As the Canadian market navigates the implications of new U.S. policy directions, including energy reforms and potential tariff changes, the TSX index has shown resilience with gains since Inauguration Day. Amidst these macroeconomic shifts, investors are often drawn to penny stocks for their affordability and growth potential. Despite being seen as a relic of past market eras, penny stocks continue to offer intriguing opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.93 | CA$180.96M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.65 | CA$970.33M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.67 | CA$429.16M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.39 | CA$217.54M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$610.81M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.43 | CA$116.42M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.51 | CA$13.75M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.64M | ★★★★★☆ |

Click here to see the full list of 931 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cronos Group (TSX:CRON)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, and marketing of cannabis products in Canada, Israel, and Germany with a market cap of CA$1.03 billion.

Operations: The company generates revenue of $111.23 million from its operations in the cultivation, manufacture, and marketing of cannabis and cannabis-derived products.

Market Cap: CA$1.03B

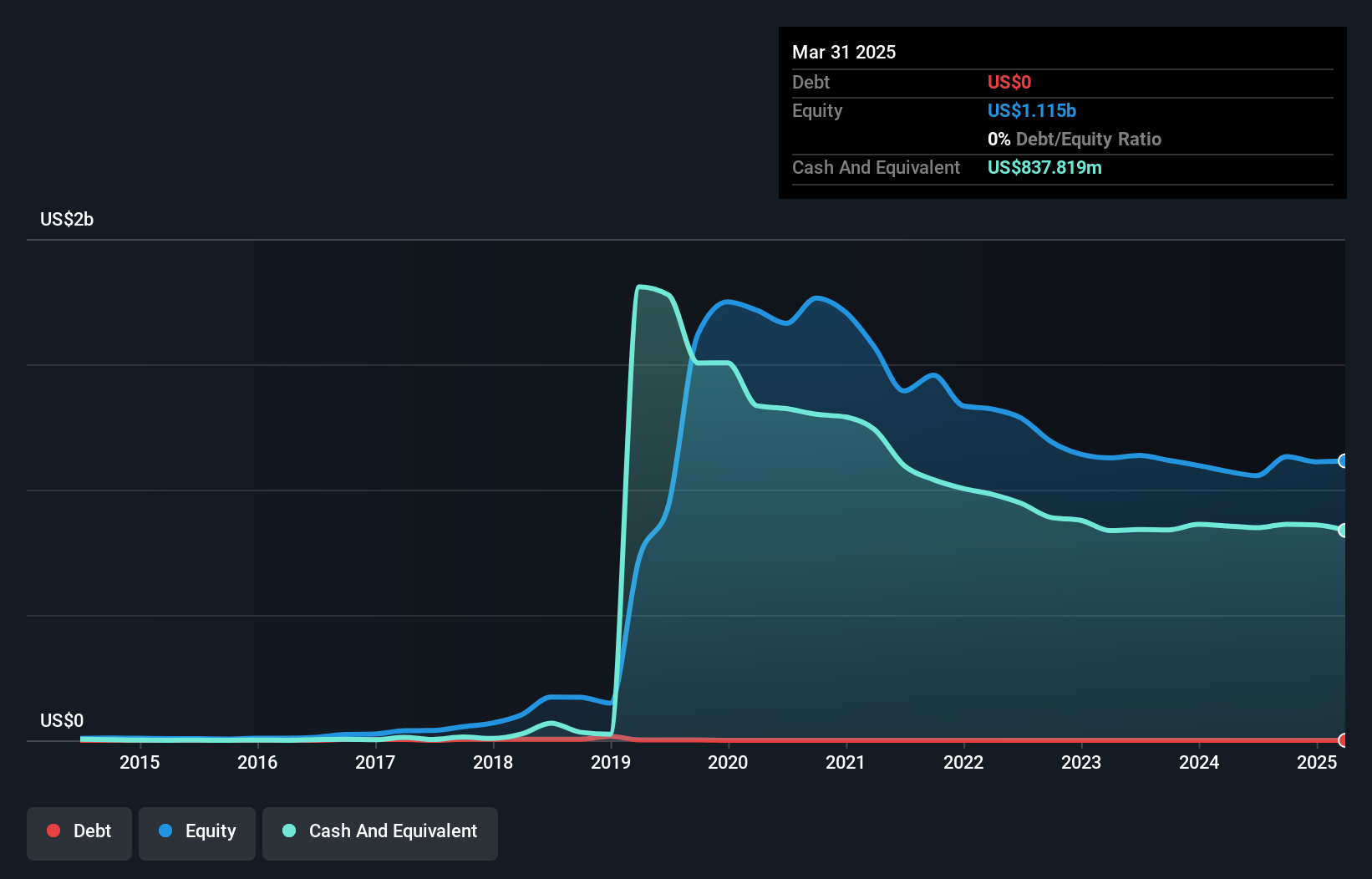

Cronos Group, with a market cap of CA$1.03 billion, is navigating the challenges typical of penny stocks. Despite being unprofitable with a negative return on equity, its short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity. The company is debt-free and has not diluted shareholders recently. Although it reported impairment charges in 2024, Cronos showed improved financial performance with increased revenue to US$34.26 million for Q3 2024 and net income of US$8.35 million compared to a loss previously. However, its board lacks experience which may impact strategic direction.

- Click here to discover the nuances of Cronos Group with our detailed analytical financial health report.

- Evaluate Cronos Group's prospects by accessing our earnings growth report.

Snipp Interactive (TSXV:SPN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Snipp Interactive Inc. offers mobile marketing, rebates, and loyalty solutions across the United States, Canada, Ireland, and other international markets with a market cap of CA$24.32 million.

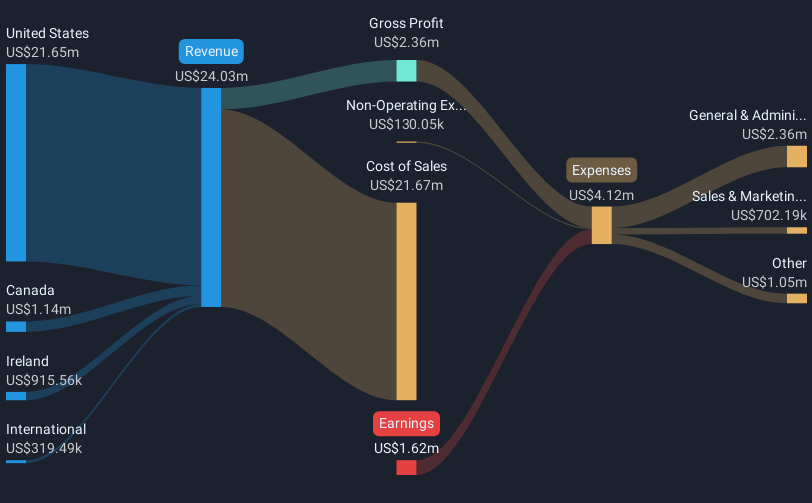

Operations: The company generates revenue of $24.03 million from its comprehensive range of mobile marketing and loyalty services.

Market Cap: CA$24.32M

Snipp Interactive Inc., with a market cap of CA$24.32 million, offers mobile marketing and loyalty solutions across multiple regions. The company is unprofitable but has reduced losses over five years by 17.9% annually, maintaining a stable cash runway for over three years without debt concerns. Recent significant contracts include a $1 million deal with a global health company and a $1.2 million agreement with a leading food and beverage firm, showcasing its ability to expand client relationships effectively. Despite high volatility, Snipp's strategic partnerships and innovative platforms position it for potential growth in consumer engagement sectors.

- Take a closer look at Snipp Interactive's potential here in our financial health report.

- Gain insights into Snipp Interactive's outlook and expected performance with our report on the company's earnings estimates.

Silver One Resources (TSXV:SVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silver One Resources Inc., along with its subsidiary, focuses on acquiring, exploring, and developing mineral properties in the United States with a market cap of CA$53.78 million.

Operations: No revenue segments are reported for this company.

Market Cap: CA$53.78M

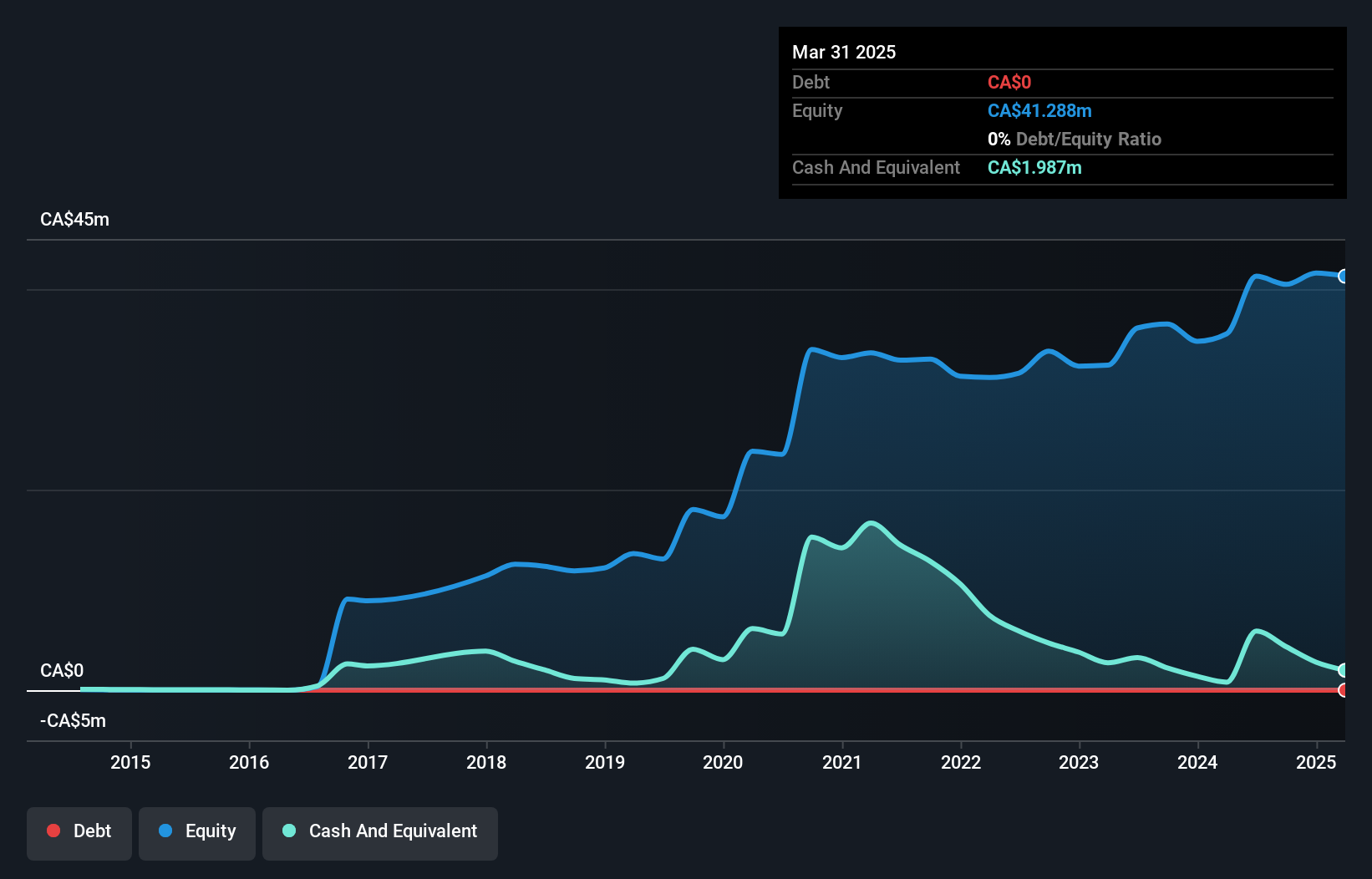

Silver One Resources Inc., with a market cap of CA$53.78 million, is pre-revenue and unprofitable, facing increased losses over the past five years. Despite this, it maintains a stable cash runway exceeding one year without debt concerns. The company's experienced management team and board offer stability amidst its financial challenges. Recent developments include its removal from the S&P/TSX Venture Composite Index and reporting a slight improvement in net loss for the nine months ending September 2024 compared to the previous year. Short-term assets comfortably cover both short- and long-term liabilities, reflecting sound financial management practices despite ongoing losses.

- Jump into the full analysis health report here for a deeper understanding of Silver One Resources.

- Assess Silver One Resources' previous results with our detailed historical performance reports.

Key Takeaways

- Navigate through the entire inventory of 931 TSX Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRON

Cronos Group

Operates as a cannabinoid company that engages in the cultivation, production and marketing of cannabis products in Canada, Israel, and Germany.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives