Positive Sentiment Still Eludes Planet 13 Holdings Inc. (CSE:PLTH) Following 28% Share Price Slump

Unfortunately for some shareholders, the Planet 13 Holdings Inc. (CSE:PLTH) share price has dived 28% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

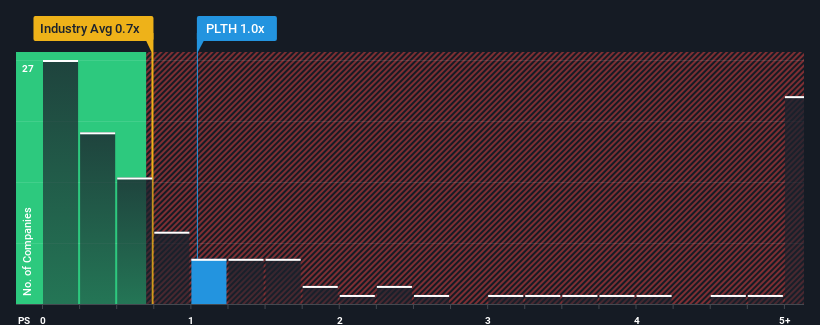

In spite of the heavy fall in price, there still wouldn't be many who think Planet 13 Holdings' price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Canada's Pharmaceuticals industry is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Planet 13 Holdings

What Does Planet 13 Holdings' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Planet 13 Holdings has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Planet 13 Holdings.Is There Some Revenue Growth Forecasted For Planet 13 Holdings?

In order to justify its P/S ratio, Planet 13 Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 8.7% gain to the company's revenues. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 48% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 9.4%, which is noticeably less attractive.

In light of this, it's curious that Planet 13 Holdings' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Planet 13 Holdings' P/S

Following Planet 13 Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Planet 13 Holdings' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for Planet 13 Holdings (2 shouldn't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Planet 13 Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:PLTH

Planet 13 Holdings

Planet 13 Holdings Inc., together with its subsidiaries, cultivates and provides cannabis and cannabis-infused products for medical and retail cannabis markets in the United States.

Undervalued with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026