Corus Entertainment (TSE:CJR.B) Has Announced A Dividend Of CA$0.06

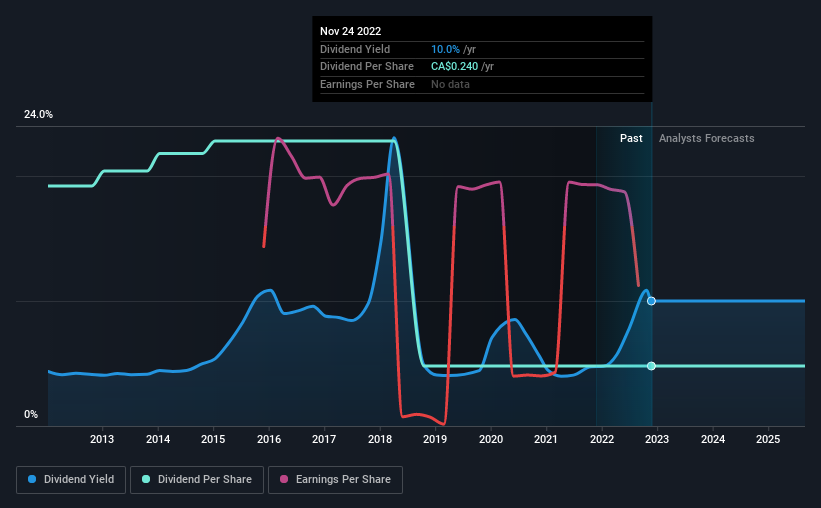

Corus Entertainment Inc.'s (TSE:CJR.B) investors are due to receive a payment of CA$0.06 per share on 29th of December. The dividend yield will be 10.0% based on this payment which is still above the industry average.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Corus Entertainment's stock price has reduced by 37% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

Check out the opportunities and risks within the CA Media industry.

Corus Entertainment's Distributions May Be Difficult To Sustain

A big dividend yield for a few years doesn't mean much if it can't be sustained. Corus Entertainment is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Assuming the trend of the last few years continues, EPS will grow by 10.9% over the next 12 months. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. However, the positive cash flow ratio gives us some comfort about the sustainability of the dividend.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was CA$0.96 in 2012, and the most recent fiscal year payment was CA$0.24. Dividend payments have fallen sharply, down 75% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Company Could Face Some Challenges Growing The Dividend

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. We are encouraged to see that Corus Entertainment has grown earnings per share at 11% per year over the past five years. It's not great that the company is not turning a profit, but the decent growth in recent years is certainly a positive sign. All is not lost, but the future of the dividend definitely rests upon the company's ability to become profitable soon.

Our Thoughts On Corus Entertainment's Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Corus Entertainment's payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Corus Entertainment that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CJR.B

Corus Entertainment

A media and content company, operates specialty and conventional television networks, and radio stations in Canada and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.