Exploring Mako Mining And 2 Other Promising Canadian Small Caps

Reviewed by Simply Wall St

The Canadian market, like many others globally, has been navigating a period of heightened volatility due to trade tensions and shifting tariff policies. Despite these challenges, the current environment may present unique opportunities for investors willing to explore promising small-cap stocks such as Mako Mining and others that could potentially benefit from strategic positioning and resilience in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Total Energy Services | 19.43% | 15.31% | 54.86% | ★★★★★★ |

| TWC Enterprises | 4.89% | 13.46% | 20.23% | ★★★★★★ |

| Pinetree Capital | 0.24% | 59.68% | 61.83% | ★★★★★★ |

| Genesis Land Development | 46.48% | 30.46% | 55.37% | ★★★★★☆ |

| Mako Mining | 8.59% | 38.81% | 59.80% | ★★★★★☆ |

| Itafos | 28.17% | 11.62% | 53.49% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Queen's Road Capital Investment | 8.87% | 13.76% | 16.18% | ★★★★☆☆ |

| Senvest Capital | 81.59% | -11.73% | -12.63% | ★★★★☆☆ |

| Dundee | 3.91% | -36.42% | 49.66% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Mako Mining (TSXV:MKO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mako Mining Corp. is involved in gold mining and exploration activities in Nicaragua, with a market cap of CA$350.49 million.

Operations: Mako Mining generates revenue primarily from its gold mining operations in Nicaragua. The company incurs costs related to exploration and production, which impact its profitability.

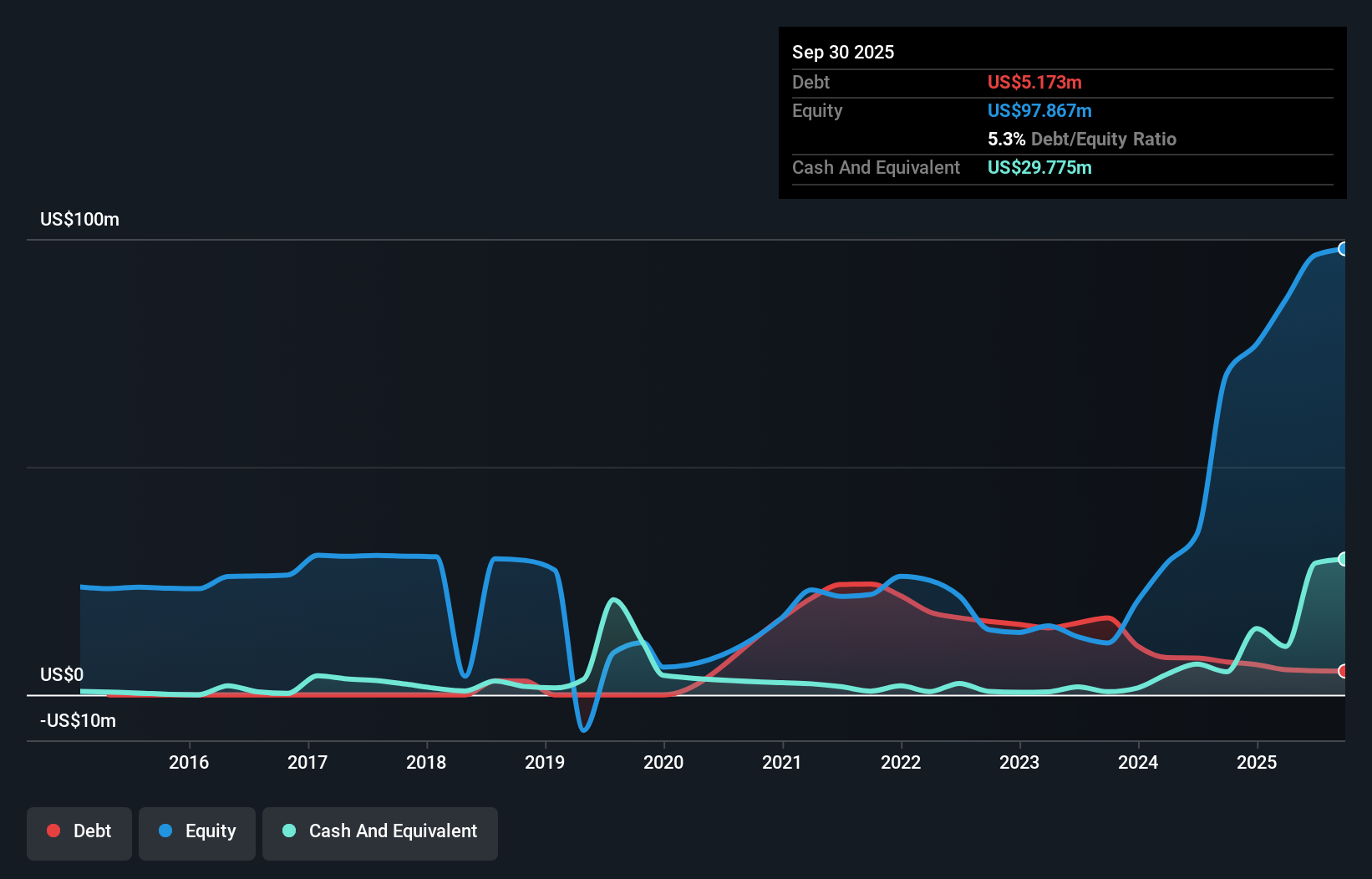

Mako Mining, a nimble player in the mining sector, has been making waves with its impressive financial performance. Earnings surged by 181%, far outpacing the industry average of 34.5%. The company trades at a significant discount, about 83% below its estimated fair value, presenting potential upside for investors. Despite an increase in debt to equity from 0% to 8.6% over five years, Mako's cash position remains robust enough to cover its total debt and interest obligations comfortably. Recent acquisition of the Moss gold mine and ongoing projects like Eagle Mountain underscore Mako's strategic growth initiatives in precious metals exploration and production.

- Navigate through the intricacies of Mako Mining with our comprehensive health report here.

Understand Mako Mining's track record by examining our Past report.

Thor Explorations (TSXV:THX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Thor Explorations Ltd., with a market cap of CA$365.38 million, operates as a gold producer and explorer through its subsidiaries.

Operations: Thor Explorations generates revenue primarily from the Segilola Mine Project, amounting to $150.41 million.

Thor Explorations has been making strategic moves to bolster its position in the gold mining sector, with a focus on projects in Senegal and Nigeria. The company is advancing the Douta project towards a preliminary feasibility study, which could unlock significant project value. Recent drilling results from the Douta-West licence revealed promising gold intersections, including 19 meters at 2.46g/t Au and 26 meters at 1.31g/t Au, indicating potential for resource expansion. Financially, Thor's debt-to-equity ratio increased to 2.8% over five years but remains manageable given its strong earnings growth of 63.1% annually over this period and positive free cash flow of C$43 million as of September 2024 suggests robust financial health despite external challenges like diesel prices impacting net margins.

Winpak (TSX:WPK)

Simply Wall St Value Rating: ★★★★★★

Overview: Winpak Ltd. is a company that manufactures and distributes packaging materials and related packaging machines across the United States, Canada, and Mexico with a market capitalization of CA$2.48 billion.

Operations: Winpak generates revenue primarily from three segments: Flexible Packaging ($597.98 million), Rigid Packaging and Flexible Lidding ($499.31 million), and Packaging Machinery ($33.61 million).

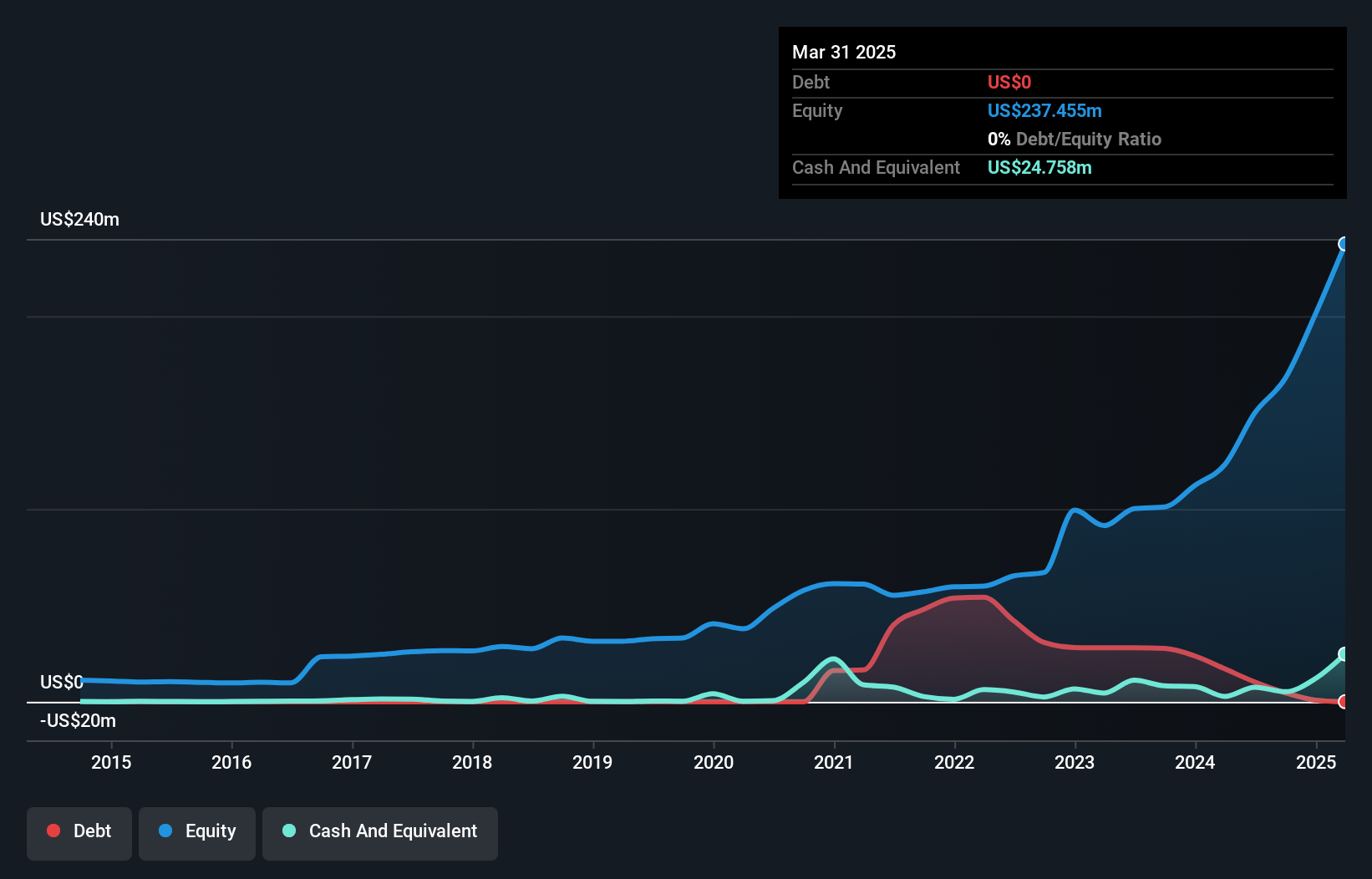

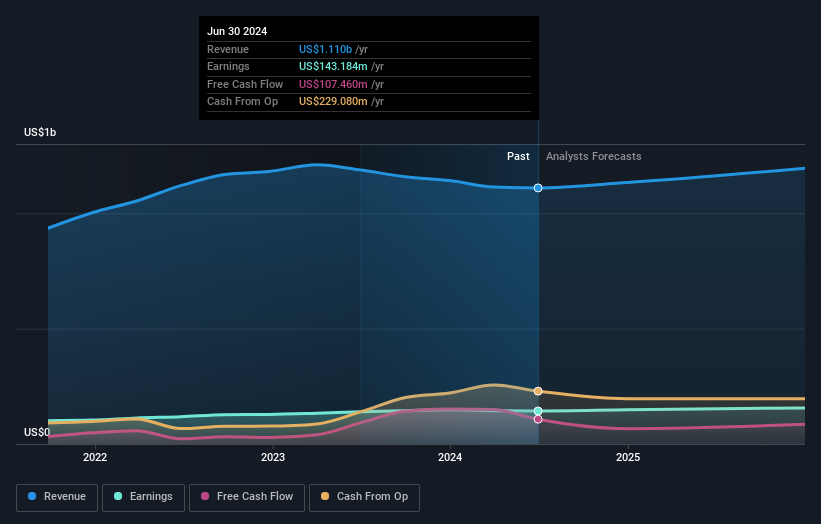

Winpak, a smaller player in the packaging sector, has demonstrated steady financial health with no debt over the past five years and an impressive 8.3% annual earnings growth during that period. Trading at 20.3% below its estimated fair value, it offers good relative value compared to peers. The company recently announced a share repurchase program for up to 5% of its shares and reported net income of US$149 million for 2024, slightly up from US$148 million in the previous year. Despite slower earnings growth than the industry average last year, Winpak's forecasted growth rate stands at 4.37%.

- Click here and access our complete health analysis report to understand the dynamics of Winpak.

Gain insights into Winpak's past trends and performance with our Past report.

Seize The Opportunity

- Navigate through the entire inventory of 36 TSX Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Winpak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WPK

Winpak

Manufactures and distributes packaging materials and related packaging machines in the United States, Canada, and Mexico.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion