- Canada

- /

- Entertainment

- /

- TSX:CGX

The past five-year earnings decline for Cineplex (TSE:CGX) likely explains shareholders long-term losses

Cineplex Inc. (TSE:CGX) shareholders should be happy to see the share price up 14% in the last quarter. But don't envy holders -- looking back over 5 years the returns have been really bad. In that time the share price has delivered a rude shock to holders, who find themselves down 71% after a long stretch. So is the recent increase sufficient to restore confidence in the stock? Not yet. We'd err towards caution given the long term under-performance.

While the last five years has been tough for Cineplex shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Cineplex

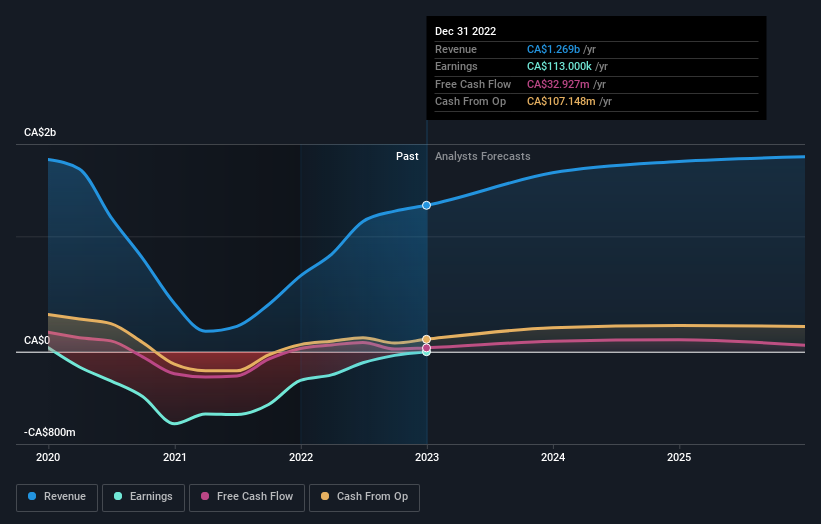

Given that Cineplex only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last five years Cineplex saw its revenue shrink by 18% per year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 11% per year in the same time period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Cineplex has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Cineplex

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Cineplex's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Cineplex shareholders, and that cash payout explains why its total shareholder loss of 67%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market lost about 5.8% in the twelve months, Cineplex shareholders did even worse, losing 32%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Cineplex (of which 2 are a bit concerning!) you should know about.

We will like Cineplex better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CGX

Cineplex

Operates as an entertainment and media company in Canada and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives