- Canada

- /

- Oil and Gas

- /

- TSX:TAL

December 2024's Must-Watch Penny Stocks On TSX

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape, with recent shifts in bond yields suggesting potential opportunities for stronger performance in fixed-income investments. Against this backdrop, investors may find value in exploring penny stocks—often smaller or newer companies that can offer unique growth prospects. While the term "penny stocks" might seem outdated, these investments remain relevant for those seeking under-the-radar opportunities with strong financial foundations and potential for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.97 | CA$372.82M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$117.44M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$939.87M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.56 | CA$510.73M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.28 | CA$224.43M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.79 | CA$174.58M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 959 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Quipt Home Medical (TSX:QIPT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quipt Home Medical Corp. operates through its subsidiaries to provide durable and home medical equipment and supplies in the United States, with a market cap of CA$162.02 million.

Operations: The company generates revenue primarily from its PHM segment, amounting to $245.92 million.

Market Cap: CA$162.02M

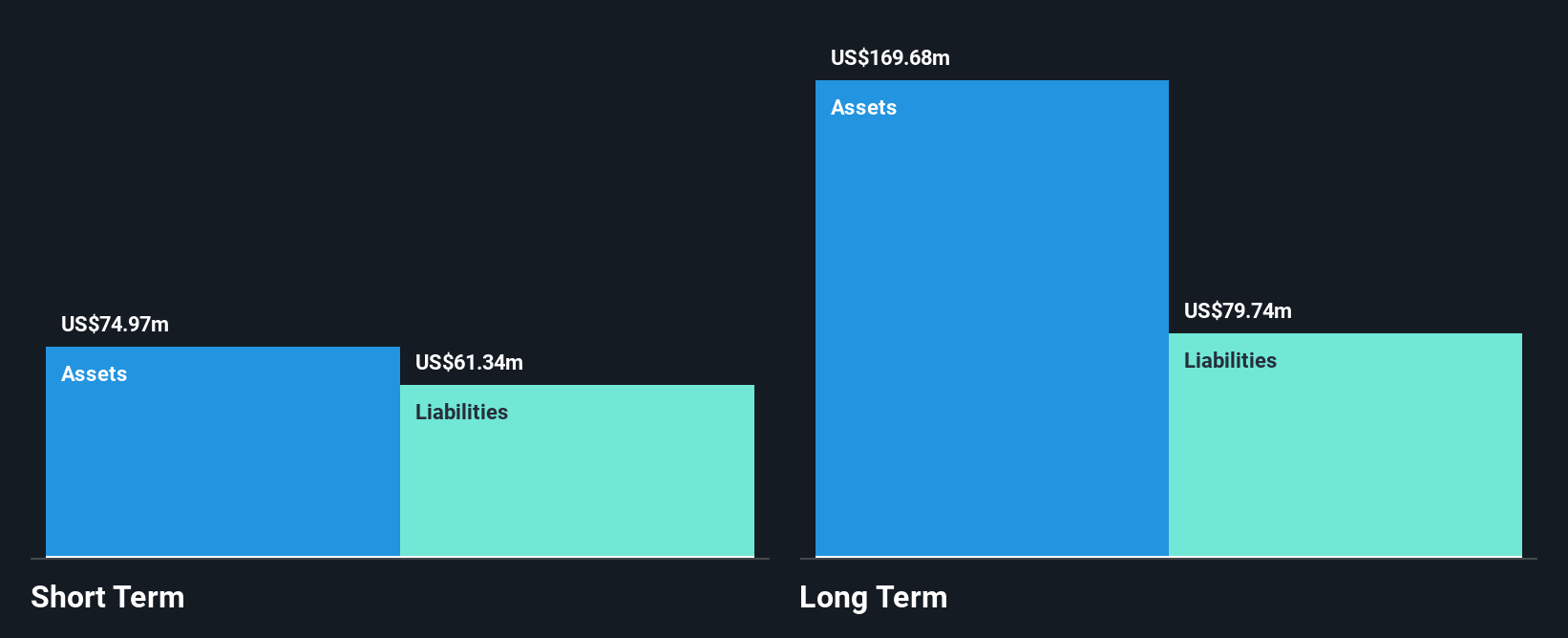

Quipt Home Medical, with a market cap of CA$162.02 million, operates in the U.S. home medical equipment sector and reported US$245.92 million in revenue for 2024, up from US$211.68 million the previous year. Despite this growth, the company remains unprofitable with a net loss of US$6.76 million and has experienced shareholder dilution over the past year due to increased shares outstanding by 2.3%. However, Quipt benefits from a seasoned management team and board of directors, sufficient cash runway for over three years due to positive free cash flow growth, and is trading at good value compared to peers.

- Take a closer look at Quipt Home Medical's potential here in our financial health report.

- Explore Quipt Home Medical's analyst forecasts in our growth report.

PetroTal (TSX:TAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PetroTal Corp. is involved in the development and exploration of oil and natural gas in Peru, South America, with a market cap of CA$510.73 million.

Operations: The company generates revenue primarily from its Oil & Gas - Exploration & Production segment, totaling $329.97 million.

Market Cap: CA$510.73M

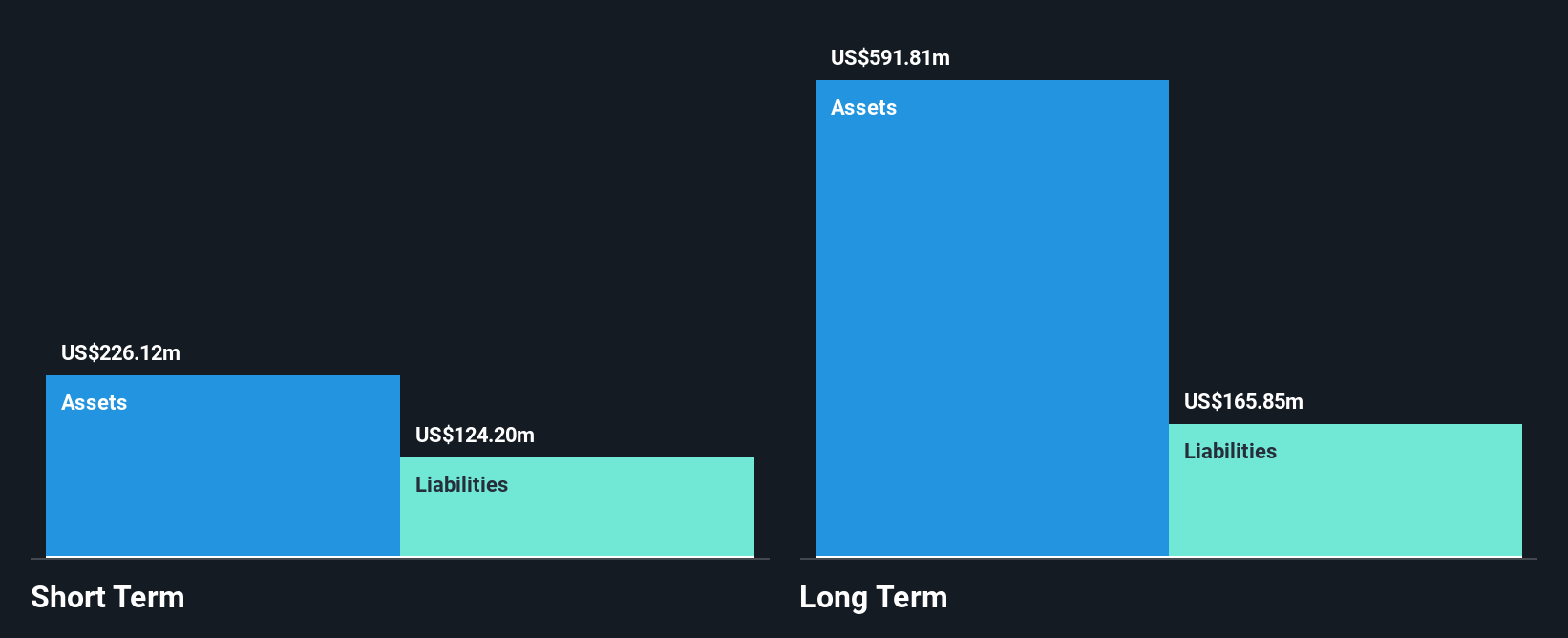

PetroTal Corp., with a market cap of CA$510.73 million, focuses on oil and gas exploration in Peru. It reported third-quarter revenue of US$71.42 million, up from US$63.31 million the previous year, though net income declined to US$7.18 million from US$25.36 million due to lower profit margins and negative earnings growth over the past year. The company is debt-free, has high-quality earnings, and its short-term assets exceed liabilities significantly, indicating strong financial health despite an inexperienced management team with only 1.1 years average tenure. PetroTal also declared a cash dividend for Q4 2024 and seeks strategic acquisitions to enhance value.

- Jump into the full analysis health report here for a deeper understanding of PetroTal.

- Learn about PetroTal's future growth trajectory here.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company with a market cap of CA$240.59 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$240.59M

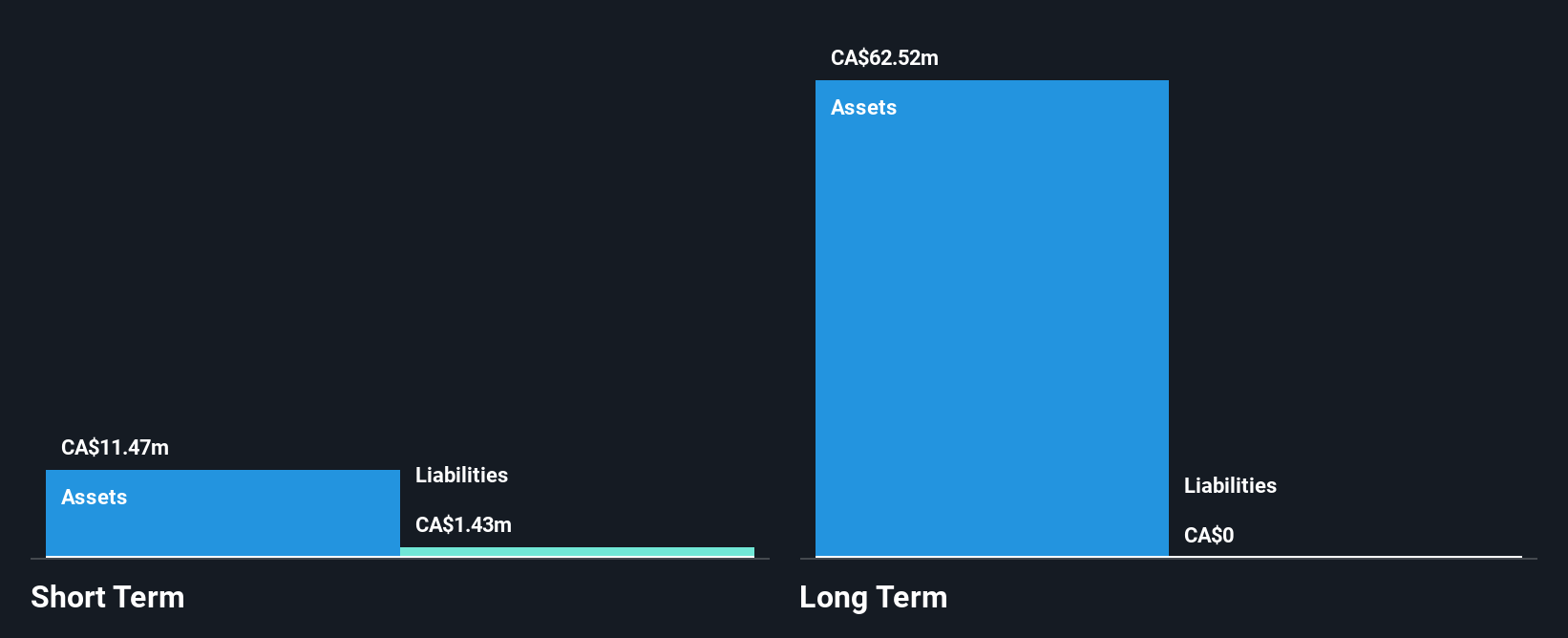

Regulus Resources, with a market cap of CA$240.59 million, is pre-revenue and debt-free, possessing sufficient cash runway for over three years. Despite being unprofitable with increasing losses at 1.2% per year over the past five years, its seasoned management team averages 11.4 years of experience. Recent strategic expansion includes acquiring the remaining 30% interest in the Colquirrumi claims from Compania de Minas Buenaventura S.A.A., enhancing its mineral rights near the AntaKori property. This acquisition involves granting a 2% NSR to Buenaventura, highlighting Regulus' focus on strengthening its asset base in a prolific mining district.

- Get an in-depth perspective on Regulus Resources' performance by reading our balance sheet health report here.

- Learn about Regulus Resources' historical performance here.

Summing It All Up

- Gain an insight into the universe of 959 TSX Penny Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TAL

PetroTal

Engages in the acquisition, exploration, appraisal, development, and production of oil and natural gas properties in Peru.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)