With A 33% Price Drop For Vireo Growth Inc. (CSE:VREO) You'll Still Get What You Pay For

Vireo Growth Inc. (CSE:VREO) shares have retraced a considerable 33% in the last month, reversing a fair amount of their solid recent performance. The last month has meant the stock is now only up 2.9% during the last year.

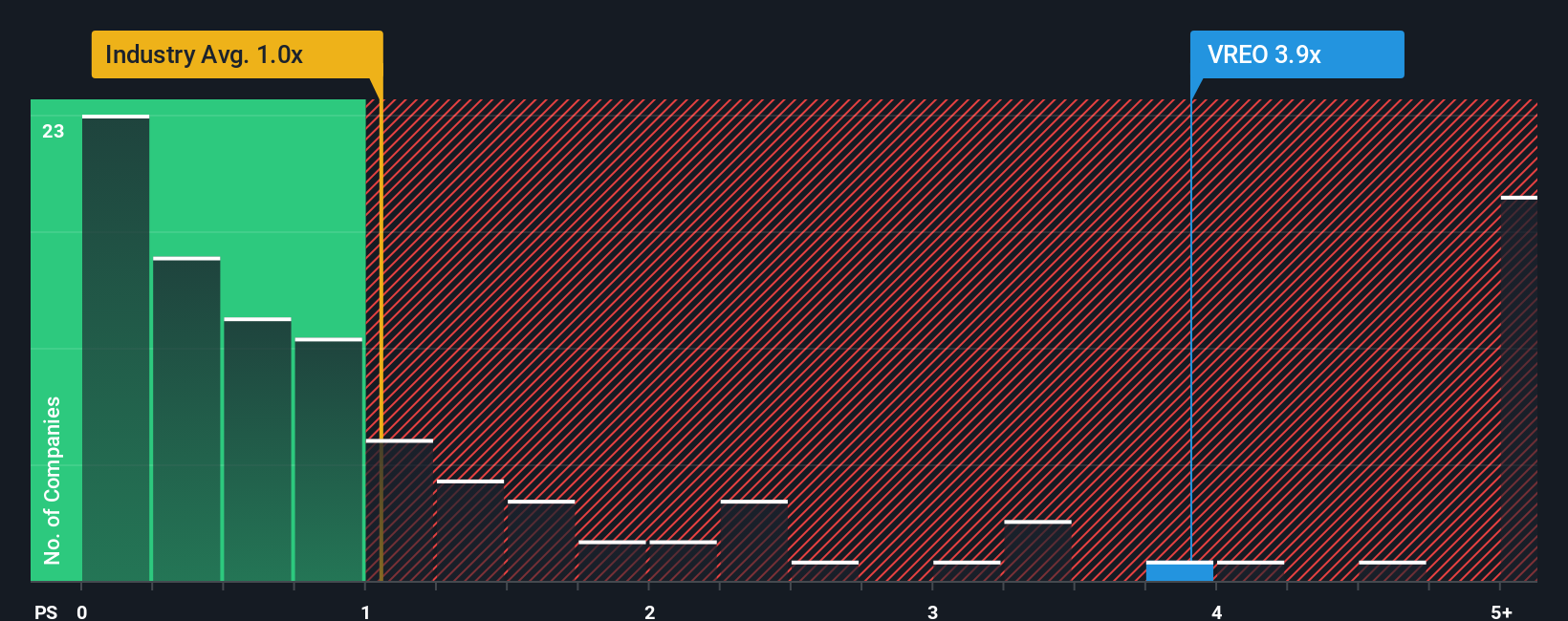

In spite of the heavy fall in price, when almost half of the companies in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 1x, you may still consider Vireo Growth as a stock not worth researching with its 3.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Vireo Growth

How Has Vireo Growth Performed Recently?

Vireo Growth certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Vireo Growth.How Is Vireo Growth's Revenue Growth Trending?

Vireo Growth's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. The strong recent performance means it was also able to grow revenue by 93% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 196% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 14% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Vireo Growth's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Vireo Growth's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Vireo Growth shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Vireo Growth that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:VREO

Vireo Growth

Operates as a cannabis company that cultivates, manufactures, processes, and distributes medical and adult-use cannabis products in Maryland, Minnesota, and New York.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives