- Canada

- /

- Metals and Mining

- /

- TSX:WRN

TSX Penny Stocks To Consider In September 2025

Reviewed by Simply Wall St

As we approach September 2025, the Canadian market is closely watching inflation trends, with both the U.S. and Canadian CPI data set to influence upcoming central bank meetings. Amidst these economic dynamics, investors are navigating a landscape marked by volatility and potential opportunities for strategic portfolio positioning. Penny stocks, often representing smaller or newer companies, continue to offer intriguing investment prospects; despite being considered an outdated term by some, they remain relevant for those looking to explore growth at lower price points. In this context, identifying penny stocks with strong balance sheets and solid fundamentals can uncover hidden gems that might provide stability and potential upside in a fluctuating market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.23 | CA$56.39M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$22.99M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.30 | CA$2.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.295 | CA$44.31M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.24 | CA$824.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.97 | CA$19.22M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.33 | CA$376.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.75 | CA$190.33M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$187.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.71 | CA$8.84M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 411 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Majestic Gold (TSXV:MJS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Majestic Gold Corp. is a mining company engaged in the exploration, development, and operation of mining properties in China, with a market cap of CA$172.04 million.

Operations: The company's revenue is derived entirely from its activities related to the exploration, development, and operation of mining properties, totaling $80.08 million.

Market Cap: CA$172.04M

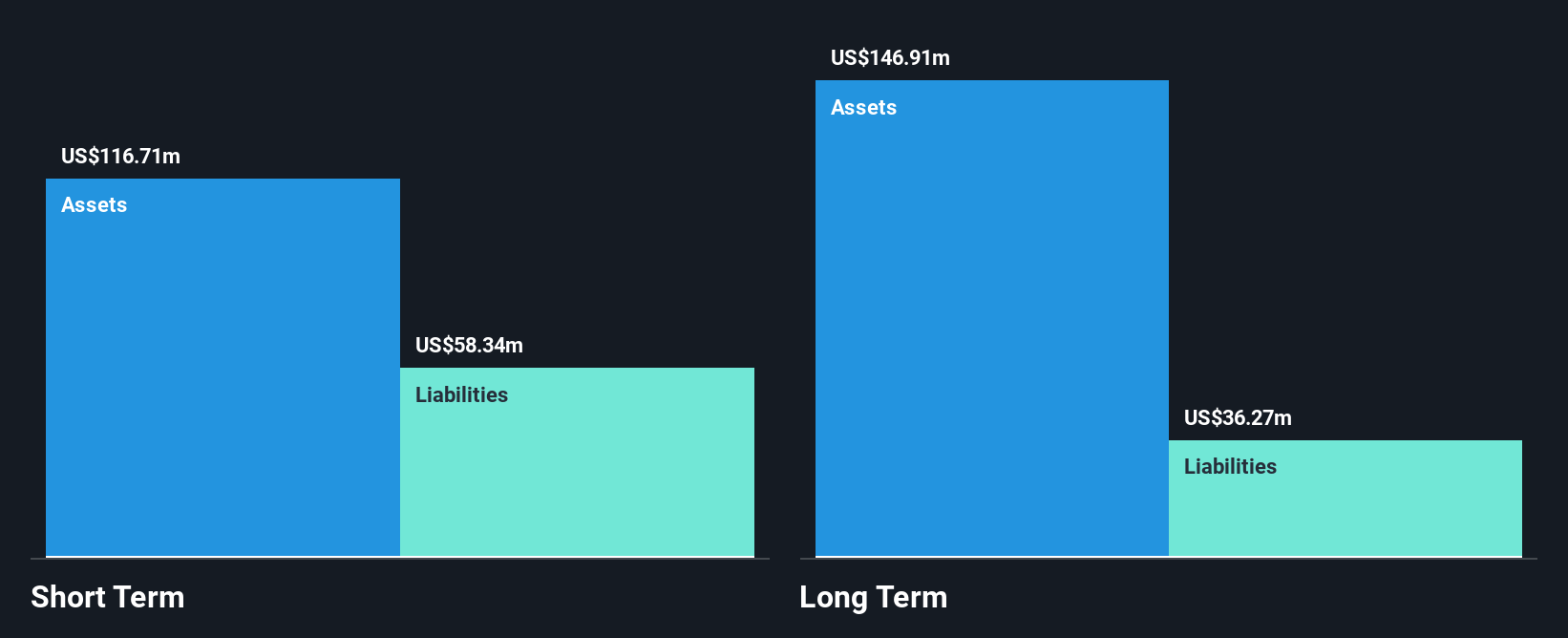

Majestic Gold Corp., with a market cap of CA$172.04 million, has shown stable weekly volatility at 11% over the past year. Despite trading at 64.2% below estimated fair value, its return on equity is considered low at 11%. The company's financial health appears robust, with more cash than total debt and short-term assets exceeding both short- and long-term liabilities. Earnings have grown by 5.2% annually over five years but slowed to 2.5% last year, underperforming the industry growth rate of 27%. Recent earnings reports show increased sales but declining net income compared to last year.

- Navigate through the intricacies of Majestic Gold with our comprehensive balance sheet health report here.

- Evaluate Majestic Gold's historical performance by accessing our past performance report.

Silver One Resources (TSXV:SVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silver One Resources Inc. focuses on acquiring, exploring, and developing mineral properties in the United States with a market cap of CA$114.75 million.

Operations: Silver One Resources Inc. has not reported any revenue segments.

Market Cap: CA$114.75M

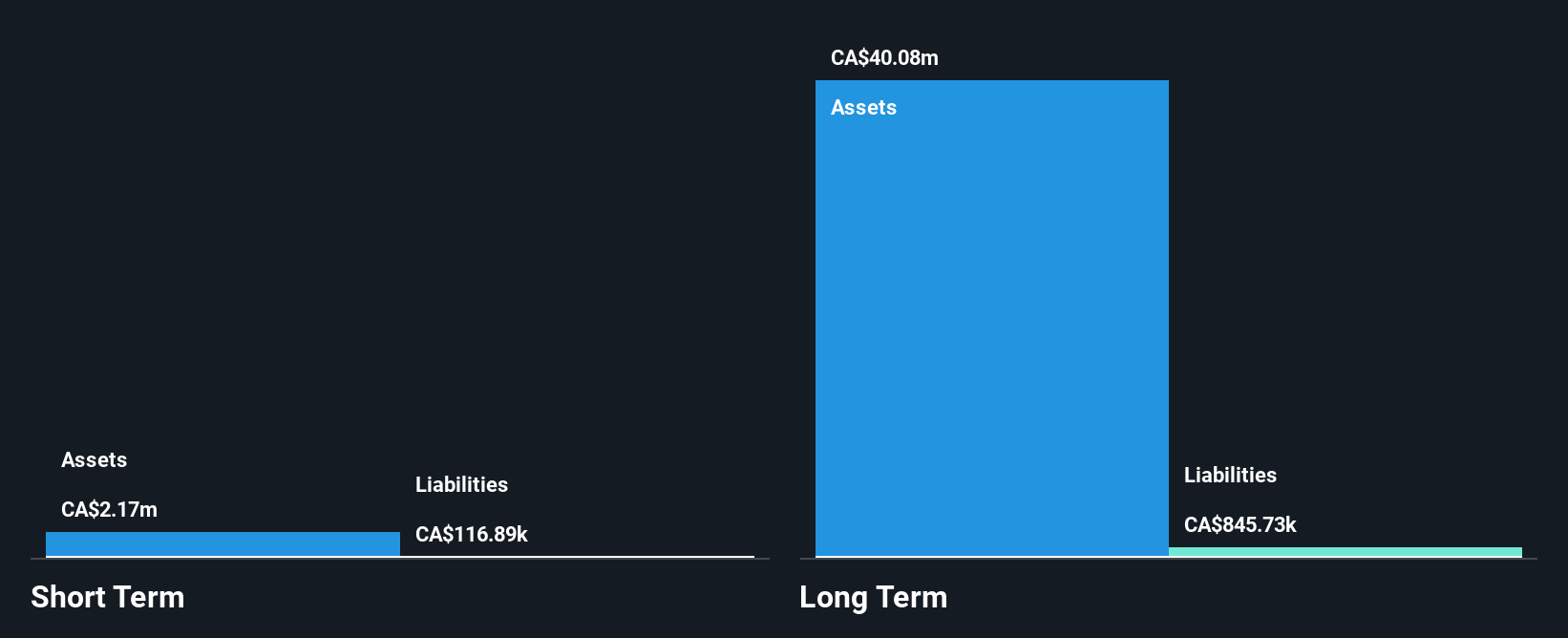

Silver One Resources Inc., with a market cap of CA$114.75 million, remains pre-revenue and unprofitable but has successfully reduced its losses over the past five years. Recent private placements raised significant capital, bolstering its short-term financial position with assets exceeding liabilities. The company is debt-free, and shareholders have not faced meaningful dilution recently. Despite a negative return on equity due to ongoing losses, Silver One's seasoned management team and stable weekly volatility suggest potential for future stability as it continues to explore mineral properties in the U.S. However, it currently faces limited cash runway without further capital inflow or revenue generation.

- Click here and access our complete financial health analysis report to understand the dynamics of Silver One Resources.

- Gain insights into Silver One Resources' past trends and performance with our report on the company's historical track record.

Western Copper and Gold (TSX:WRN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Western Copper and Gold Corporation is an exploration stage company focused on the exploration and development of mineral properties in Canada, with a market cap of CA$421.44 million.

Operations: Western Copper and Gold Corporation does not report any revenue segments as it is an exploration stage company.

Market Cap: CA$421.44M

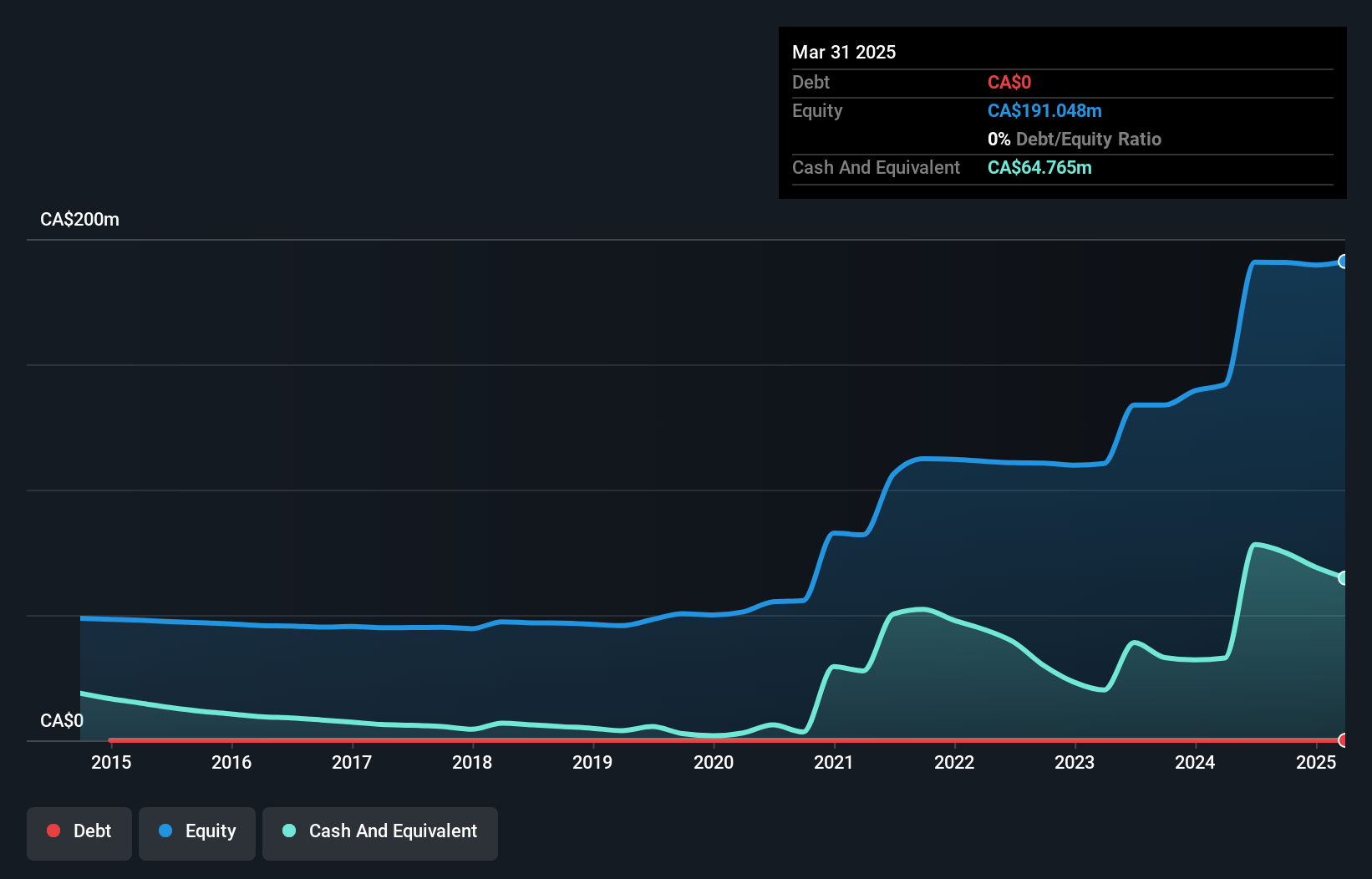

Western Copper and Gold Corporation, with a market cap of CA$421.44 million, is pre-revenue and currently unprofitable, although it has reduced its net losses significantly over the past year. The company is debt-free and maintains a strong short-term financial position with assets far exceeding liabilities. Its recent progress on the Environmental and Socio-economic Effects Statement for the Casino Project highlights ongoing engagement with First Nations and communities, potentially strengthening its project outlook. However, both management and board are relatively inexperienced, which may impact strategic execution as it remains unprofitable without near-term profitability forecasts.

- Get an in-depth perspective on Western Copper and Gold's performance by reading our balance sheet health report here.

- Evaluate Western Copper and Gold's prospects by accessing our earnings growth report.

Where To Now?

- Click this link to deep-dive into the 411 companies within our TSX Penny Stocks screener.

- Ready For A Different Approach? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Copper and Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WRN

Western Copper and Gold

An exploration stage company, engages in the exploration and development of mineral properties in Canada.

Excellent balance sheet and fair value.

Market Insights

Community Narratives