- Canada

- /

- Metals and Mining

- /

- TSXV:RCK

Majestic Gold And 2 Other Top Penny Stocks On The TSX

Reviewed by Simply Wall St

The Canadian market is experiencing strong momentum as it heads into 2025, supported by resilient consumer spending and rising corporate profits, though investors are advised to stay vigilant for potential challenges. Penny stocks, while considered a throwback term, continue to represent intriguing investment opportunities in the form of smaller or less-established companies that might offer significant value. By focusing on those with solid financials and growth potential, investors can uncover hidden gems within this segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.36 | CA$158.19M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$283.52M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$121.61M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.45 | CA$13.32M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.66 | CA$324.12M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$574.88M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.76 | CA$188.71M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.15 | CA$208.8M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.155 | CA$4.71M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.89 | CA$181.41M | ★★★★★☆ |

Click here to see the full list of 953 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Majestic Gold (TSXV:MJS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Majestic Gold Corp. is a mining company engaged in the exploration, development, and operation of mining properties in China, Australia, and Canada with a market cap of CA$78.20 million.

Operations: The company's revenue of $60.08 million is generated from its activities in exploration, development, and operation of mining properties.

Market Cap: CA$78.2M

Majestic Gold Corp., with a market cap of CA$78.20 million, has shown financial stability by maintaining more cash than its total debt and reducing its debt to equity ratio from 18.5% to 2.6% over five years. Despite earnings growth slowing to 1.2% last year, the company has achieved an average annual earnings growth of 14% over five years, supported by high-quality earnings and stable weekly volatility at 10%. Recently added to the S&P/TSX Venture Composite Index, Majestic Gold reported increased sales and net income for the first half of 2024 and announced a special dividend distribution totaling approximately CA$7.3 million.

- Navigate through the intricacies of Majestic Gold with our comprehensive balance sheet health report here.

- Gain insights into Majestic Gold's historical outcomes by reviewing our past performance report.

Quorum Information Technologies (TSXV:QIS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quorum Information Technologies Inc. is an information technology company that specializes in the automotive retail sector in Canada and the United States, with a market cap of CA$66.96 million.

Operations: The company's revenue is derived from three main segments: Services and One-Time (CA$1.19 million), Software as a Service (SaaS) (CA$28.67 million), and Business Development Centre (BDC) (CA$10.00 million).

Market Cap: CA$66.96M

Quorum Information Technologies Inc., with a market cap of CA$66.96 million, has shown resilience in the penny stock space by maintaining profitability over the past five years, although recent earnings growth of 12% lags its historical average. The company's revenue streams from SaaS and BDC segments are stable, but short-term assets fall short of covering long-term liabilities. Despite a low return on equity at 4.3%, Quorum's debt management is commendable with a reduced debt-to-equity ratio and satisfactory net debt levels. Recent strategic moves include pursuing M&A opportunities to expand its product offerings across North America.

- Unlock comprehensive insights into our analysis of Quorum Information Technologies stock in this financial health report.

- Explore Quorum Information Technologies' analyst forecasts in our growth report.

Rock Tech Lithium (TSXV:RCK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rock Tech Lithium Inc. focuses on the exploration and development of lithium properties, with a market cap of CA$115.55 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$115.55M

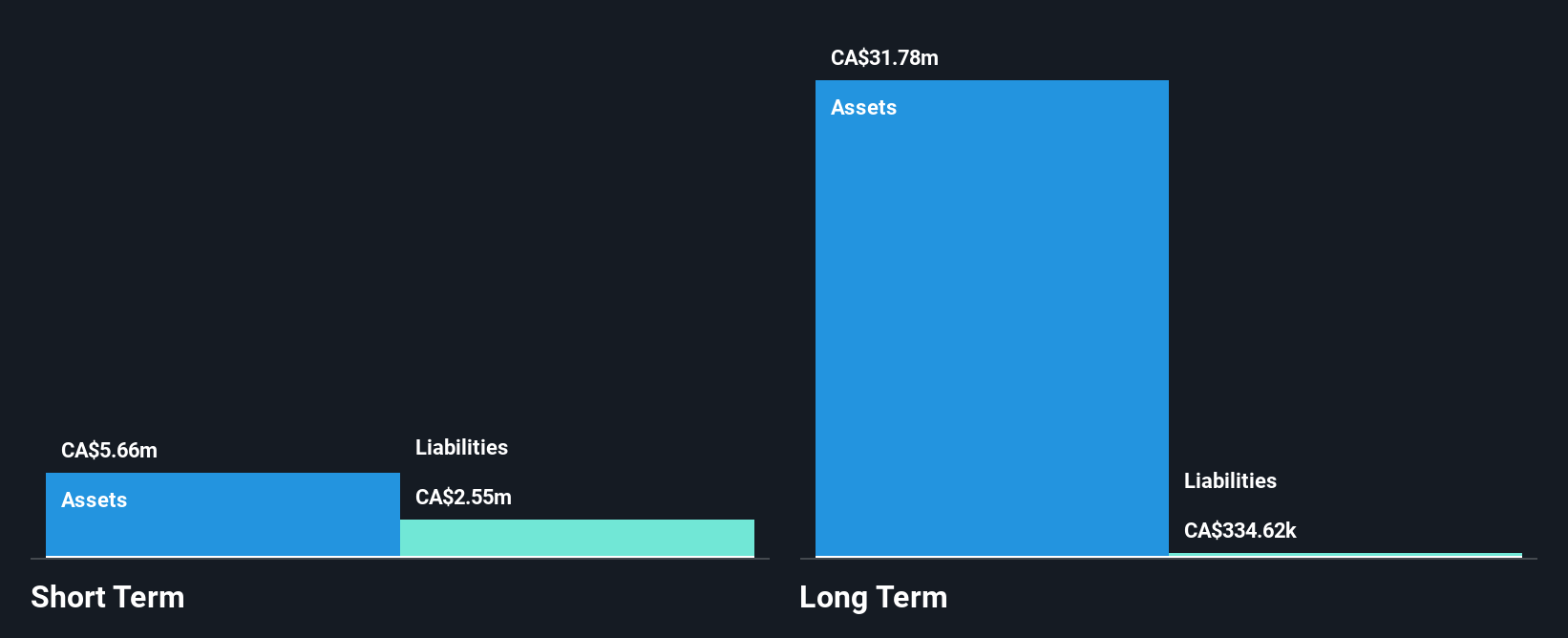

Rock Tech Lithium Inc., with a market cap of CA$115.55 million, is pre-revenue and unprofitable, with no significant revenue streams reported. The company recently announced a net loss reduction for the third quarter to CA$3.06 million from CA$5.4 million year-over-year, reflecting some improvement in financial performance despite ongoing losses. Shareholders have experienced dilution over the past year as the company raised capital through private placements totaling over CA$4.71 million in October 2024, including government participation via Canada's Critical Minerals Infrastructure Fund. The management team is relatively new, averaging 0.8 years of tenure, while the board shows more stability with an average tenure of 6.8 years.

- Click to explore a detailed breakdown of our findings in Rock Tech Lithium's financial health report.

- Gain insights into Rock Tech Lithium's future direction by reviewing our growth report.

Make It Happen

- Investigate our full lineup of 953 TSX Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RCK

Rock Tech Lithium

Engages in the exploration and development of lithium properties.

Flawless balance sheet moderate.