- Canada

- /

- Metals and Mining

- /

- TSXV:CUSN

Discover Promising TSX Penny Stocks In January 2025

Reviewed by Simply Wall St

While the backup in bond yields over recent months has impacted bond prices, it sets the stage for stronger performance ahead as yields are typically a key driver of fixed-income returns. In this context, penny stocks—though an outdated term—remain relevant as they often represent smaller or newer companies with potential growth opportunities. By focusing on those with robust financials and a clear growth trajectory, investors can find promising candidates among these lesser-known stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$121.5M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.55 | CA$939.87M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.13 | CA$370M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$15.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.60 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$237.23M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.48M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$2.03 | CA$116.34M | ★★★★☆☆ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cornish Metals (TSXV:CUSN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cornish Metals Inc. focuses on acquiring, evaluating, exploring, and developing mineral properties in the United Kingdom with a market cap of CA$80.29 million.

Operations: Cornish Metals Inc. currently does not report any revenue segments.

Market Cap: CA$80.29M

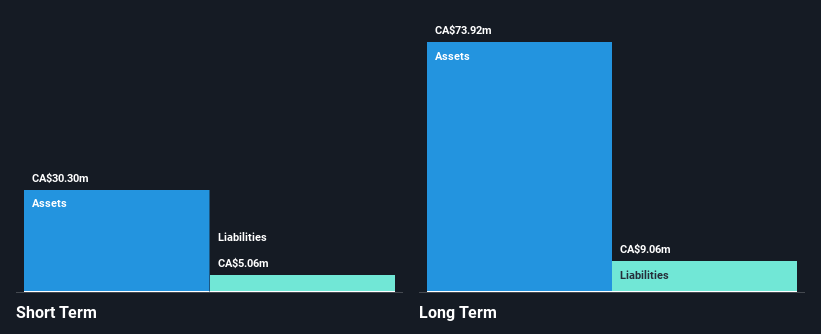

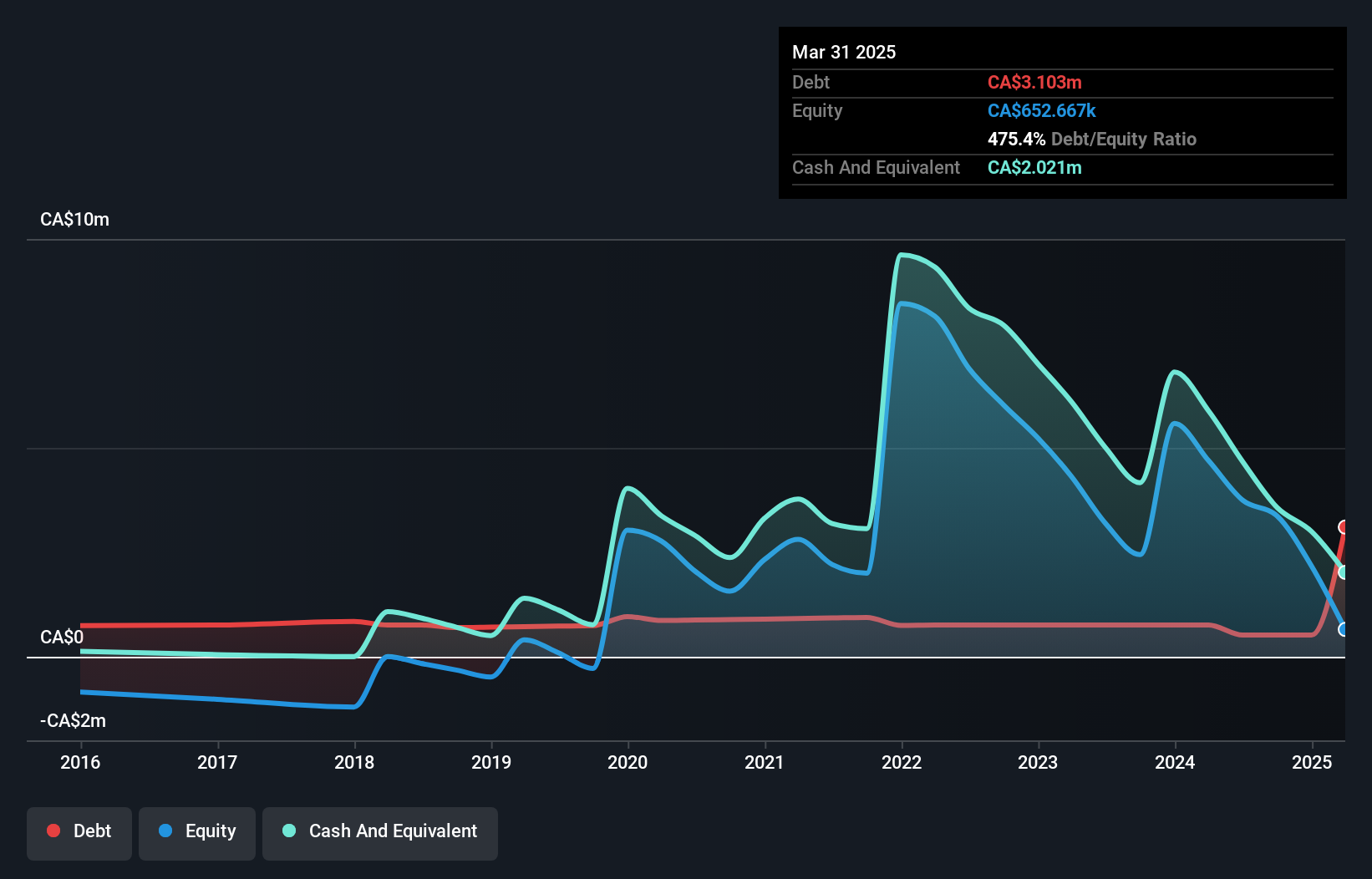

Cornish Metals Inc., with a market cap of CA$80.29 million, is pre-revenue, focusing on mineral exploration and development in the UK. Recent earnings announcements showed a shift to net income for Q3 2024, indicating potential financial improvement. The company has developed a near mine Exploration Target at South Crofty, highlighting significant mineralisation potential with high-grade tin resources. Despite being unprofitable and not forecasted to achieve profitability soon, Cornish Metals maintains strong asset coverage over its liabilities and benefits from an experienced management team. A recent non-dilutive credit facility supports ongoing project developments without shareholder dilution.

- Click here to discover the nuances of Cornish Metals with our detailed analytical financial health report.

- Examine Cornish Metals' past performance report to understand how it has performed in prior years.

MustGrow Biologics (TSXV:MGRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MustGrow Biologics Corp. is an agricultural biotechnology company that develops and commercializes natural biological technologies and products derived from mustard seeds, with a market cap of CA$59.39 million.

Operations: MustGrow Biologics Corp. currently does not report any revenue segments.

Market Cap: CA$59.39M

MustGrow Biologics Corp., with a market cap of CA$59.39 million, is pre-revenue and remains unprofitable, with recent earnings showing minimal sales and continued net losses. The company announced a private placement to raise CA$2 million through convertible debentures and warrants, potentially diluting future shareholder value but providing necessary funding. Despite its high share price volatility, MustGrow maintains strong asset coverage over its liabilities and has more cash than debt. While earnings are forecasted to decline significantly over the next three years, the management team is experienced, offering some stability in navigating financial challenges.

- Click to explore a detailed breakdown of our findings in MustGrow Biologics' financial health report.

- Gain insights into MustGrow Biologics' outlook and expected performance with our report on the company's earnings estimates.

01 Communique Laboratory (TSXV:ONE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 01 Communique Laboratory Inc. offers cybersecurity and remote access solutions across the United States, Asia-Pacific, and Canada, with a market cap of CA$65.05 million.

Operations: The company generates revenue of CA$0.46 million from the development and marketing of its communications software.

Market Cap: CA$65.05M

01 Communique Laboratory Inc., with a market cap of CA$65.05 million, is pre-revenue, generating less than US$1 million annually. Despite its seasoned board and lack of debt, the company faces challenges such as high share price volatility and a negative return on equity due to unprofitability. Short-term assets exceed liabilities, but it has less than a year of cash runway based on current free cash flow trends. Recent events include a special call in December 2024, suggesting ongoing strategic discussions or developments within the company as it navigates financial constraints and seeks growth opportunities in cybersecurity solutions.

- Get an in-depth perspective on 01 Communique Laboratory's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into 01 Communique Laboratory's track record.

Make It Happen

- Embark on your investment journey to our 947 TSX Penny Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CUSN

Cornish Metals

Engages in the acquisition, evaluation, exploration, and development of mineral properties in the United Kingdom.

Excellent balance sheet very low.

Market Insights

Community Narratives