- Canada

- /

- Metals and Mining

- /

- TSX:DSV

Top TSX Growth Companies With High Insider Ownership For April 2025

Reviewed by Simply Wall St

As the Canadian TSX outperforms its U.S. counterparts amidst ongoing tariff uncertainties, investors are keenly observing the market's response to economic pressures and monetary policy stances. In such a climate, growth companies with high insider ownership can offer unique insights and potential resilience, as insiders often have a vested interest in steering their companies through challenging times.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 35.8% |

| Discovery Silver (TSX:DSV) | 24.1% | 47% |

| Allied Gold (TSX:AAUC) | 17.7% | 74.5% |

| West Red Lake Gold Mines (TSXV:WRLG) | 12.5% | 76.8% |

| Almonty Industries (TSX:AII) | 16.3% | 50.5% |

| Aritzia (TSX:ATZ) | 17.6% | 41.1% |

| Enterprise Group (TSX:E) | 32.2% | 41.9% |

| Burcon NutraScience (TSX:BU) | 16.4% | 152.2% |

| SolarBank (NEOE:SUNN) | 17.3% | 178.3% |

| Ivanhoe Mines (TSX:IVN) | 12.4% | 44.5% |

Let's dive into some prime choices out of the screener.

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market cap of CA$4.75 billion.

Operations: The company's revenue primarily comes from its apparel segment, which generated CA$2.52 billion.

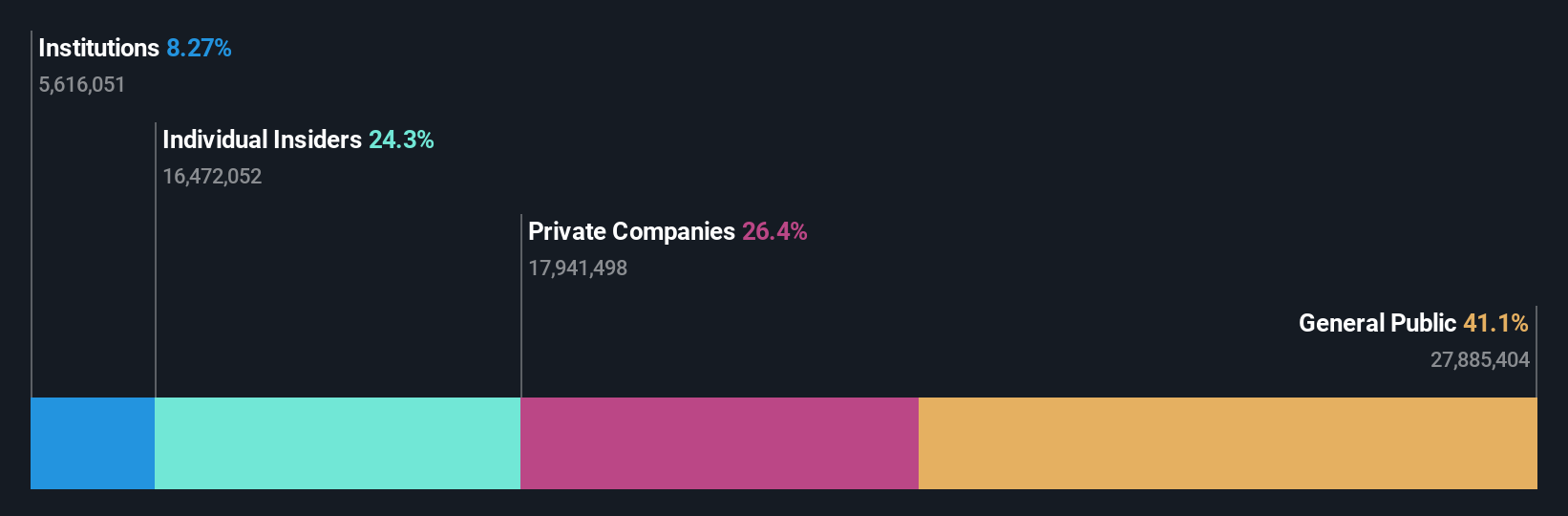

Insider Ownership: 17.6%

Aritzia's earnings are expected to grow significantly, outpacing the Canadian market. Despite recent insider selling and no substantial buying in the past three months, analysts agree on a potential 69.7% stock price increase from current levels. The company trades at 76.4% below its estimated fair value, suggesting room for appreciation. Recent events include a CAD 66.36 million follow-on equity offering, signaling strategic capital management amidst robust growth forecasts and high forecasted return on equity of 23.8%.

- Delve into the full analysis future growth report here for a deeper understanding of Aritzia.

- Upon reviewing our latest valuation report, Aritzia's share price might be too pessimistic.

Discovery Silver (TSX:DSV)

Simply Wall St Growth Rating: ★★★★★★

Overview: Discovery Silver Corp. is a mineral exploration company focused on the exploration and development of polymetallic mineral deposits, with a market cap of CA$1.12 billion.

Operations: Discovery Silver Corp. does not report any revenue segments in its financial disclosures.

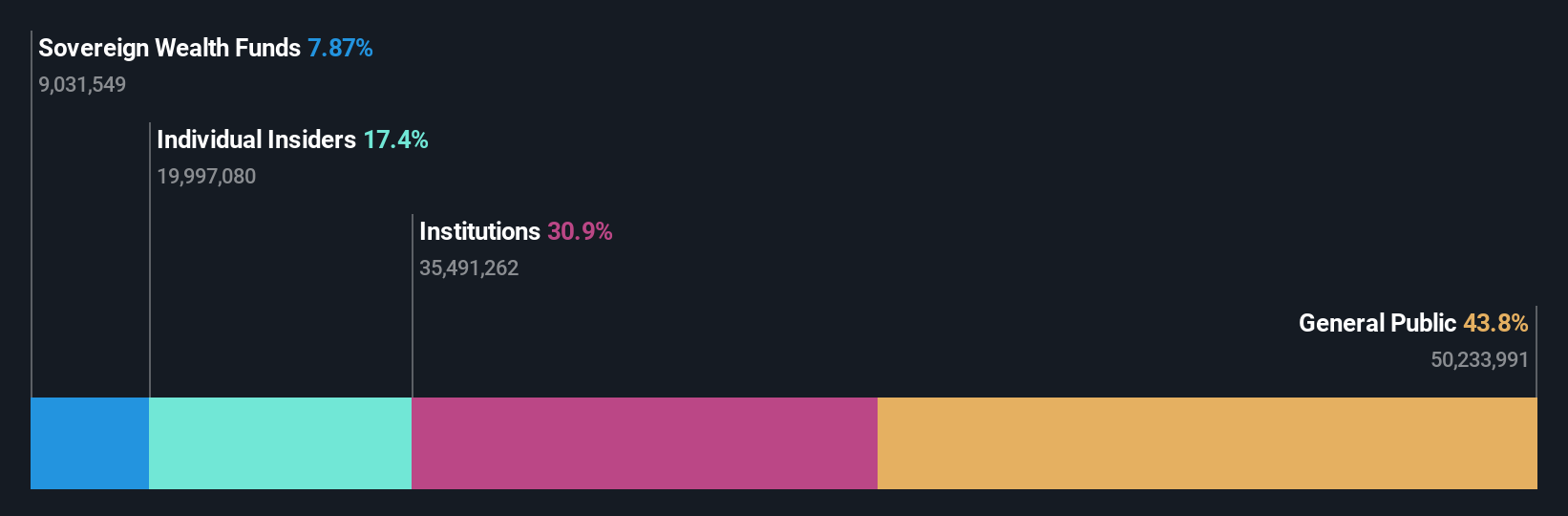

Insider Ownership: 24.1%

Discovery Silver is poised for significant growth, with revenue expected to increase 50.3% annually, outpacing the Canadian market. Insider buying indicates confidence in its future prospects despite recent volatility and a CAD 20.9 million net loss for 2024. The company trades at a substantial discount to its estimated fair value and has filed a CAD 500 million shelf registration following a CAD 225 million equity offering, supporting strategic initiatives like the Porcupine Complex acquisition.

- Click here and access our complete growth analysis report to understand the dynamics of Discovery Silver.

- Our valuation report here indicates Discovery Silver may be undervalued.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a global music, media, and technology company with a market capitalization of CA$574.90 million.

Operations: The company's revenue is derived from two primary segments: Radio, generating CA$131.18 million, and Broadcasting and Commercial Music, contributing CA$243.37 million.

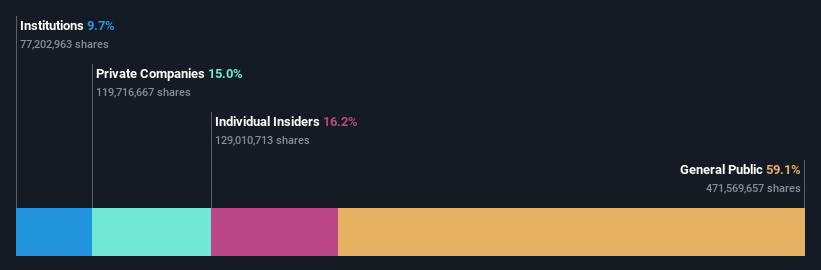

Insider Ownership: 25.6%

Stingray Group's growth potential is tempered by high debt levels and slower revenue growth of 4.5% annually compared to the Canadian market. Despite this, analysts see a 31.4% upside in its stock price, trading at a significant discount to fair value. Recent earnings showed improved quarterly net income of C$15.68 million, yet substantial insider selling raises concerns about confidence in future performance despite ongoing dividend payments and international presentations highlighting strategic outreach efforts.

- Navigate through the intricacies of Stingray Group with our comprehensive analyst estimates report here.

- The analysis detailed in our Stingray Group valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Click this link to deep-dive into the 37 companies within our Fast Growing TSX Companies With High Insider Ownership screener.

- Ready To Venture Into Other Investment Styles? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DSV

Discovery Silver

A mineral exploration company, engages in the acquisition, exploration, and development of mineral properties in Canada.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives