- Canada

- /

- Metals and Mining

- /

- TSXV:FNC

TSX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As we move into February 2025, the Canadian market is navigating a complex landscape of persistent inflation and solid corporate earnings, with European equities quietly outperforming expectations. In this environment, identifying promising investments requires a keen eye on fundamentals and growth potential. While the term "penny stocks" might seem outdated, these smaller or newer companies can still offer significant opportunities when backed by strong financial health. Let's explore three penny stocks that combine balance sheet strength with long-term potential in today's market climate.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.67 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.86 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.19 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 940 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Fancamp Exploration (TSXV:FNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fancamp Exploration Ltd. is involved in the exploration and development of mineral properties, with a market cap of CA$20.48 million.

Operations: Fancamp Exploration Ltd. currently does not report any revenue segments.

Market Cap: CA$20.48M

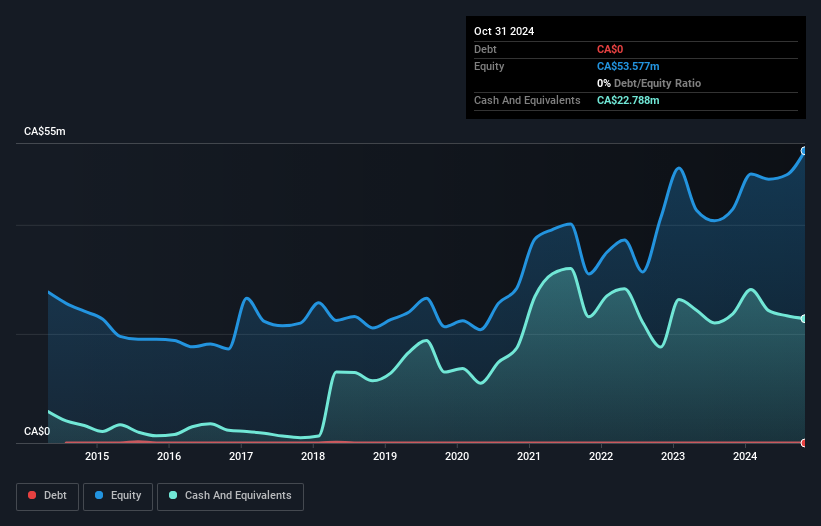

Fancamp Exploration Ltd., with a market cap of CA$20.48 million, is pre-revenue and involved in mineral exploration. Recent developments include promising initial exploration results from its Acadian Gold joint venture in New Brunswick, expanding known mineralization at McIntyre Brook. The company has no debt and has shown substantial earnings growth over the past year, significantly outpacing industry averages. Despite this growth, Fancamp's share price remains highly volatile. Its management and board are experienced, providing stability amidst operational expansion efforts in prospective geological domains for gold and polymetallic discoveries within Canada’s mining sector.

- Take a closer look at Fancamp Exploration's potential here in our financial health report.

- Examine Fancamp Exploration's past performance report to understand how it has performed in prior years.

Imagine Lithium (TSXV:ILI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Imagine Lithium Inc. is a junior mineral exploration company focused on acquiring, exploring, and evaluating mineral properties in North America, with a market cap of CA$5.54 million.

Operations: Currently, there are no reported revenue segments for this junior mineral exploration company focused on North American properties.

Market Cap: CA$5.54M

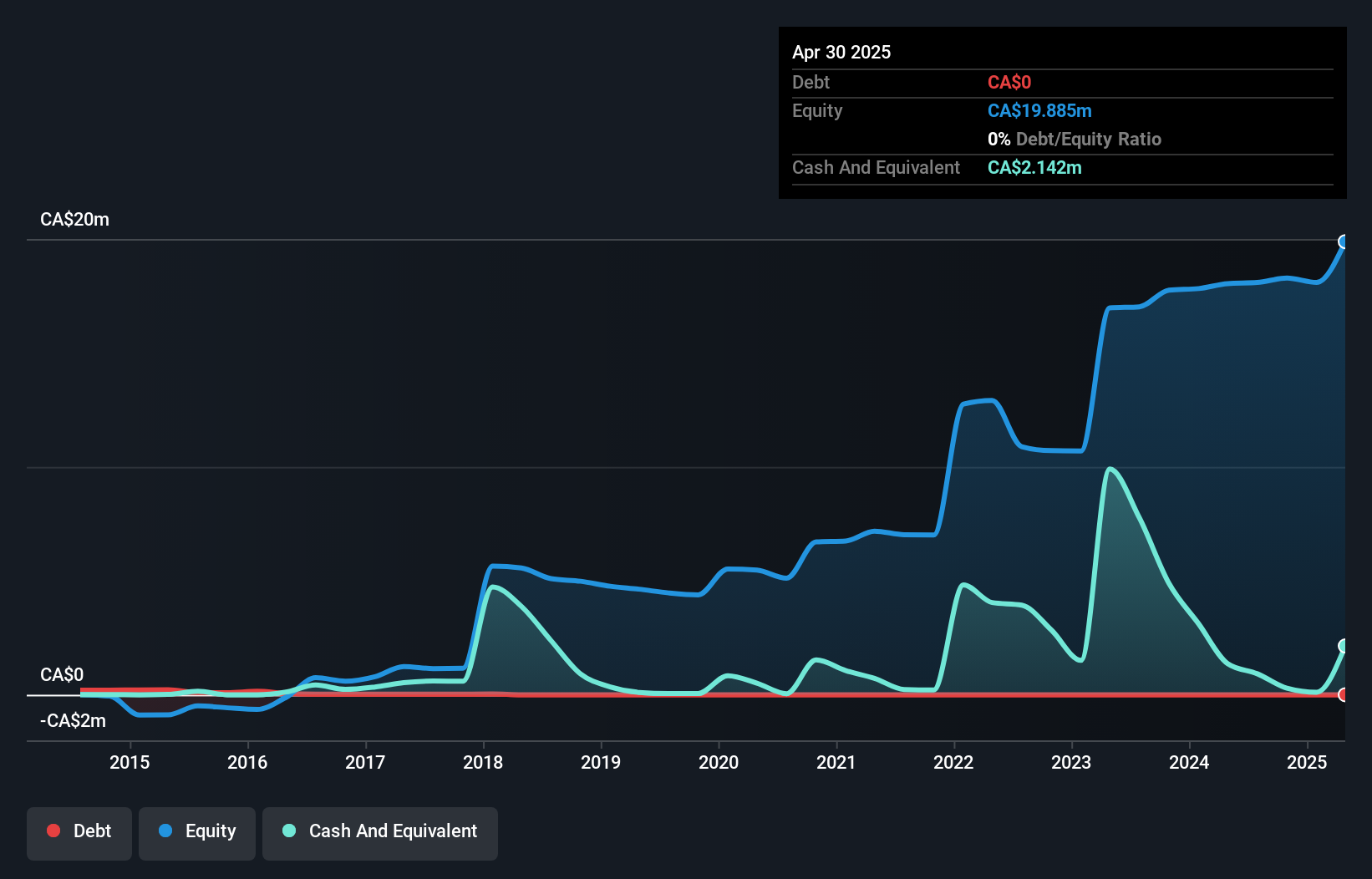

Imagine Lithium Inc., with a market cap of CA$5.54 million, is pre-revenue and focused on mineral exploration in North America. Recent developments include the discovery of a new lithium pegmatite dike at its Jackpot Project in Ontario, highlighting significant lithium concentrations. The company has no long-term liabilities and short-term assets exceed liabilities, indicating stable financial management. Despite achieving profitability recently, its share price remains highly volatile compared to other Canadian stocks. Both the management team and board are experienced, which could provide strategic direction as they continue to explore promising geological formations for lithium deposits.

- Click here to discover the nuances of Imagine Lithium with our detailed analytical financial health report.

- Gain insights into Imagine Lithium's historical outcomes by reviewing our past performance report.

Vision Lithium (TSXV:VLI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vision Lithium Inc. is a Canadian company involved in mineral resource exploration, with a market cap of CA$5.58 million.

Operations: Currently, there are no reported revenue segments for this Canadian mineral resource exploration company.

Market Cap: CA$5.58M

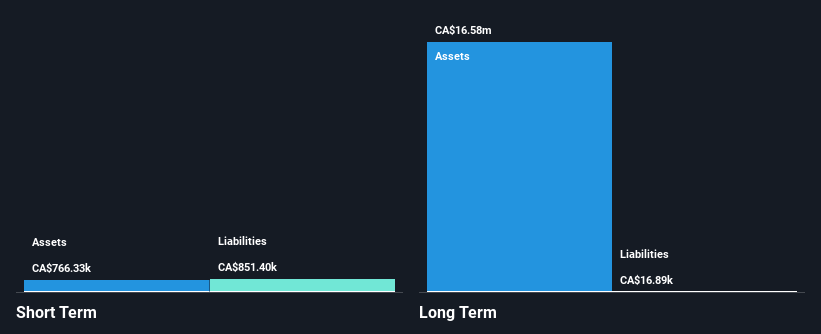

Vision Lithium Inc., with a market cap of CA$5.58 million, is pre-revenue and focused on mineral exploration. Recent developments include the discovery of high-grade cesium mineralization at its Sirmac property, indicating potential for valuable deposits. However, the company faces financial challenges; auditors have expressed doubts about its ability to continue as a going concern. Despite raising CA$499,999 through private placements, Vision Lithium remains unprofitable with increasing losses over five years and short-term liabilities exceeding assets. The board's experience may aid in navigating these difficulties while pursuing further exploration opportunities.

- Jump into the full analysis health report here for a deeper understanding of Vision Lithium.

- Review our historical performance report to gain insights into Vision Lithium's track record.

Where To Now?

- Get an in-depth perspective on all 940 TSX Penny Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FNC

Fancamp Exploration

Engages in the exploration and development of mineral properties.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives