As the Canadian market maintains strong momentum heading into 2025, investors are advised to be mindful of potential curveballs despite the optimism surrounding solid fundamentals and rising corporate profits. In this context, penny stocks—though an outdated term—continue to represent an intriguing investment area for those interested in smaller or less-established companies. By focusing on stocks with robust financials and a clear growth trajectory, investors may uncover opportunities that offer both stability and potential upside.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.24 | CA$160.38M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$281.86M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.36 | CA$120.59M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$565.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.45 | CA$335.5M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.89 | CA$187.19M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.03M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.15 | CA$215.73M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 960 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

PharmaTher Holdings (CNSX:PHRM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PharmaTher Holdings Ltd. is a specialty pharmaceutical company focused on developing and commercializing pharmaceuticals with novel delivery methods to improve patient outcomes, with a market cap of CA$20.36 million.

Operations: PharmaTher Holdings Ltd. does not report any specific revenue segments.

Market Cap: CA$20.36M

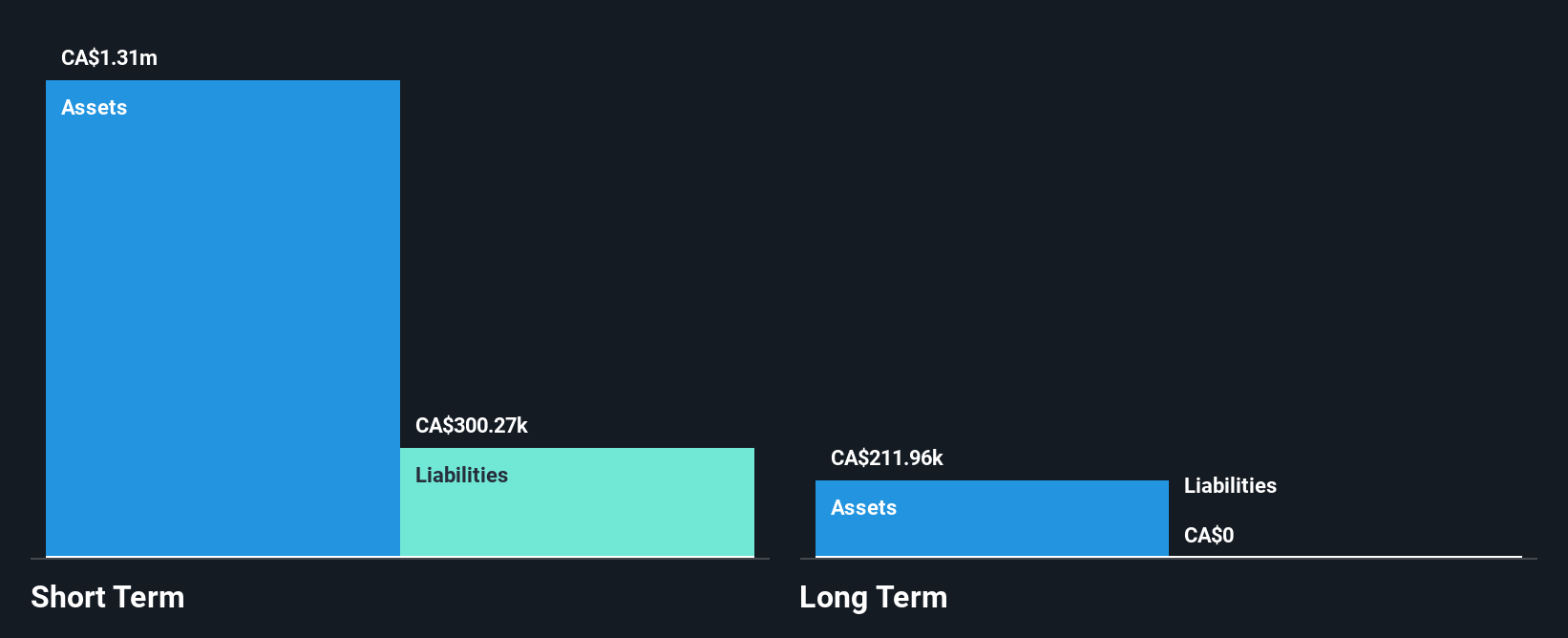

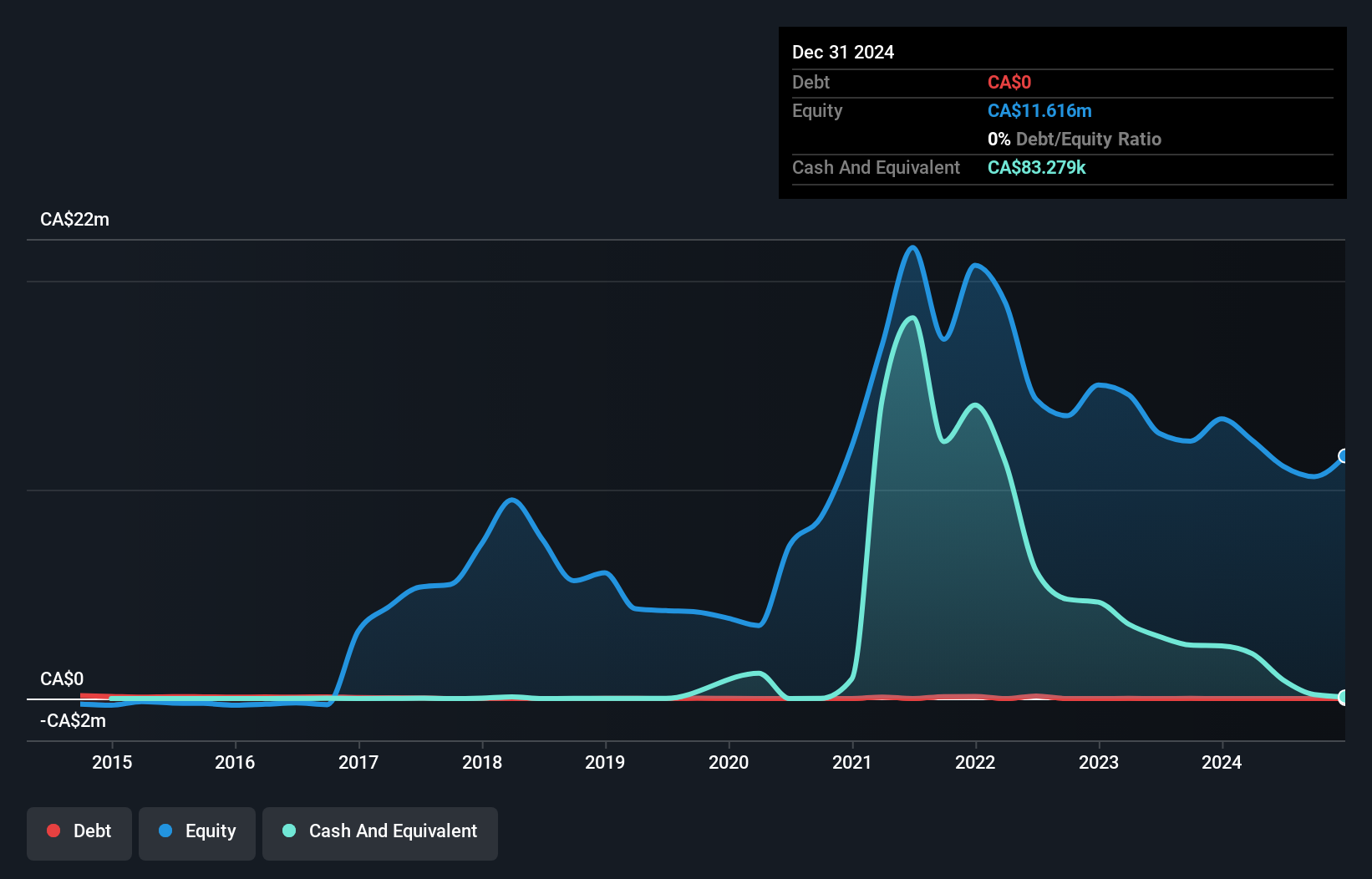

PharmaTher Holdings, with a market cap of CA$20.36 million, is a pre-revenue company focused on innovative pharmaceutical delivery methods. Recent developments include an FDA post-complete letter clarification meeting for its ketamine application, addressing minor deficiencies without new clinical studies required. Despite no long-term liabilities and short-term assets covering liabilities, the company faces financial challenges with less than a year of cash runway and ongoing losses. The stock exhibits high volatility compared to most Canadian stocks. The board's average tenure indicates experienced governance amidst concerns about the company's ability to continue as a going concern raised by auditors.

- Click here to discover the nuances of PharmaTher Holdings with our detailed analytical financial health report.

- Explore historical data to track PharmaTher Holdings' performance over time in our past results report.

Tartisan Nickel (CNSX:TN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tartisan Nickel Corp. focuses on the acquisition, exploration, and development of mineral properties in Canada and Peru, with a market cap of CA$24.39 million.

Operations: Tartisan Nickel Corp. has not reported any revenue segments.

Market Cap: CA$24.39M

Tartisan Nickel Corp., with a market cap of CA$24.39 million, remains pre-revenue, focusing on mineral exploration and development. The company recently raised CA$1.5 million through a private placement, enhancing its short-term liquidity despite ongoing losses and shareholder dilution. Its cash runway is limited to several months without further capital influx. Tartisan's strategic progress includes infrastructure developments at the Kenbridge Nickel Project in Ontario, potentially improving project access and community connectivity. While it has no long-term liabilities and more cash than debt, the company's negative return on equity highlights challenges in achieving profitability amidst stable stock volatility.

- Jump into the full analysis health report here for a deeper understanding of Tartisan Nickel.

- Evaluate Tartisan Nickel's historical performance by accessing our past performance report.

Quipt Home Medical (TSX:QIPT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Quipt Home Medical Corp., operating through its subsidiaries, provides durable and home medical equipment and supplies in the United States, with a market cap of CA$144.36 million.

Operations: The company's revenue segment, PHM, generated $244.23 million.

Market Cap: CA$144.36M

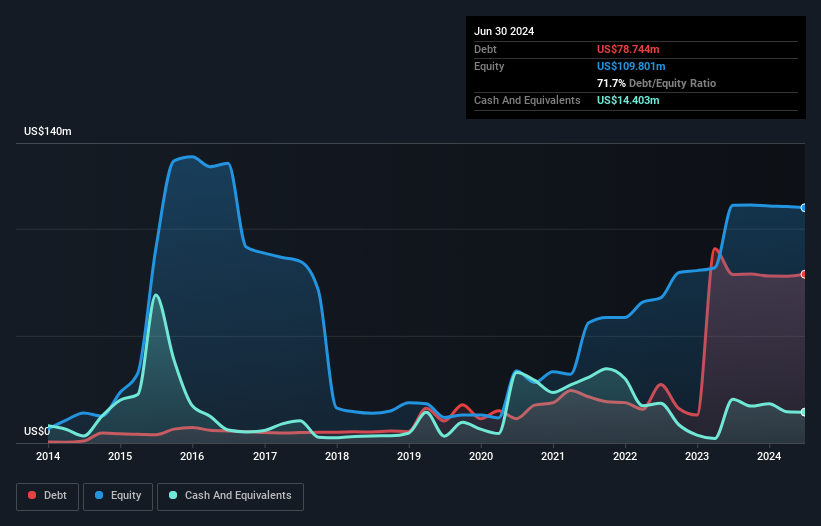

Quipt Home Medical Corp., with a market cap of CA$144.36 million, operates in the durable and home medical equipment sector. Despite being unprofitable, it shows promise with a positive and growing free cash flow, providing a cash runway exceeding three years. The company has reduced its net debt to equity ratio over five years but remains relatively high at 58.6%. While shareholders experienced dilution recently, Quipt trades at a significant discount to its estimated fair value and is forecasted for substantial earnings growth. Recent inclusion in the S&P Global BMI Index may enhance visibility among investors.

- Take a closer look at Quipt Home Medical's potential here in our financial health report.

- Examine Quipt Home Medical's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Discover the full array of 960 TSX Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:PHRM

PharmaTher Holdings

A specialty pharmaceutical company, develops and commercialize specialty pharmaceuticals exhibiting the adoption and permitting novel delivery methods to enhance patient outcomes.

Moderate with adequate balance sheet.

Market Insights

Community Narratives