Did Business Growth Power Core One Labs' (CSE:COOL) Share Price Gain of 104%?

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right stock, you can make a lot more than 100%. For example, the Core One Labs Inc. (CSE:COOL) share price had more than doubled in just one year - up 104%. Better yet, the share price has gained 184% in the last quarter. On the other hand, longer term shareholders have had a tougher run, with the stock falling 87% in three years.

View our latest analysis for Core One Labs

Core One Labs isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Core One Labs actually shrunk its revenue over the last year, with a reduction of 61%. So we would not have expected the share price to rise 104%. It just goes to show the market doesn't always pay attention to the reported numbers. It's quite likely the revenue fall was already priced in, anyway.

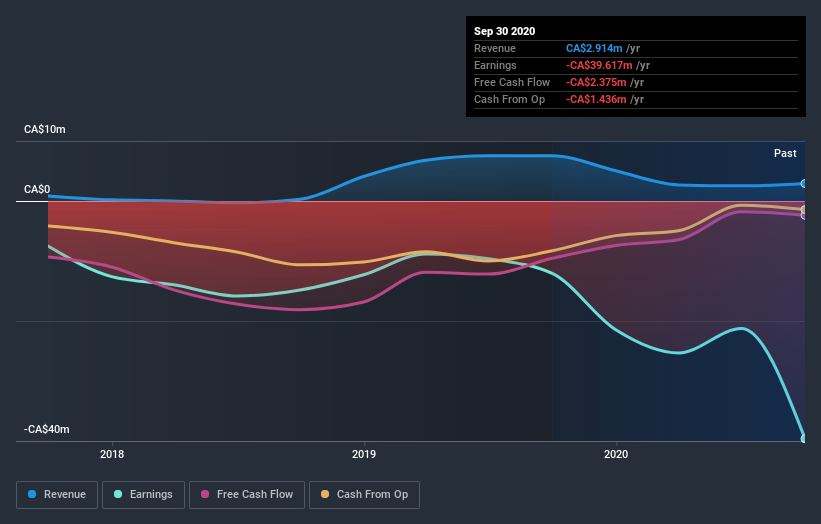

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Core One Labs' financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Core One Labs shareholders have received a total shareholder return of 104% over the last year. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 7 warning signs for Core One Labs (3 don't sit too well with us) that you should be aware of.

We will like Core One Labs better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

When trading Core One Labs or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CNSX:COOL

Core One Labs

Operates as a psychedelic research and development company.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives