- Canada

- /

- Capital Markets

- /

- TSX:GCG.A

Discovering Canada's Undiscovered Gem Stocks This March 2025

Reviewed by Simply Wall St

Amidst the backdrop of tariff tensions and political uncertainty, Canadian markets have shown resilience with the TSX slightly up, while investors adopt a more defensive stance across various asset classes. In this environment, identifying undiscovered gem stocks requires a keen eye for companies that demonstrate stability and potential growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.38% | 13.35% | 20.20% | ★★★★★★ |

| Genesis Land Development | 46.48% | 30.46% | 55.37% | ★★★★★☆ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Queen's Road Capital Investment | 8.87% | 13.76% | 16.18% | ★★★★☆☆ |

| Senvest Capital | 78.27% | -8.22% | -9.65% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Guardian Capital Group (TSX:GCG.A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guardian Capital Group Limited operates through its subsidiaries to provide investment services to clients across Canada, the United States, the United Kingdom, the Caribbean, and internationally, with a market capitalization of approximately CA$947.81 million.

Operations: Guardian Capital Group's revenue primarily stems from its Investment Management segment, including Wealth Management, which generated CA$281.18 million. The Corporate Activities and Investments segment contributed an additional CA$44.66 million to the total revenue.

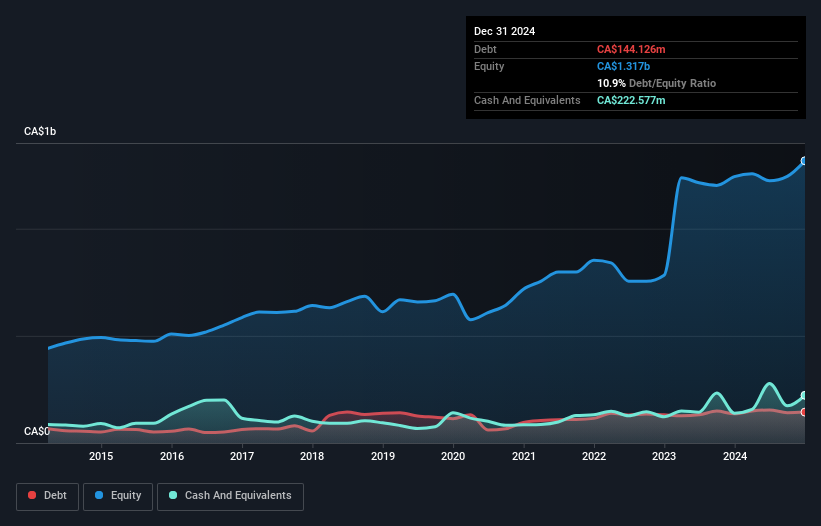

Guardian Capital Group, a notable player in Canada's financial landscape, has shown impressive earnings growth of 1151.9% over the past year, outpacing the industry average of 14.6%. Despite this surge, net income fell to CA$100.1 million from CA$562.93 million the previous year due to large one-off gains impacting results. The company's price-to-earnings ratio stands at 9.5x, below the Canadian market average of 14.6x, suggesting potential undervaluation. Recently completing a share buyback program worth CA$24.9 million for nearly 2.49% of its shares underscores its commitment to returning value to shareholders while maintaining a healthy debt-to-equity ratio that decreased from 16.4% to 10.9% over five years.

Standard Lithium (TSXV:SLI)

Simply Wall St Value Rating: ★★★★★★

Overview: Standard Lithium Ltd. explores, develops, and processes lithium brine properties in the United States with a market capitalization of CA$363.82 million.

Operations: Standard Lithium Ltd. does not currently generate revenue from its operations.

