- Canada

- /

- Metals and Mining

- /

- TSXV:MTA

Discover Promising Penny Stocks On TSX In March 2025

Reviewed by Simply Wall St

In 2025, the Canadian stock market has experienced volatility and negative returns, highlighting the importance of diversification as a key theme for investors. Amid this backdrop, penny stocks—often representing smaller or newer companies—continue to capture interest due to their potential for growth and affordability. While the term may seem outdated, these stocks can still offer intriguing opportunities when backed by strong financials, making them worth exploring for those seeking to diversify their portfolios.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.60 | CA$168.17M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.91 | CA$461.09M | ★★★★★★ |

| NTG Clarity Networks (TSXV:NCI) | CA$1.88 | CA$79.25M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.04 | CA$38.4M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.66 | CA$604.82M | ★★★★★★ |

| McCoy Global (TSX:MCB) | CA$2.92 | CA$79.37M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.10 | CA$29.55M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.89 | CA$411.57M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.73 | CA$168M | ★★★★★☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

PetroTal (TSX:TAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PetroTal Corp. is involved in the development and exploration of oil and natural gas in Peru, South America, with a market capitalization of CA$604.82 million.

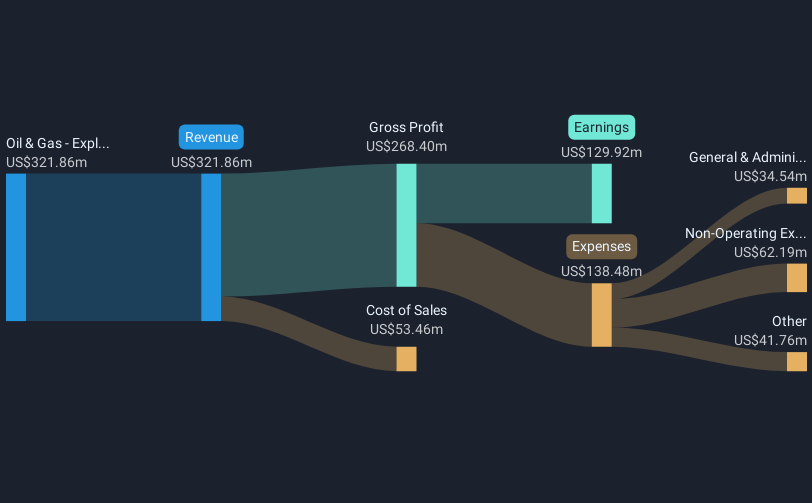

Operations: The company generates revenue from its Oil & Gas - Exploration & Production segment, amounting to $329.97 million.

Market Cap: CA$604.82M

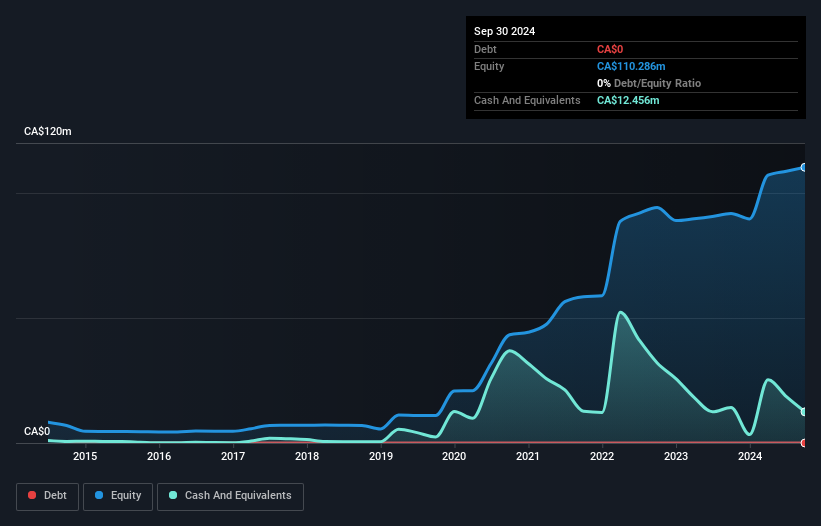

PetroTal Corp., with a market cap of CA$604.82 million, operates in the oil and gas sector, generating US$329.97 million in revenue. Despite recent negative earnings growth, it remains debt-free and trades at a significant discount to its estimated fair value. Its short-term assets comfortably cover both short- and long-term liabilities. The company has declared a cash dividend of US$0.015 per share for Q1 2025, though its dividend history is unstable. PetroTal's management team is relatively new, which may impact strategic continuity despite an experienced board guiding operations with stable weekly volatility over the past year.

- Get an in-depth perspective on PetroTal's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into PetroTal's future.

Amex Exploration (TSXV:AMX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amex Exploration Inc., along with its subsidiaries, focuses on exploring gold mining properties in Canada and has a market cap of CA$124.54 million.

Operations: Amex Exploration Inc. does not report any revenue segments, as it is primarily focused on the exploration of gold mining properties in Canada.

Market Cap: CA$124.54M

Amex Exploration Inc., with a market cap of CA$124.54 million, focuses on gold exploration and remains pre-revenue, lacking significant revenue streams. Recent developments include a fully funded 2025 exploration drill program at its Perron Project in Quebec, targeting new discoveries and expanding known zones. The company is debt-free but faces challenges with long-term liabilities exceeding short-term assets (CA$14.3M vs CA$16.4M). Despite becoming profitable recently, earnings are forecasted to decline by 19.2% annually over the next three years. Amex's management and board are seasoned, contributing to strategic stability amid stable weekly volatility in its stock performance.

- Unlock comprehensive insights into our analysis of Amex Exploration stock in this financial health report.

- Understand Amex Exploration's earnings outlook by examining our growth report.

Metalla Royalty & Streaming (TSXV:MTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metalla Royalty & Streaming Ltd. is a precious metals royalty and streaming company focused on acquiring and managing gold, silver, and copper royalties and streams in Canada, with a market cap of CA$400.50 million.

Operations: The company's revenue is derived entirely from the acquisition and management of precious metal royalties, streams, and similar production-based interests, totaling $5.05 million.

Market Cap: CA$400.5M

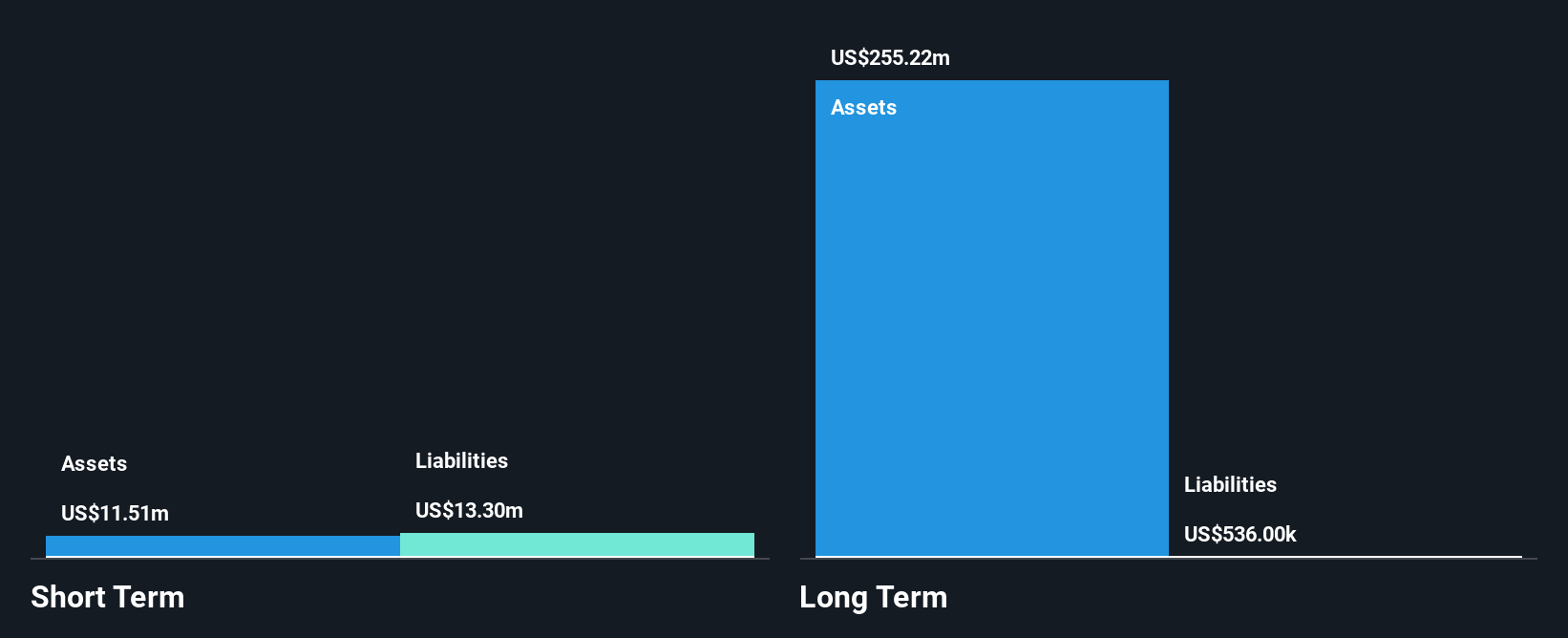

Metalla Royalty & Streaming Ltd., with a market cap of CA$400.50 million, operates in the precious metals sector, focusing on gold, silver, and copper royalties. Despite being unprofitable with revenue of US$5.05 million, it trades significantly below its estimated fair value and has a satisfactory net debt to equity ratio of 1.2%. Recent developments include substantial resource increases at Wharf and production plans at Endeavor set for Q2 2025. While short-term liabilities exceed assets (US$13.8M vs US$12.3M), Metalla's seasoned management team supports strategic execution amid stable weekly volatility in stock performance.

- Jump into the full analysis health report here for a deeper understanding of Metalla Royalty & Streaming.

- Examine Metalla Royalty & Streaming's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Click this link to deep-dive into the 934 companies within our TSX Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Metalla Royalty & Streaming, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MTA

Metalla Royalty & Streaming

A precious metals royalty and streaming company, engages in the acquisition and management of gold, silver, copper royalties, streams, and related production-based interests in Canada.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives