- Canada

- /

- Metals and Mining

- /

- TSXV:MON

Will Montero Mining and Exploration (CVE:MON) Spend Its Cash Wisely?

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for Montero Mining and Exploration (CVE:MON) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business's cash, relative to its cash burn.

See our latest analysis for Montero Mining and Exploration

When Might Montero Mining and Exploration Run Out Of Money?

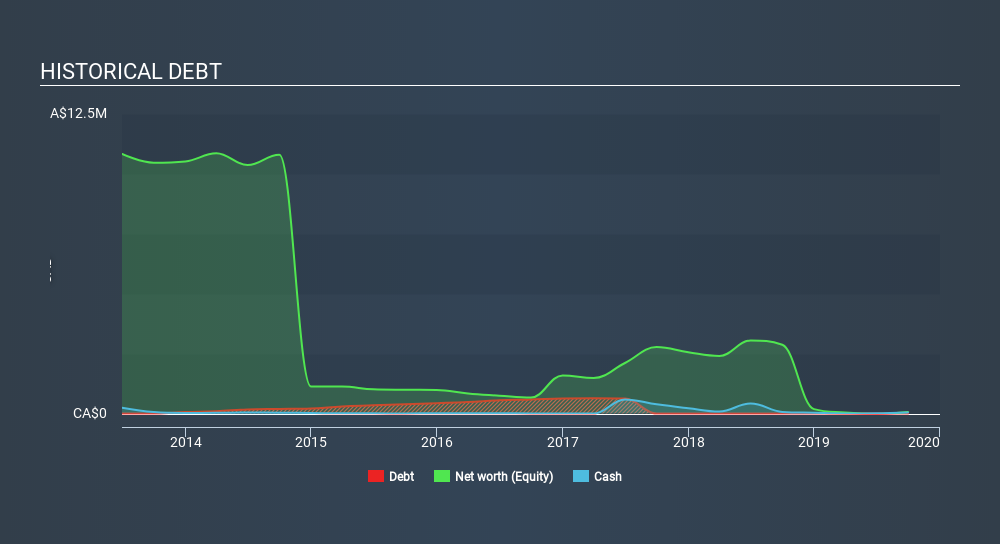

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Montero Mining and Exploration last reported its balance sheet in September 2019, it had zero debt and cash worth CA$48k. Looking at the last year, the company burnt through CA$67k. That means it had a cash runway of around 9 months as of September 2019. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. The image below shows how its cash balance has been changing over the last few years.

How Is Montero Mining and Exploration's Cash Burn Changing Over Time?

Montero Mining and Exploration didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. From a cash flow perspective, it's great to see the company's cash burn dropped by 94% over the last year. That might not be promising when it comes to business development, but it's good for the companies cash preservation. Admittedly, we're a bit cautious of Montero Mining and Exploration due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

Can Montero Mining and Exploration Raise More Cash Easily?

While we're comforted by the recent reduction evident from our analysis of Montero Mining and Exploration's cash burn, it is still worth considering how easily the company could raise more funds, if it wanted to accelerate spending to drive growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash to drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of CA$547k, Montero Mining and Exploration's CA$67k in cash burn equates to about 12% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

How Risky Is Montero Mining and Exploration's Cash Burn Situation?

On this analysis of Montero Mining and Exploration's cash burn, we think its cash burn reduction was reassuring, while its cash runway has us a bit worried. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Taking a deeper dive, we've spotted 4 warning signs for Montero Mining and Exploration you should be aware of, and 2 of them are potentially serious.

Of course Montero Mining and Exploration may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:MON

Montero Mining and Exploration

Engages in the identification, evaluation, acquisition, exploration, and development of mineral properties in Chile.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026