As the U.S. grapples with a government shutdown and its potential economic ripple effects, Canada's stock market remains an intriguing landscape for investors seeking opportunities beyond the usual suspects. In this environment, identifying undiscovered gems requires a keen eye on sectors benefiting from resilient consumer spending and technological advancements, making small-cap stocks particularly appealing for those looking to diversify their portfolios amidst broader market resilience.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Zoomd Technologies | NA | 10.82% | 51.35% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Cronos Group (TSX:CRON)

Simply Wall St Value Rating: ★★★★★★

Overview: Cronos Group Inc. is a cannabinoid company involved in the cultivation, production, distribution, and marketing of cannabis products across Canada, Israel, and internationally with a market cap of CA$1.39 billion.

Operations: Cronos generates revenue primarily from the cultivation, manufacture, and marketing of cannabis and cannabis-derived products, totaling $130.28 million. The company has experienced fluctuations in its net profit margin over recent periods.

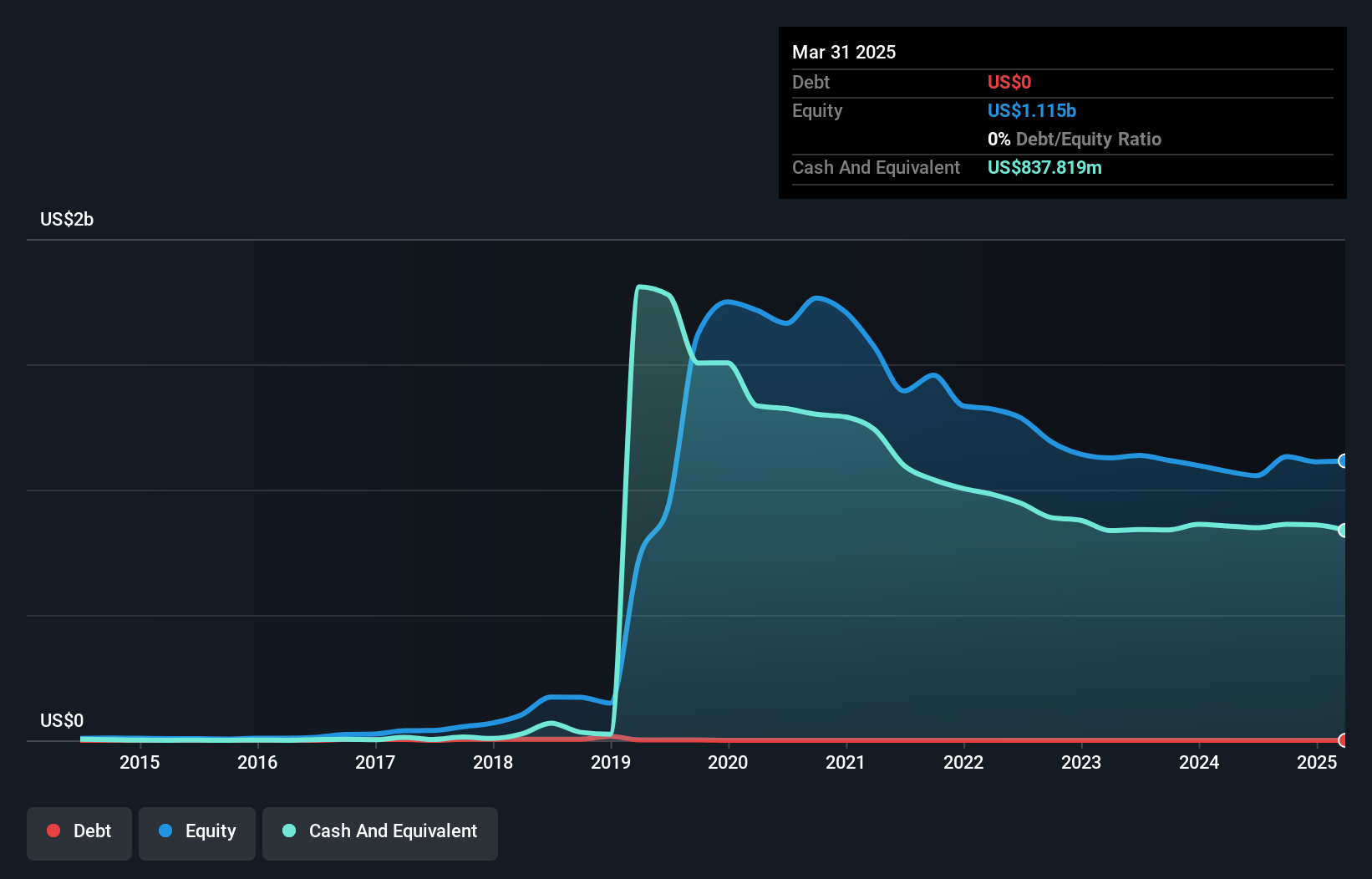

Cronos Group, a Canadian cannabis company, has recently become profitable and is debt-free, which strengthens its financial position. Despite reporting a net loss of US$39.71 million in Q2 2025, sales grew to US$44.25 million from US$38.68 million the previous year. The company repurchased nearly 1.87 million shares for US$3.61 million between May and June 2025, reflecting confidence in its future prospects. With earnings forecasted to grow at over 31% annually and expansion into markets like Israel and Germany on the horizon, Cronos seems poised for growth despite challenges such as regulatory uncertainties and cash outflows impacting flexibility.

Guardian Capital Group (TSX:GCG.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guardian Capital Group Limited operates through its subsidiaries to provide investment services across Canada, the United States, the United Kingdom, and internationally, with a market cap of approximately CA$1.55 billion.

Operations: Guardian Capital Group generates revenue primarily from its corporate activities and investments, totaling CA$37.72 million. The company has a market cap of approximately CA$1.55 billion.

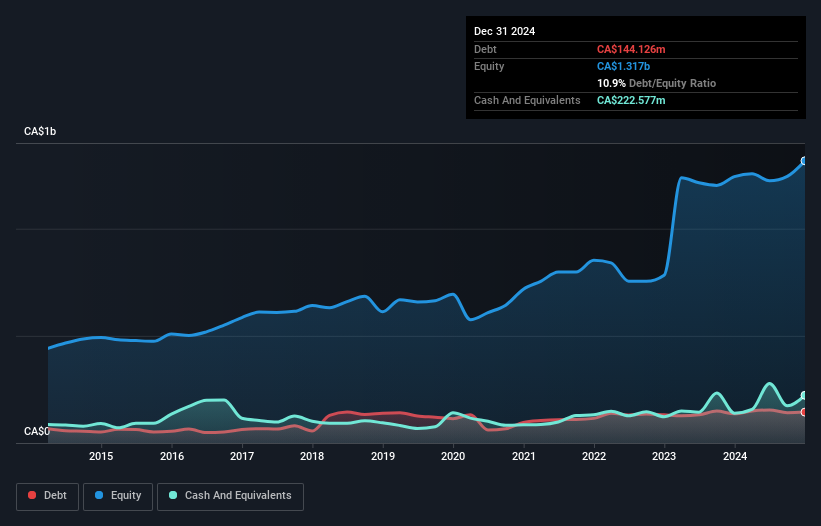

Guardian Capital Group has shown impressive growth with earnings surging 141.5% over the past year, outpacing its industry peers. Despite a rise in debt to equity from 9.9% to 11.2% over five years, it maintains more cash than total debt and enjoys a solid interest coverage of 3.7x EBIT on its obligations. A notable CA$148 million one-off gain significantly impacted recent financial results, while the company’s P/E ratio of 10.3x suggests good value compared to the broader Canadian market at 16.6x. Recently, Guardian repurchased shares worth CA$6 million and announced an acquisition by Desjardins for CA$1.67 billion, reflecting strategic maneuvers in its capital structure and market positioning.

ShaMaran Petroleum (TSXV:SNM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ShaMaran Petroleum Corp. is involved in the exploration and production of oil and gas, with a market capitalization of CA$746.20 million.

Operations: ShaMaran generates revenue primarily from the exploration and development of oil and gas assets, totaling $135.44 million.

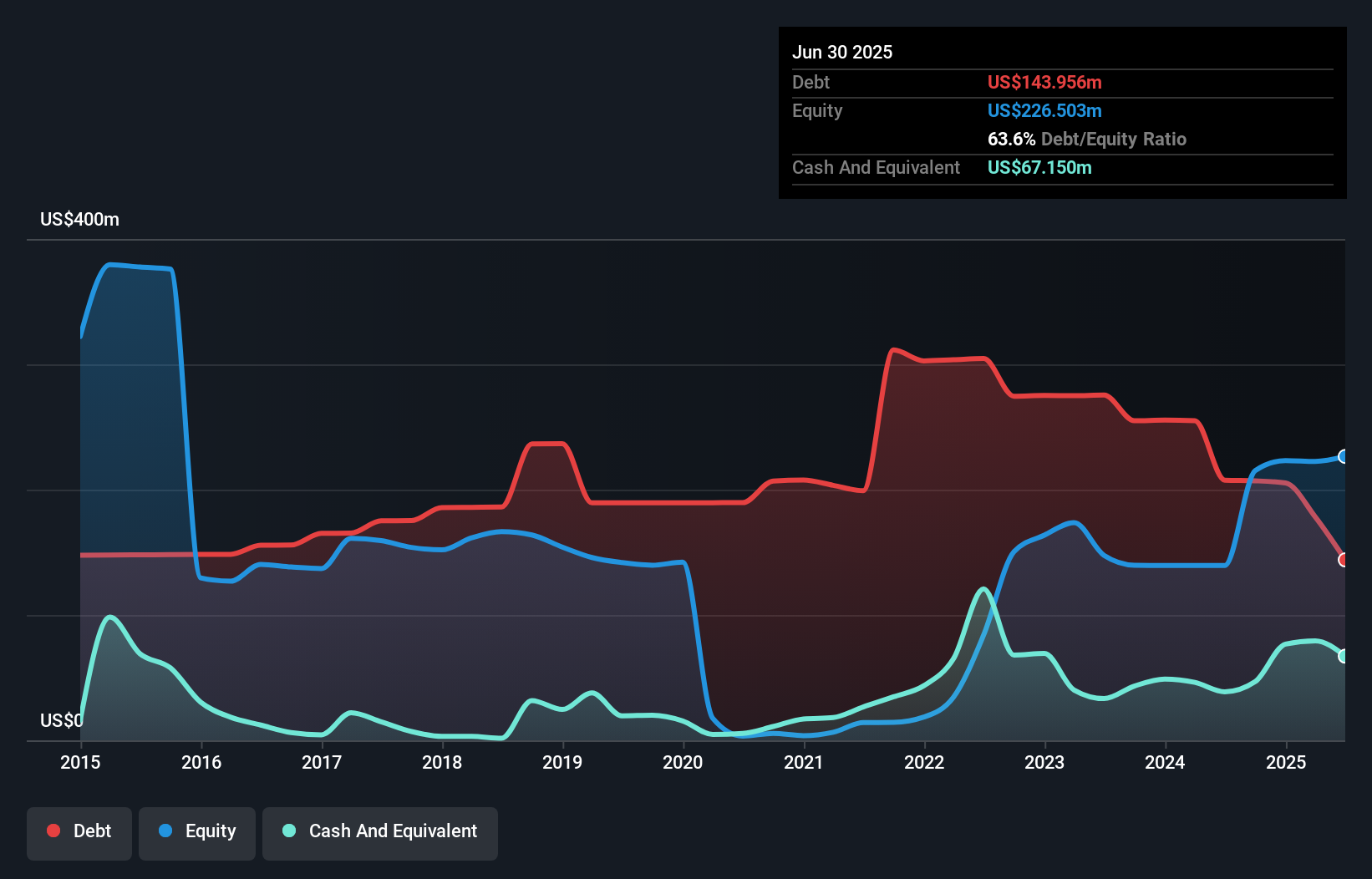

ShaMaran Petroleum, a Canadian oil player, has seen its debt to equity ratio significantly drop from 5638.1% to 63.6% over five years, reflecting improved financial health. The company is trading at 64.7% below estimated fair value and boasts a satisfactory net debt to equity ratio of 33.9%. Despite becoming profitable this year with net income reaching US$3.52 million in Q2 2025, earnings are forecasted to decline by an average of 4.7% annually over the next three years due to industry challenges and large one-off gains impacting results, including a $69.8 million gain in the past year ending June 2025.

Make It Happen

- Take a closer look at our TSX Undiscovered Gems With Strong Fundamentals list of 48 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRON

Cronos Group

A cannabinoid company, engages in the cultivation, production, distribution, and marketing of cannabis products in Canada, Israel, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.