The Canadian market has been buoyed by easing trade tensions, with recent developments such as the U.S.-U.K. trade deal and upcoming U.S.-China talks potentially creating a more favorable economic backdrop. Amidst these broader market movements, penny stocks—often considered a relic of past eras—continue to offer intriguing opportunities for investors interested in smaller or newer companies. These stocks can present affordable entry points with growth potential, especially when backed by solid financials and strong balance sheets.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.81 | CA$80.92M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.19 | CA$91.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.47 | CA$136.57M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.58 | CA$412.48M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.07 | CA$558.58M | ✅ 4 ⚠️ 2 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.82 | CA$466.69M | ✅ 3 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.63 | CA$4.45M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.58 | CA$540.02M | ✅ 3 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.55 | CA$130.44M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.465 | CA$13.32M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 905 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

VerticalScope Holdings (TSX:FORA)

Simply Wall St Financial Health Rating: ★★★★☆☆

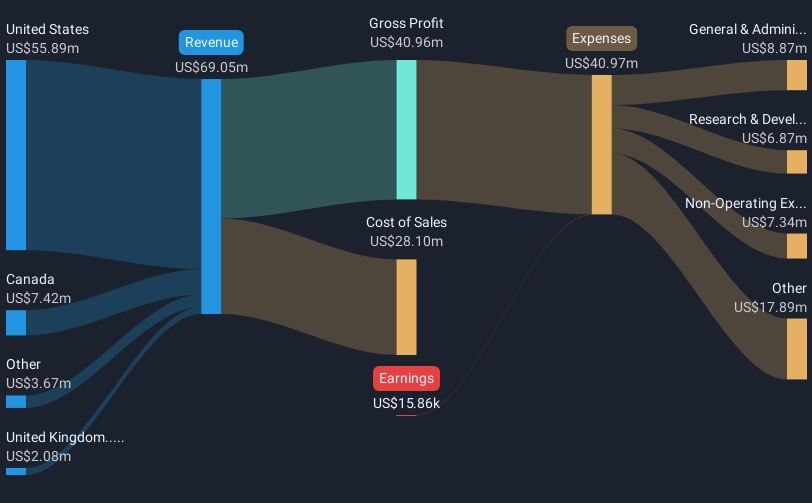

Overview: VerticalScope Holdings Inc. is a technology company that operates a cloud-based digital community platform for online enthusiast communities across various regions, with a market cap of CA$104.15 million.

Operations: The company generates revenue from digital advertising and e-commerce, totaling $69.05 million.

Market Cap: CA$104.15M

VerticalScope Holdings Inc., with a market cap of CA$104.15 million, reported first-quarter sales of US$13.57 million, down from US$14.72 million the previous year, and a net loss of US$2.42 million compared to US$0.98 million last year. Despite being unprofitable, it has a positive cash flow runway exceeding three years and reduced losses by 5.4% annually over five years. The management team is experienced with an average tenure of 8.3 years, and its short-term assets cover short-term liabilities but not long-term ones, highlighting potential financial stability concerns amidst high debt levels.

- Click here and access our complete financial health analysis report to understand the dynamics of VerticalScope Holdings.

- Assess VerticalScope Holdings' future earnings estimates with our detailed growth reports.

Mogo (TSX:MOGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

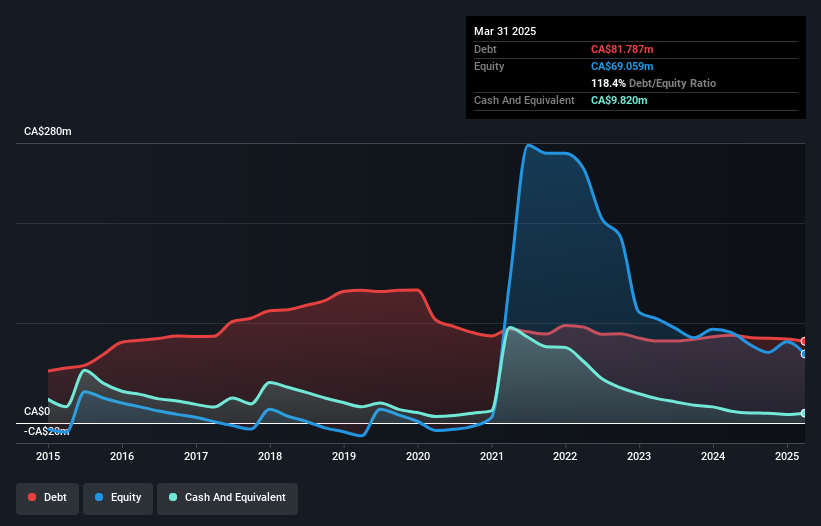

Overview: Mogo Inc. is a financial technology company that operates in Canada, Europe, and internationally with a market cap of CA$32.54 million.

Operations: Mogo Inc. has not reported any specific revenue segments.

Market Cap: CA$32.54M

Mogo Inc., with a market cap of CA$32.54 million, reported first-quarter revenue of CA$17.33 million, slightly down from the previous year, and a net loss that widened to CA$11.87 million. Despite its unprofitability and high net debt to equity ratio (104.2%), Mogo maintains a positive cash flow runway exceeding three years and forecasts revenue growth of 25.91% annually. The company recently amended its credit facility, extending maturity and increasing available capital, which may support future operations amid volatility concerns in share price stability over the past three months. Management is seasoned with an average tenure of 13.8 years.

- Click to explore a detailed breakdown of our findings in Mogo's financial health report.

- Understand Mogo's earnings outlook by examining our growth report.

Westport Fuel Systems (TSX:WPRT)

Simply Wall St Financial Health Rating: ★★★★★★

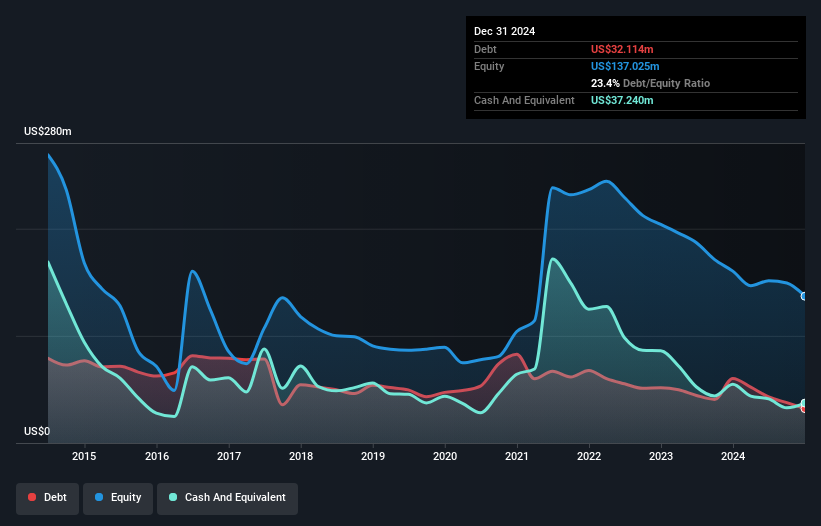

Overview: Westport Fuel Systems Inc. specializes in engineering, manufacturing, and supplying alternative fuel systems and components for transportation applications worldwide, with a market cap of CA$68.96 million.

Operations: The company's revenue is primarily derived from its Light-duty segment at $262.18 million, followed by the Heavy-duty OEM segment at $31.32 million, and High-pressure Controls & Systems at $8.80 million.

Market Cap: CA$68.96M

Westport Fuel Systems, with a market cap of CA$68.96 million, is navigating challenges typical for penny stocks. Despite a stable cash runway exceeding three years and reduced debt levels over five years, the company remains unprofitable with increasing losses over the past five years. Recent earnings show a net loss reduction to US$2.45 million for Q1 2025 from US$13.65 million a year prior, yet sales declined to US$70.96 million from US$77.57 million in the same period last year. The board is experienced; however, auditors have expressed doubts about its ability to continue as a going concern.

- Get an in-depth perspective on Westport Fuel Systems' performance by reading our balance sheet health report here.

- Gain insights into Westport Fuel Systems' future direction by reviewing our growth report.

Make It Happen

- Click through to start exploring the rest of the 902 TSX Penny Stocks now.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Westport Fuel Systems, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Westport Fuel Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WPRT

Westport Fuel Systems

Engages in the engineering, manufacturing, and supplying alternative fuel systems and components for use in transportation applications in Europe, Asia, North America, South America, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives