Curaleaf (TSX:CURA): Has the Recent Pullback Opened a Valuation Opportunity?

Reviewed by Simply Wall St

Curaleaf Holdings (TSX:CURA) has quietly slipped about 4% in the past day and nearly 18% over the past month, even though revenue is still growing and net losses are narrowing significantly year over year.

See our latest analysis for Curaleaf Holdings.

Still, that recent 1 month share price return of negative 17.97% sits against a much healthier year to date share price return of about 40.87%. This suggests momentum has cooled as investors reassess regulatory and profitability risks after a strong run.

If Curaleaf’s swings have you rethinking your sector exposure, this could be a good moment to explore other healthcare stocks that blend growth potential with different risk and regulatory profiles.

With Curaleaf still unprofitable but growing revenue and trading at a steep discount to analyst targets, investors face a crucial question: is this a mispriced cannabis leader, or is the market already baking in all the future upside?

Most Popular Narrative Narrative: 31.8% Undervalued

With Curaleaf closing at CA$3.24 versus a narrative fair value near CA$4.75, the implied upside rests on a specific path to profitable growth.

Focused investment in R&D driven product innovation such as new premium oil extraction methods (ACE), proprietary vape devices, and expanded product lines (Anthem pre rolls, new launches in Australia) positions Curaleaf to capture emerging health and wellness consumer trends, potentially boosting brand equity and supporting higher margin product sales, thus improving net margins.

Want to see what kind of growth curve could justify that higher value, including a sharp profit swing and a rich future earnings multiple, despite today’s losses? Read how those projections stack up against a relatively modest revenue growth outlook and a premium valuation that assumes the cannabis narrative plays out almost perfectly.

Result: Fair Value of $4.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pricing pressure and ongoing regulatory uncertainty could quickly undercut those margin and growth assumptions, forcing investors to reconsider Curaleaf’s potential upside.

Find out about the key risks to this Curaleaf Holdings narrative.

Another Angle on Valuation

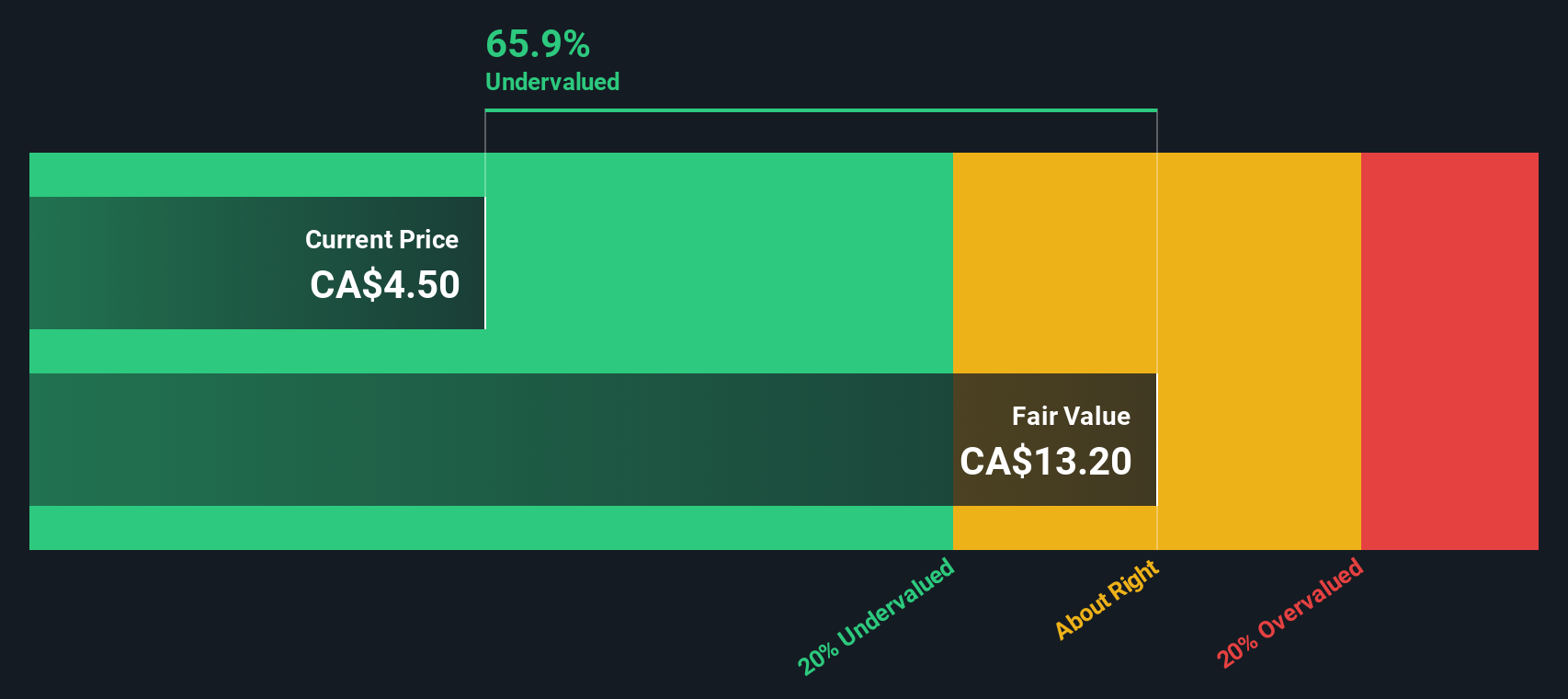

Our SWS DCF model paints a much rosier picture than the narrative fair value, suggesting Curaleaf could be worth around CA$14.96, roughly 78% above today’s CA$3.24 price. If the cash flows materialize, is the market underestimating just how much upside is on the table?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Curaleaf Holdings Narrative

If our take does not quite match your view, or you prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way

A great starting point for your Curaleaf Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one stock. Use the Simply Wall St Screener to uncover fresh opportunities that could strengthen your portfolio before other investors catch on.

- Capture early-stage potential by scanning these 3568 penny stocks with strong financials that combine market mispricing with improving fundamentals.

- Position yourself at the frontier of innovation by targeting these 25 AI penny stocks benefiting from accelerating demand for intelligent automation.

- Focus on these 14 dividend stocks with yields > 3% that can support income and cushion volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CURA

Curaleaf Holdings

Produces and distributes cannabis products in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026