Unveiling 3 Top Growth Companies With High Insider Ownership On The TSX

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has dropped 3.7%, but it remains up 8.2% over the past year with earnings forecasted to grow by 15% annually. In this fluctuating environment, identifying growth companies with high insider ownership can be a strategic approach as it often signals confidence in long-term prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.6% | 58.4% |

| goeasy (TSX:GSY) | 21.5% | 16.3% |

| Payfare (TSX:PAY) | 14.8% | 38.6% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Ivanhoe Mines (TSX:IVN) | 12.3% | 41.3% |

| Allied Gold (TSX:AAUC) | 22.5% | 58.0% |

| Alpha Cognition (CNSX:ACOG) | 17.9% | 66.5% |

| Aya Gold & Silver (TSX:AYA) | 10.3% | 68.5% |

| Magna Mining (TSXV:NICU) | 10.6% | 94.7% |

| Almonty Industries (TSX:AII) | 17.7% | 105% |

Let's take a closer look at a couple of our picks from the screened companies.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a global music, media, and technology company with a market cap of CA$562.03 million.

Operations: Stingray Group Inc. generates revenue primarily from its Radio segment, which accounts for CA$129.37 million, and its Broadcasting and Commercial Music segment, which brings in CA$216.06 million.

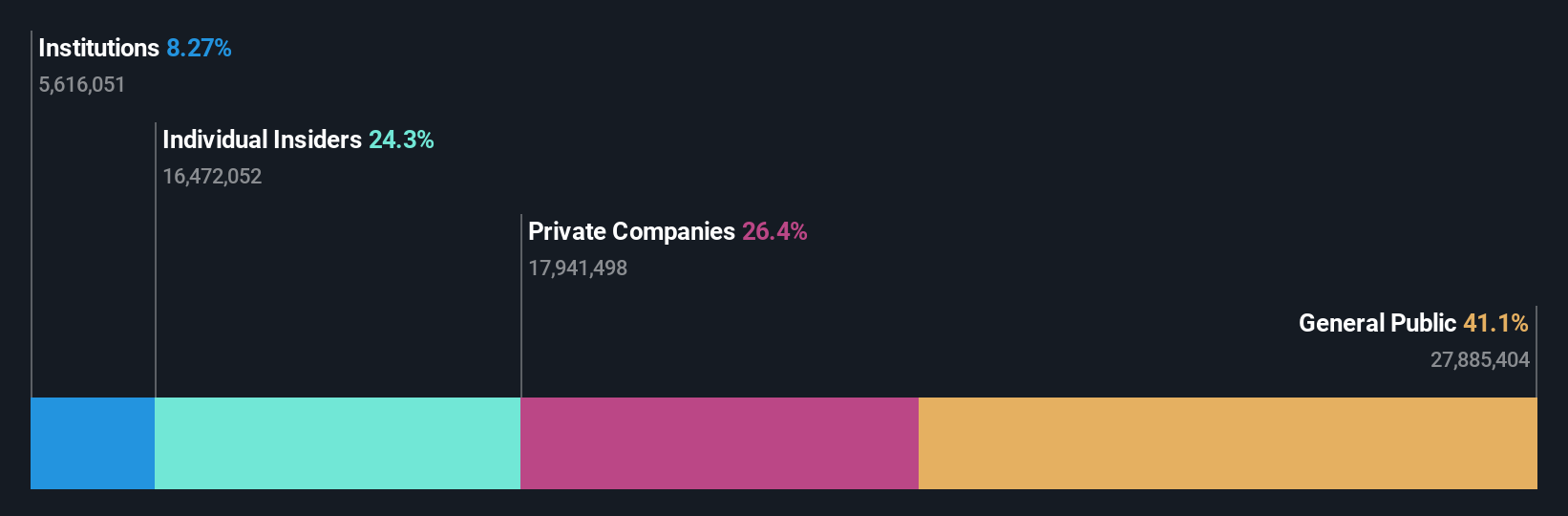

Insider Ownership: 25.6%

Return On Equity Forecast: 22% (2027 estimate)

Stingray Group, a growth company with high insider ownership, has seen substantial insider buying in the past three months. The company's revenue is forecast to grow at 5.3% annually, slightly below the Canadian market average of 6.8%. Despite a high level of debt and recent declines in net income, Stingray is expected to become profitable within three years and has a projected return on equity of 22%. Recent developments include new streaming channels on The Roku Channel and executive board changes.

- Unlock comprehensive insights into our analysis of Stingray Group stock in this growth report.

- Our valuation report unveils the possibility Stingray Group's shares may be trading at a discount.

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged individuals across Canada, the United States, Europe, and internationally, with a market cap of CA$1.37 billion.

Operations: The company generates revenue from its Patient Care segment (CA$183.82 million) and Segment Adjustment (CA$650.96 million).

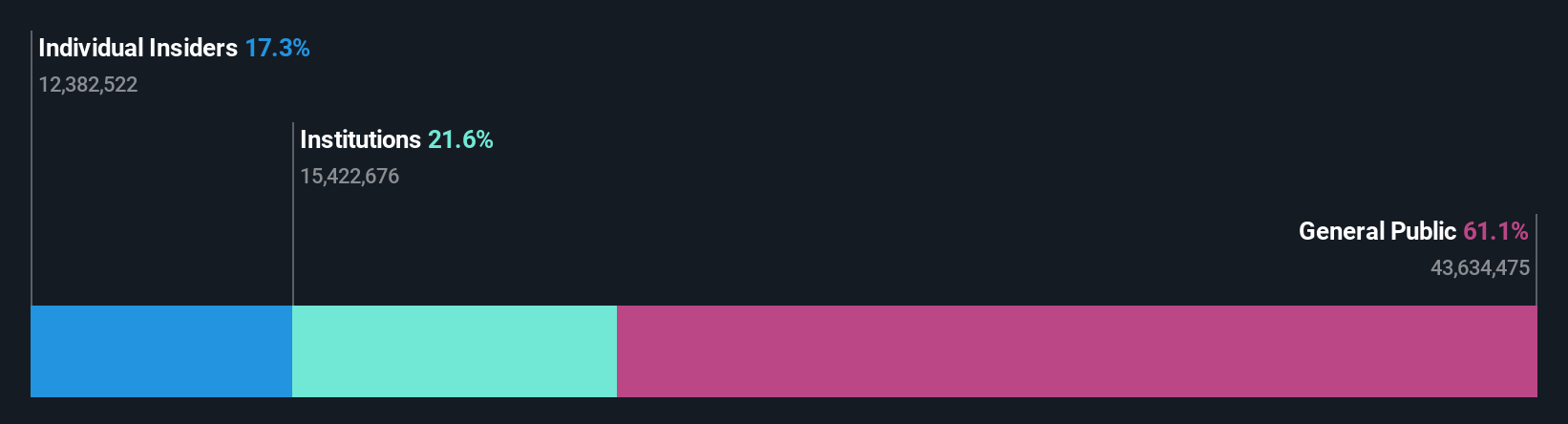

Insider Ownership: 19.6%

Return On Equity Forecast: N/A (2027 estimate)

Savaria Corporation, characterized by high insider ownership, has seen substantial insider buying recently. Earnings are forecast to grow 24.87% annually, outpacing the Canadian market's 14.8%. Despite trading at 63.9% below its estimated fair value and experiencing shareholder dilution over the past year, Savaria’s revenue is expected to grow at 7.4% per year. Recent developments include appointing Pernilla Lindén to the Board and consistent monthly dividends of CAD$0.0433 per share.

- Get an in-depth perspective on Savaria's performance by reading our analyst estimates report here.

- The analysis detailed in our Savaria valuation report hints at an inflated share price compared to its estimated value.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. provides technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally with a market cap of CA$407.84 million.

