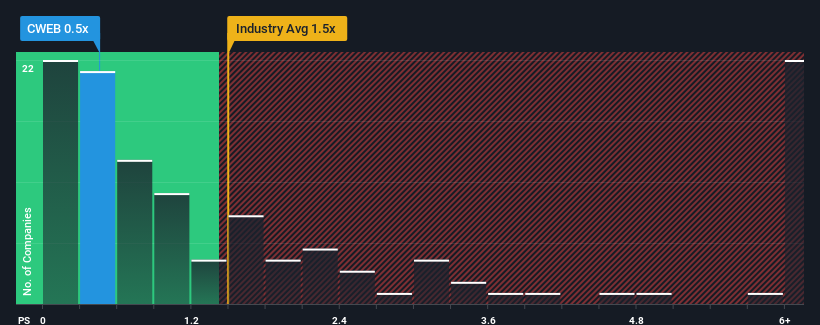

Following the heavy fall in price, considering around half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.5x, you may consider Charlotte's Web Holdings as an solid investment opportunity with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Charlotte's Web Holdings

How Has Charlotte's Web Holdings Performed Recently?

While the industry has experienced revenue growth lately, Charlotte's Web Holdings' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Charlotte's Web Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Charlotte's Web Holdings?

In order to justify its P/S ratio, Charlotte's Web Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. The last three years don't look nice either as the company has shrunk revenue by 40% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 1.0% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 5.2%, which is noticeably more attractive.

With this information, we can see why Charlotte's Web Holdings is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Charlotte's Web Holdings' P/S Mean For Investors?

Charlotte's Web Holdings' P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Charlotte's Web Holdings maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

You always need to take note of risks, for example - Charlotte's Web Holdings has 4 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CWEB

Charlotte's Web Holdings

Engages in the farming, manufacturing, marketing, and sale of hemp-derived cannabidiol (CBD) and other botanical-based wellness products.

Low risk and overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026