- Canada

- /

- Metals and Mining

- /

- TSXV:RBX

Investors Could Be Concerned With Robex Resources' (CVE:RBX) Returns On Capital

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after investigating Robex Resources (CVE:RBX), we don't think it's current trends fit the mold of a multi-bagger.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Robex Resources:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = CA$32m ÷ (CA$312m - CA$73m) (Based on the trailing twelve months to September 2023).

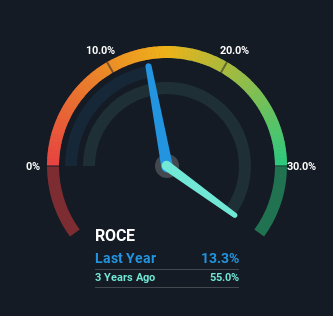

So, Robex Resources has an ROCE of 13%. In absolute terms, that's a satisfactory return, but compared to the Metals and Mining industry average of 2.4% it's much better.

Check out our latest analysis for Robex Resources

Historical performance is a great place to start when researching a stock so above you can see the gauge for Robex Resources' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Robex Resources, check out these free graphs here.

What Can We Tell From Robex Resources' ROCE Trend?

The trend of ROCE doesn't look fantastic because it's fallen from 31% five years ago, while the business's capital employed increased by 225%. Usually this isn't ideal, but given Robex Resources conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. It's unlikely that all of the funds raised have been put to work yet, so as a consequence Robex Resources might not have received a full period of earnings contribution from it.

On a related note, Robex Resources has decreased its current liabilities to 23% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

In Conclusion...

In summary, Robex Resources is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Yet to long term shareholders the stock has gifted them an incredible 349% return in the last five years, so the market appears to be rosy about its future. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

If you're still interested in Robex Resources it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

While Robex Resources may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:RBX

Robex Resources

Engages in the exploration, development, and production of gold in West Africa.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026