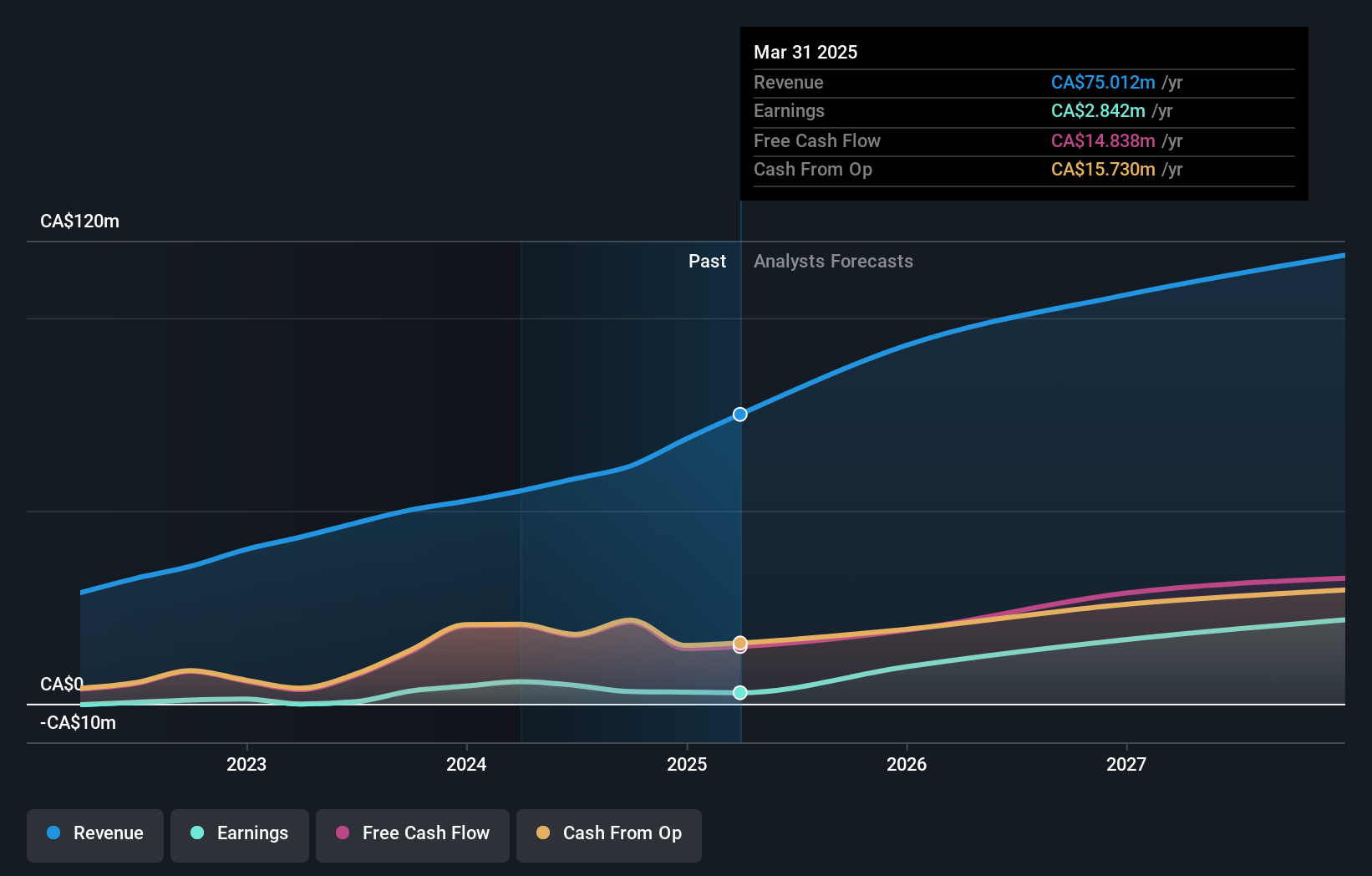

Operations: Vitalhub generates CA$55.17 million in revenue from its healthcare software segment.

Insider Ownership: 15.1%

Return On Equity Forecast: N/A (2027 estimate)

Vitalhub Corp., with significant insider ownership, recently announced a strategic partnership with Lumenus Community Services to deploy TREAT, enhancing data management and client tracking. The company reported Q1 2024 revenue of CAD$15.26 million and net income of CAD$1.32 million, both showing growth from the previous year. Despite past shareholder dilution, Vitalhub's earnings are forecast to grow significantly at 39.57% annually, outpacing the Canadian market's 14.8%.

- Click to explore a detailed breakdown of our findings in Vitalhub's earnings growth report.

- Our comprehensive valuation report raises the possibility that Vitalhub is priced lower than what may be justified by its financials.

Make It Happen

- Get an in-depth perspective on all 32 Fast Growing TSX Companies With High Insider Ownership by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RAY.A

Stingray Group

Operates as a music, media, and technology company in Canada, the United States, and internationally.

Exceptional growth potential established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion