- Canada

- /

- Personal Products

- /

- TSXV:LOVE

Can You Imagine How Cannara Biotech's (CSE:LOVE) Shareholders Feel About The -6.5% Share Price Increase?

Cannara Biotech Inc. (CSE:LOVE) shareholders will doubtless be very grateful to see the share price up 81% in the last month. But that doesn't change the fact that the returns over the last year have been less than pleasing. In fact the stock is down 6.5% in the last year, well below the market return.

Check out our latest analysis for Cannara Biotech

Cannara Biotech wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Cannara Biotech increased its revenue by 22%. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 6.5%. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

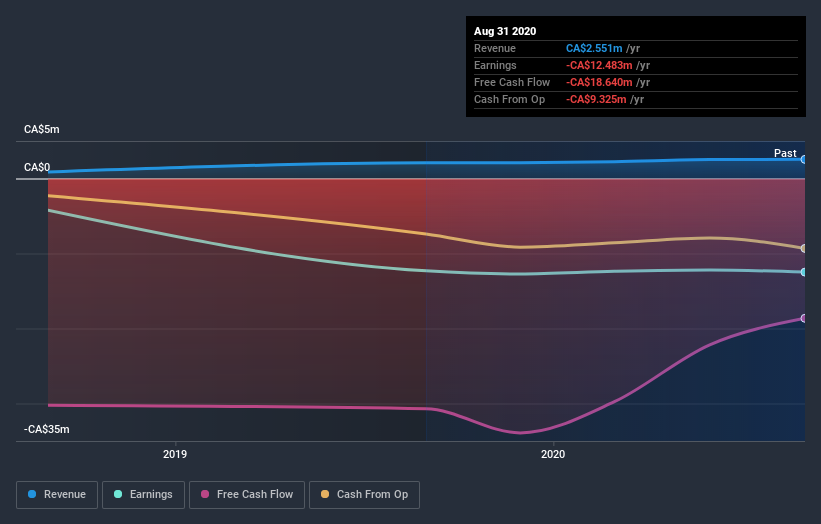

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Cannara Biotech's earnings, revenue and cash flow.

A Different Perspective

While Cannara Biotech shareholders are down 6.5% for the year, the market itself is up 5.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 61% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 5 warning signs for Cannara Biotech you should be aware of, and 1 of them can't be ignored.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

When trading Cannara Biotech or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:LOVE

Cannara Biotech

Engages in the indoor cultivation, processing, and sale of cannabis and cannabis-derivative products in Canada.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026