- Canada

- /

- Metals and Mining

- /

- TSXV:ZNG

Royal Road Minerals And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of changing bond yields and potential rate cuts by the Bank of Canada, investors are reevaluating their strategies to optimize returns. In this context, penny stocks—though an older term—remain relevant as they represent smaller or less-established companies that can offer significant value when chosen carefully. By identifying those with strong financials and clear growth potential, investors can uncover promising opportunities among these often-overlooked stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.39 | CA$116.93M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$913.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.94 | CA$368.12M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.53 | CA$12.75M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$501.61M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.41 | CA$231.32M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$33.85M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$179.46M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$113.26M | ★★★★☆☆ |

Click here to see the full list of 949 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Royal Road Minerals (TSXV:RYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Royal Road Minerals Limited is involved in the exploration and development of mineral properties across Saudi Arabia, Morocco, Colombia, and Nicaragua with a market cap of CA$26.57 million.

Operations: Royal Road Minerals Limited does not report any revenue segments.

Market Cap: CA$26.57M

Royal Road Minerals Limited, with a market cap of CA$26.57 million, remains pre-revenue and unprofitable, having experienced increased losses over the past five years. Despite its financial challenges, the company is debt-free and has sufficient cash runway for over three years based on current free cash flow. Recent developments include relinquishing rights to the Al Miyah tender in Saudi Arabia to focus on expanding drilling activities at Jabal Sahabiyah and obtaining permits for exploration in Morocco's Alouana project. These strategic moves highlight Royal Road's focus on advancing its mineral exploration projects across multiple regions.

- Take a closer look at Royal Road Minerals' potential here in our financial health report.

- Review our historical performance report to gain insights into Royal Road Minerals' track record.

Tower Resources (TSXV:TWR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tower Resources Ltd. is involved in the acquisition, evaluation, and exploration of mineral properties in Canada with a market capitalization of CA$21.81 million.

Operations: Tower Resources Ltd. does not have any reported revenue segments.

Market Cap: CA$21.81M

Tower Resources Ltd., with a market cap of CA$21.81 million, is pre-revenue and focuses on mineral exploration in Canada. Recent drilling at the Rabbit North property has revealed promising gold assays, particularly from the Blue Sky discovery hole RN24-055, indicating significant potential for both open pit and underground development. The company remains debt-free but has diluted shareholders by 7.3% over the past year to raise capital, including a recent CA$800,000 private placement. While unprofitable, Tower's short-term assets comfortably cover liabilities, and it maintains sufficient cash runway following its latest financing efforts.

- Click to explore a detailed breakdown of our findings in Tower Resources' financial health report.

- Explore historical data to track Tower Resources' performance over time in our past results report.

Group Eleven Resources (TSXV:ZNG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Group Eleven Resources Corp. is a mineral exploration company focused on acquiring, exploring, and evaluating mineral properties in Ireland with a market cap of CA$36.20 million.

Operations: Group Eleven Resources Corp. does not report any revenue segments.

Market Cap: CA$36.2M

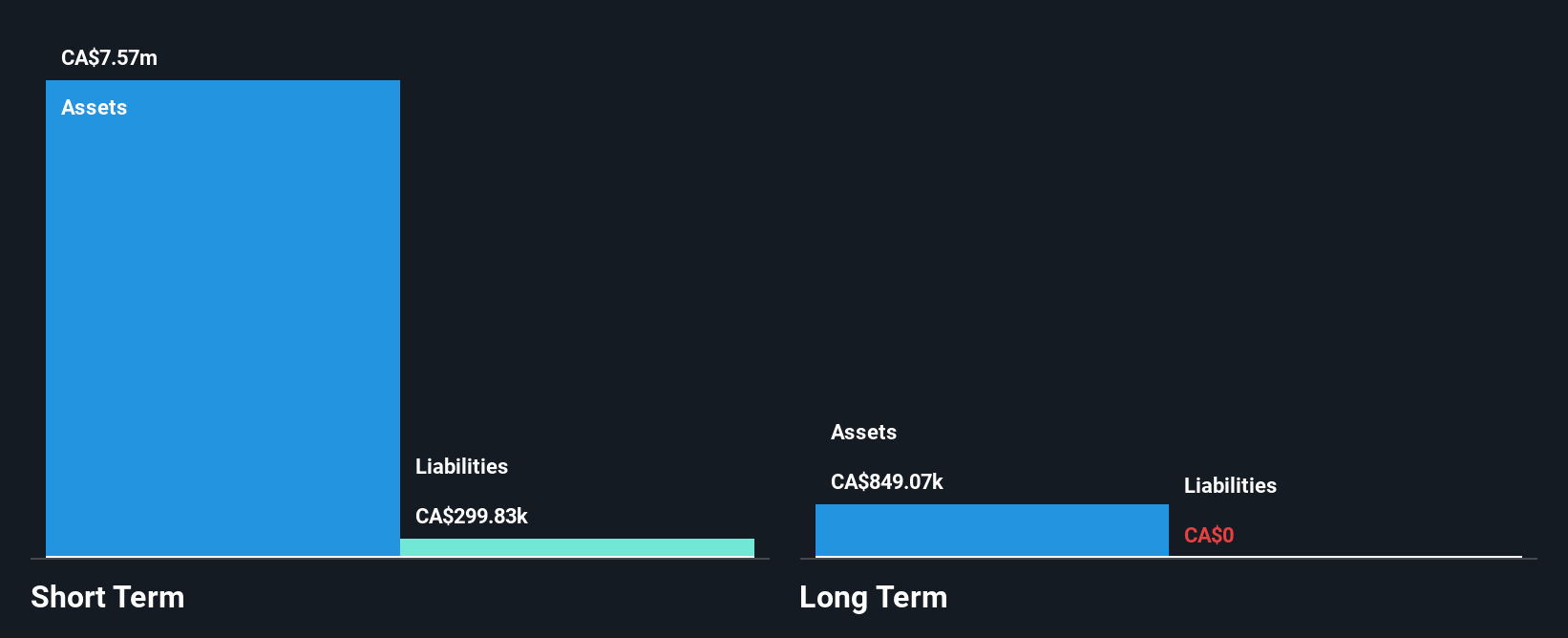

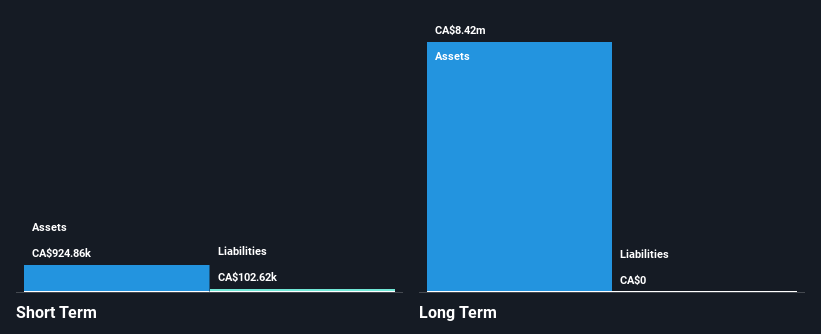

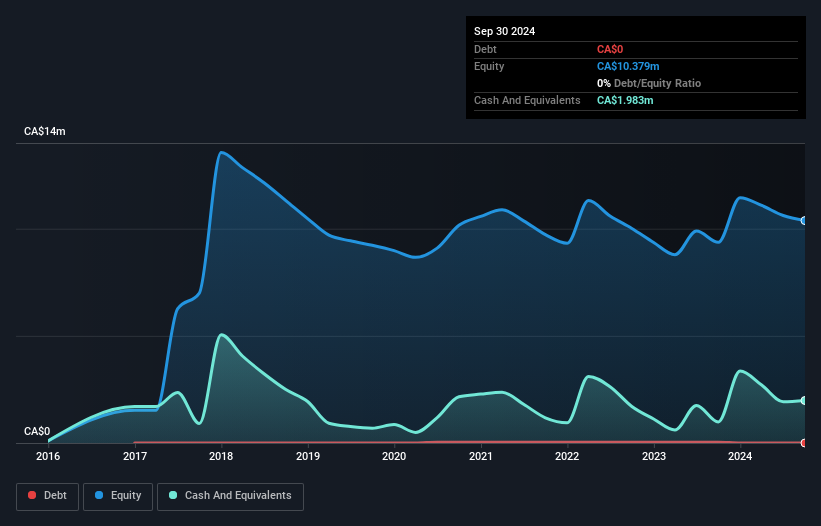

Group Eleven Resources Corp., with a market cap of CA$36.20 million, is pre-revenue and focused on mineral exploration in Ireland. Recent drilling at the Ballywire zinc-lead-silver discovery has shown promising high-grade mineralization, enhancing its exploration potential. The company remains debt-free and has experienced shareholder dilution of 6.5% over the past year to support its ongoing drill program expansion. Despite being unprofitable, Group Eleven's short-term assets exceed liabilities, though it faces less than a year of cash runway at current expenditure rates. Recent board appointments may strengthen strategic direction as drilling progresses at Ballywire.

- Get an in-depth perspective on Group Eleven Resources' performance by reading our balance sheet health report here.

- Learn about Group Eleven Resources' historical performance here.

Summing It All Up

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 946 more companies for you to explore.Click here to unveil our expertly curated list of 949 TSX Penny Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZNG

Group Eleven Resources

A mineral exploration company, engages in the acquisition, exploration, and evaluation of mineral properties in Ireland.

Moderate with adequate balance sheet.