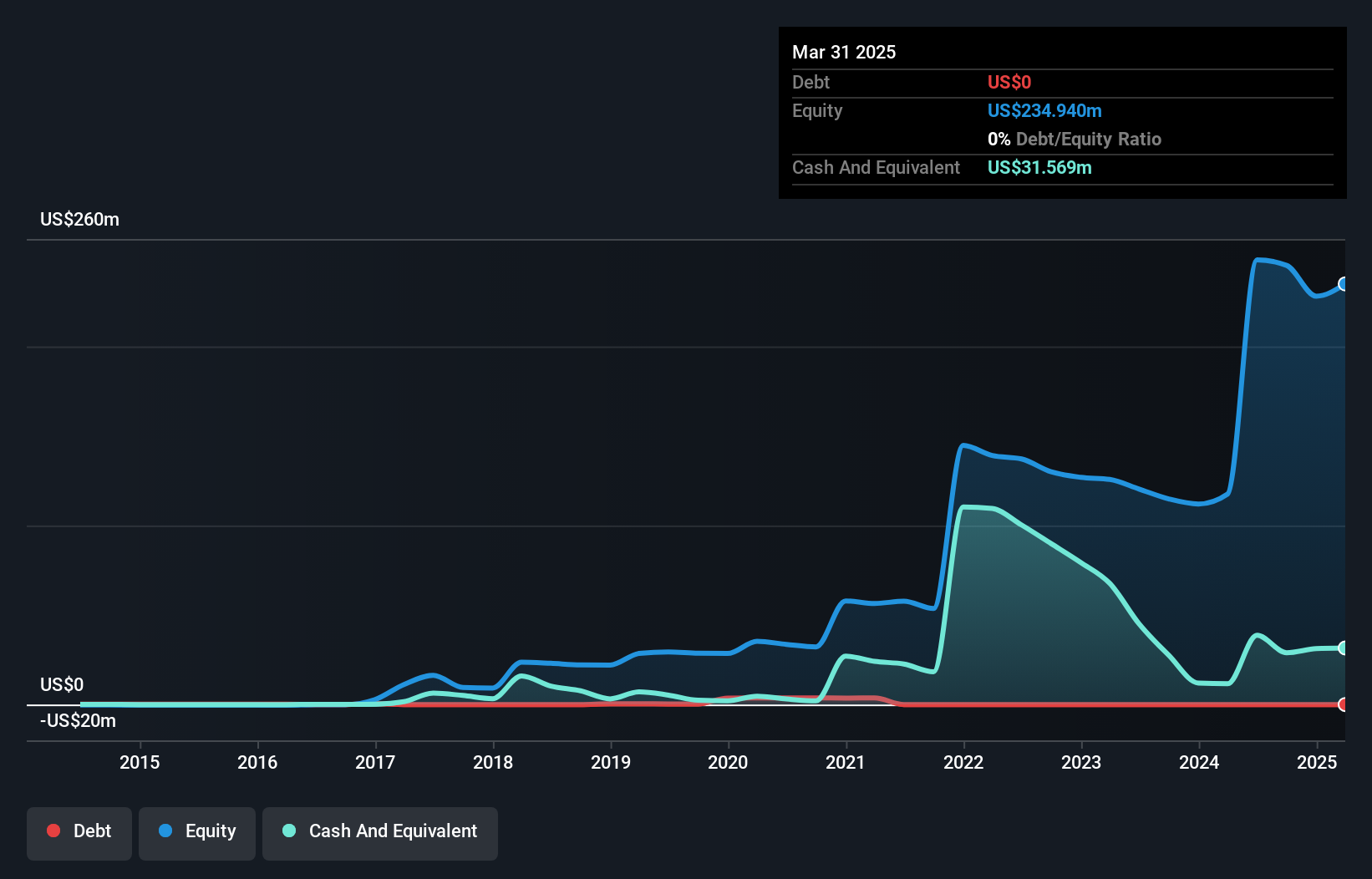

Standard Lithium, a nimble player in the lithium extraction space, has recently turned profitable, showcasing a high level of non-cash earnings. The company is debt-free, contrasting its position five years ago when it had a debt-to-equity ratio of 1.1%. Its price-to-earnings ratio sits at an attractive 2.2x compared to the Canadian market's 14.6x average, indicating potential undervaluation. Recent strategic moves include forming Smackover Lithium with Equinor to advance direct lithium extraction projects in Arkansas and Texas, supported by a USD$225 million grant from the U.S. Department of Energy for their South West Arkansas project aimed at producing 45,000 tonnes annually by 2028.

Winpak (TSX:WPK)

Simply Wall St Value Rating: ★★★★★★

Overview: Winpak Ltd. manufactures and distributes packaging materials and related machines across the United States, Canada, and Mexico, with a market cap of CA$2.35 billion.

Operations: Winpak generates revenue primarily from three segments: Flexible Packaging ($597.98 million), Packaging Machinery ($33.61 million), and Rigid Packaging and Flexible Lidding ($499.31 million).

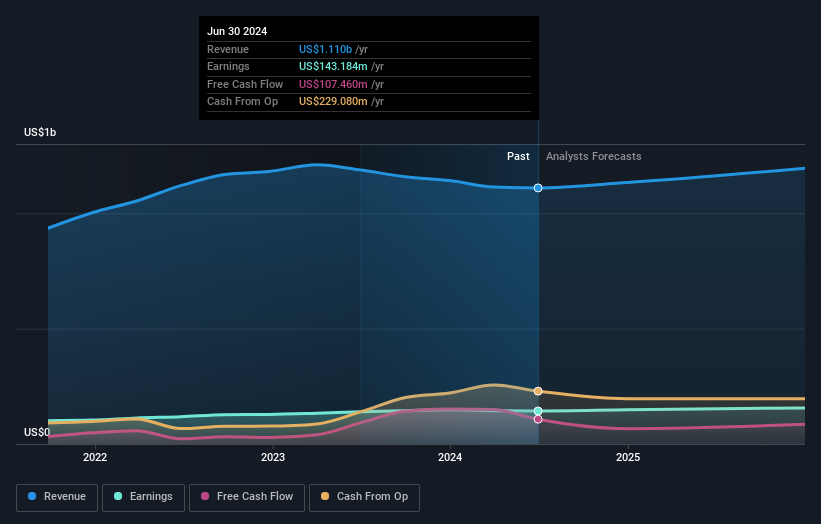

Winpak, a nimble player in the packaging sector, showcases financial resilience with high-quality earnings and no debt on its books. Over the past five years, earnings have grown at 8.3% annually, although last year's 0.9% growth lagged behind the industry's robust 40.7%. The company trades at a notable discount of 31.8% below estimated fair value, suggesting potential upside for investors seeking value opportunities. Recent activities include repurchasing over 3 million shares for CAD148 million and declaring a modest dividend of CAD0.05 per share, reflecting strategic capital allocation while forecasting sales volume growth between 5% to 7% this year.

Key Takeaways

- Explore the 40 names from our TSX Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GCG.A

Guardian Capital Group

Through its subsidiaries, primarily engages in the provision of investment services to a range of clients in Canada, the United States, the United Kingdom, the Caribbean, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives