- Canada

- /

- Metals and Mining

- /

- TSXV:SCZ

Santacruz Silver Mining (TSXV:SCZ) Posts Strong Q2 Sales but Can Profitability Momentum Hold?

Reviewed by Simply Wall St

- Santacruz Silver Mining reported its second quarter and six-month earnings for the period ended June 30, 2025, highlighting sales of US$73.3 million and net income of US$20.98 million for the quarter.

- Although quarterly sales and net income increased compared to last year, the six-month net income decreased significantly from the same period in 2024.

- We will examine how Santacruz Silver Mining’s quarterly sales growth shapes its investment narrative following recent earnings revelations.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

What Is Santacruz Silver Mining's Investment Narrative?

To see the bigger picture as a Santacruz Silver Mining shareholder, you need confidence in the company’s ability to translate periodic sales growth into consistently healthy profits, especially as production figures have fluctuated significantly year-over-year. The new earnings report marks a jump in quarterly net income, yet the marked decline in six-month profits may temper short-term momentum from recent price gains. This creates an interesting scenario for investors: while operational discipline under a refreshed management team is a positive catalyst, persistent production declines and thinner profit margins remain key risks. The company’s continued payments for Bolivian assets also shine a light on future growth ambitions, but execution and integration risks will be top of mind. The fresh earnings beat certainly gives short-term optimism, but whether this momentum can overcome ongoing operational headwinds will be a crucial question for the quarters ahead. On the other hand, recent insider selling is something investors should keep in mind.

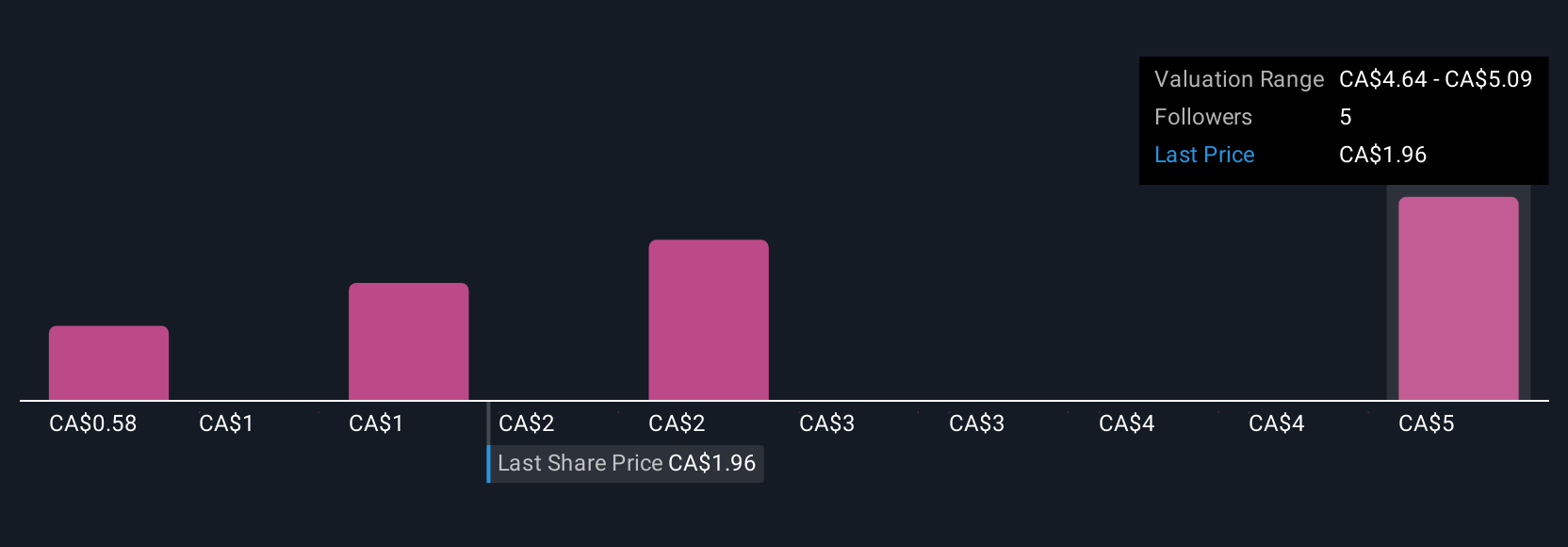

Santacruz Silver Mining's shares have been on the rise but are still potentially undervalued by 49%. Find out what it's worth.Exploring Other Perspectives

Explore 7 other fair value estimates on Santacruz Silver Mining - why the stock might be worth less than half the current price!

Build Your Own Santacruz Silver Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Santacruz Silver Mining research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Santacruz Silver Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Santacruz Silver Mining's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SCZ

Santacruz Silver Mining

Engages in the acquisition, exploration, development, production, and operation of mineral properties in Latin America.

Flawless balance sheet and good value.

Market Insights

Community Narratives