- Canada

- /

- Metals and Mining

- /

- TSXV:MMY

Discover TSX Penny Stocks: G2 Goldfields And Two More Hidden Opportunities

Reviewed by Simply Wall St

As the Canadian economy navigates through a period of moderated services inflation and shifting employment dynamics, investors are exploring diverse opportunities in the stock market. Penny stocks, though an older term, continue to represent smaller or newer companies with potential value for those willing to explore beyond established names. By focusing on financial strength and growth potential, these stocks can offer intriguing prospects for investors seeking both affordability and opportunity in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.69 | CA$69.79M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.735 | CA$488.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.96 | CA$19.03M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.97 | CA$201.5M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.45 | CA$646.16M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.68 | CA$158.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$179.49M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.51 | CA$8.62M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 443 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

G2 Goldfields (TSX:GTWO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: G2 Goldfields Inc. focuses on the acquisition and exploration of mineral properties in Canada and Guyana, with a market capitalization of CA$670.35 million.

Operations: The company generates its revenue exclusively from mineral exploration, totaling CA$0.63 million.

Market Cap: CA$670.35M

G2 Goldfields Inc. operates in the mineral exploration sector with a focus on gold discoveries in Guyana and Canada, holding significant exploration rights. Despite being pre-revenue, the company has made notable progress with its recent drilling programs, including new assay results from the New Oko Discovery Area and Peters Mine Property. While G2 is debt-free and maintains short-term financial stability with CA$32.9 million in assets against CA$3.3 million liabilities, it faces challenges such as a limited cash runway of less than one year and unprofitability without expected profitability within three years according to analyst forecasts.

- Get an in-depth perspective on G2 Goldfields' performance by reading our balance sheet health report here.

- Explore G2 Goldfields' analyst forecasts in our growth report.

Questerre Energy (TSX:QEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Questerre Energy Corporation is an energy technology and innovation company focused on acquiring, exploring, and developing non-conventional oil and gas projects in Canada, with a market cap of CA$154.27 million.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, generating CA$34.78 million.

Market Cap: CA$154.27M

Questerre Energy Corporation, an energy technology firm, has demonstrated financial resilience despite being unprofitable. Its seasoned management and board have overseen a reduction in debt to equity from 11.1% to 0.04% over five years, with short-term assets of CA$31.6 million covering both long-term and short-term liabilities. The company reported first-quarter revenue of CA$8.58 million, up from CA$7.95 million the previous year, alongside marginal production increases to 1,729 boe/d. Questerre's cash runway exceeds three years if free cash flow grows at historical rates, providing stability amid its ongoing profitability challenges.

- Take a closer look at Questerre Energy's potential here in our financial health report.

- Explore historical data to track Questerre Energy's performance over time in our past results report.

Monument Mining (TSXV:MMY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Monument Mining Limited is a gold producer involved in the acquisition, exploration, and development of gold, precious metals, and base metal properties across Canada, Australia, and Malaysia with a market cap of CA$139.63 million.

Operations: The company generates revenue from its gold mine operations, totaling $77.62 million.

Market Cap: CA$139.63M

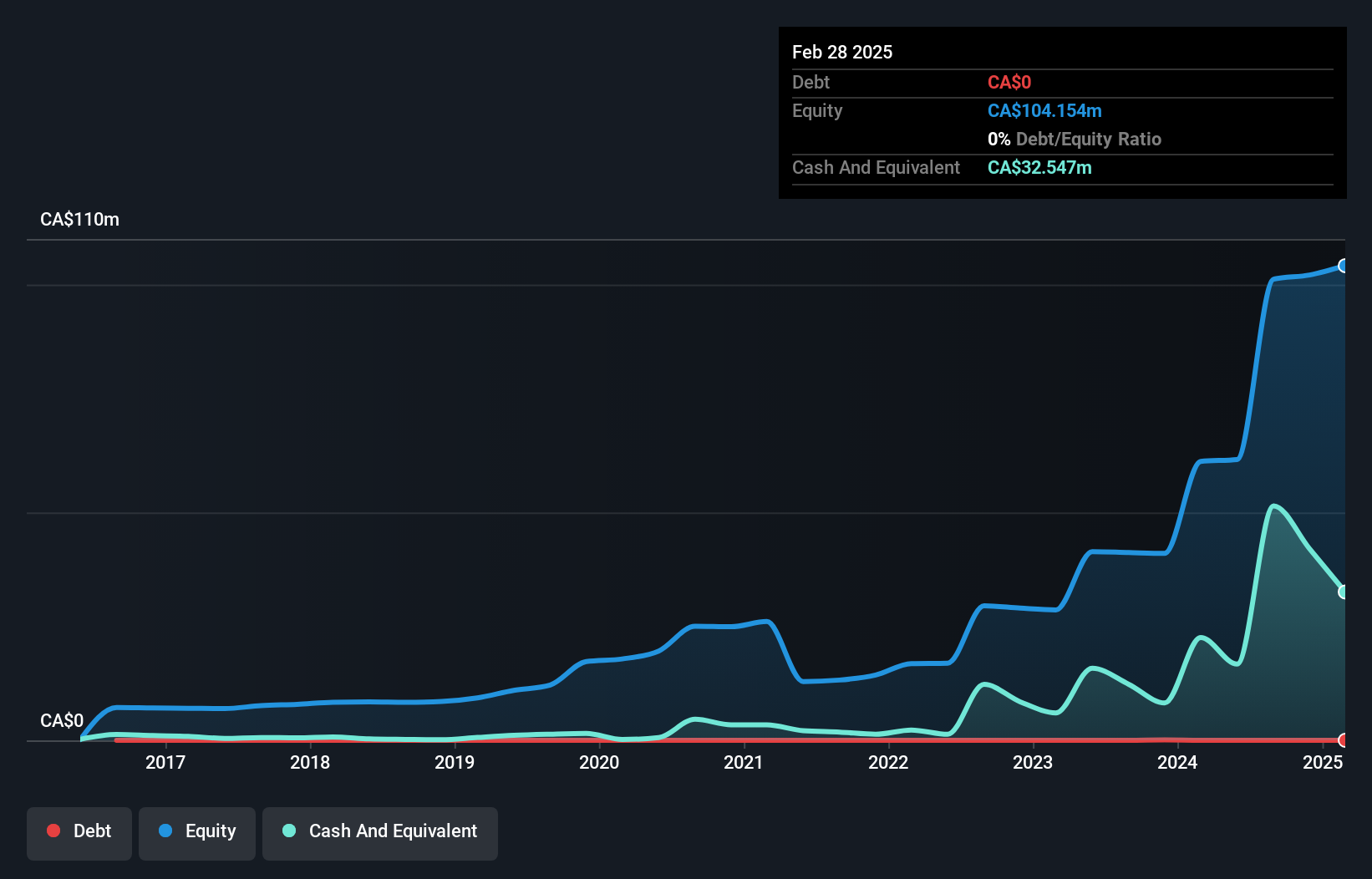

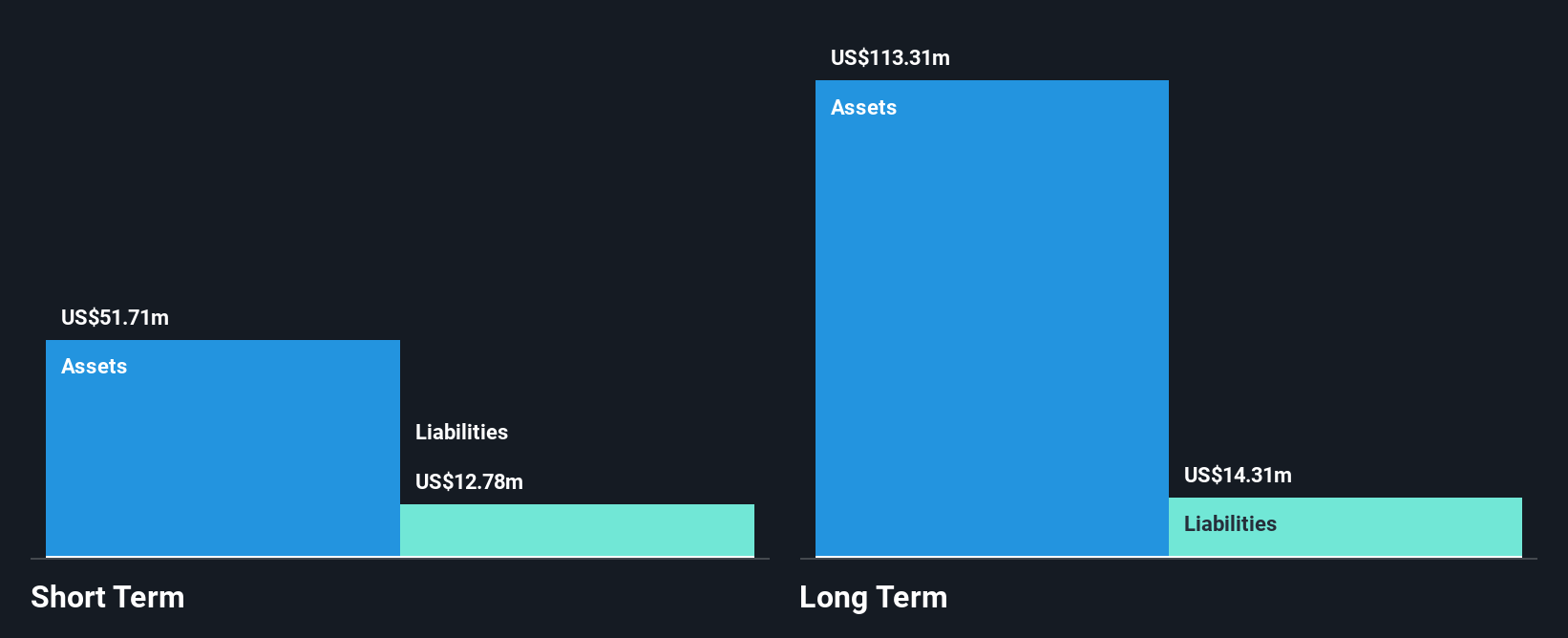

Monument Mining Limited has transitioned to profitability, reporting a net income of US$16.7 million for the first nine months of 2025, up significantly from the previous year. The company is debt-free with short-term assets covering all liabilities, and it trades at a substantial discount to its estimated fair value. Monument's expansion drilling program at Selinsing Gold Mine aims to extend its life-of-mine by exploring new mineralized zones outside current pit shells, backed by a recent cash commitment of US$2.5 million. This strategic focus on resource discovery could enhance future production capabilities and financial performance.

- Click to explore a detailed breakdown of our findings in Monument Mining's financial health report.

- Learn about Monument Mining's future growth trajectory here.

Seize The Opportunity

- Investigate our full lineup of 443 TSX Penny Stocks right here.

- Want To Explore Some Alternatives? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MMY

Monument Mining

Engages in the production, exploration, and development of precious metals in Canada, Australia, and Malaysia.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)