We Take A Look At Why QYOU Media Inc.'s (CVE:QYOU) CEO Compensation Is Well Earned

The performance at QYOU Media Inc. (CVE:QYOU) has been quite strong recently and CEO Curt Marvis has played a role in it. Coming up to the next AGM on 14 March 2022, shareholders would be keeping this in mind. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for QYOU Media

How Does Total Compensation For Curt Marvis Compare With Other Companies In The Industry?

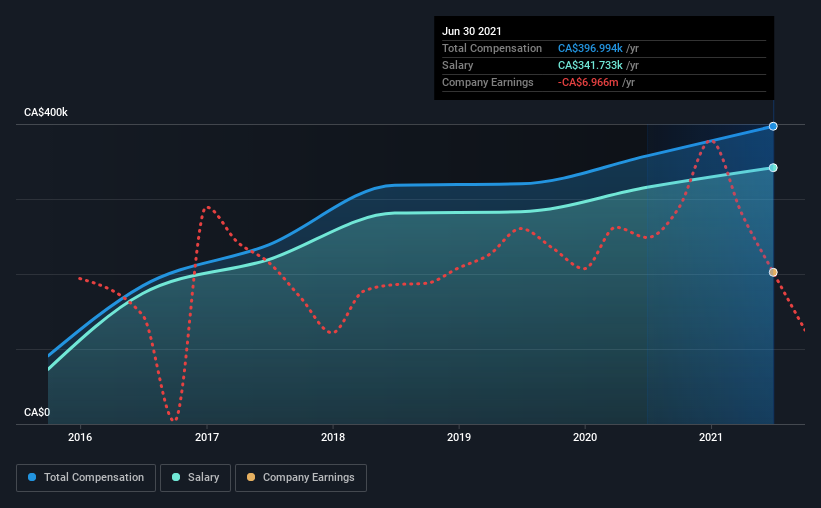

At the time of writing, our data shows that QYOU Media Inc. has a market capitalization of CA$62m, and reported total annual CEO compensation of CA$397k for the year to June 2021. We note that's an increase of 11% above last year. In particular, the salary of CA$341.7k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under CA$255m, the reported median total CEO compensation was CA$317k. This suggests that QYOU Media remunerates its CEO largely in line with the industry average. Moreover, Curt Marvis also holds CA$546k worth of QYOU Media stock directly under their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CA$342k | CA$316k | 86% |

| Other | CA$55k | CA$42k | 14% |

| Total Compensation | CA$397k | CA$358k | 100% |

Talking in terms of the industry, salary represented approximately 84% of total compensation out of all the companies we analyzed, while other remuneration made up 16% of the pie. QYOU Media is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at QYOU Media Inc.'s Growth Numbers

Over the past three years, QYOU Media Inc. has seen its earnings per share (EPS) grow by 50% per year. It achieved revenue growth of 224% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has QYOU Media Inc. Been A Good Investment?

Most shareholders would probably be pleased with QYOU Media Inc. for providing a total return of 123% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for QYOU Media (1 is a bit concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if QYOU Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:QYOU

QYOU Media

Through its subsidiaries, curates, produces, and distributes content created by social media stars and digital content creators in the United States, Canada, and India.

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives