- Canada

- /

- Metals and Mining

- /

- TSXV:RDG

We're Hopeful That Ridgeline Minerals (CVE:RDG) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Ridgeline Minerals (CVE:RDG) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Ridgeline Minerals

When Might Ridgeline Minerals Run Out Of Money?

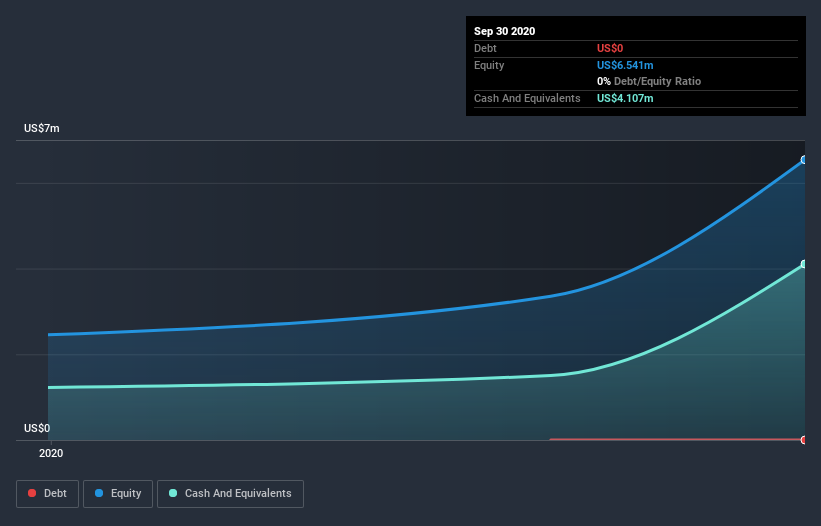

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In September 2020, Ridgeline Minerals had US$4.1m in cash, and was debt-free. Looking at the last year, the company burnt through US$2.0m. So it had a cash runway of about 2.1 years from September 2020. That's decent, giving the company a couple years to develop its business. You can see how its cash balance has changed over time in the image below.

How Easily Can Ridgeline Minerals Raise Cash?

Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Ridgeline Minerals' cash burn of US$2.0m is about 9.2% of its US$22m market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

Is Ridgeline Minerals' Cash Burn A Worry?

Because Ridgeline Minerals is an early stage company, we don't have a great deal of data on which to form an opinion of its cash burn. We would undoubtedly be more comfortable if it had reported some operating revenue. Having said that, we can say that its cash burn relative to its market cap was a real positive. To put it simply, we think its cash burn situation is totally fine given it is still developing its business. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 3 warning signs for Ridgeline Minerals that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

When trading Ridgeline Minerals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:RDG

Ridgeline Minerals

Engages in the exploration of mineral property interests in the states of Nevada and Idaho, United States.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026