- Canada

- /

- Commercial Services

- /

- TSX:DCM

TSX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Canadian market is showing strong momentum as we approach 2025, supported by resilient consumer activity and rising corporate profits. Amidst this positive backdrop, investors are considering how to strategically position themselves for potential challenges. While the term "penny stock" might seem outdated, these smaller or newer companies can still offer significant opportunities when backed by solid financials. We'll explore three penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.54 | CA$160.38M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.74 | CA$281.86M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$120.59M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$565.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.52 | CA$335.5M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.89 | CA$187.19M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.03M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.18 | CA$215.73M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 962 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

DATA Communications Management (TSX:DCM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DATA Communications Management Corp. offers solutions for complex marketing and communication workflows mainly in the United States and Canada, with a market cap of CA$110.06 million.

Operations: The company generates revenue from its Printing & Publishing segment, amounting to CA$493.70 million.

Market Cap: CA$110.06M

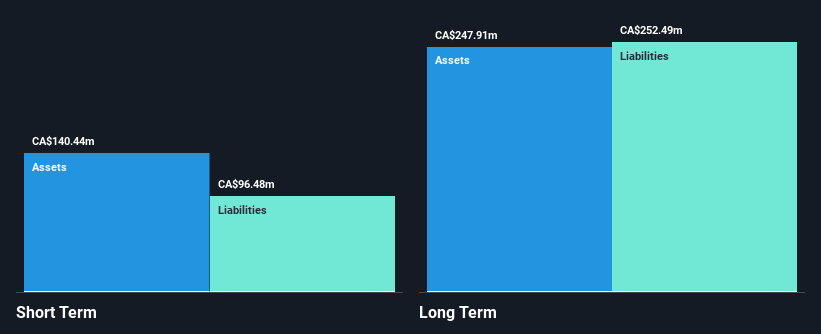

DATA Communications Management Corp. recently reported a significant improvement in financial performance, with nine-month sales reaching CA$363.73 million and net income of CA$2.87 million, reversing a prior year's loss. Despite being unprofitable overall, the company maintains a positive cash flow trajectory and has enough cash runway for over three years if it continues on this path. Short-term assets exceed liabilities, but long-term liabilities remain uncovered by current assets, highlighting potential financial risk. Trading at a substantial discount to estimated fair value suggests potential upside if operational efficiencies continue to improve amidst stable weekly volatility and experienced management oversight.

- Navigate through the intricacies of DATA Communications Management with our comprehensive balance sheet health report here.

- Explore DATA Communications Management's analyst forecasts in our growth report.

Solaris Resources (TSX:SLS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Solaris Resources Inc. is involved in the exploration of mineral properties and has a market capitalization of CA$721.32 million.

Operations: Solaris Resources Inc. has not reported any revenue segments, as it focuses on the exploration of mineral properties.

Market Cap: CA$721.32M

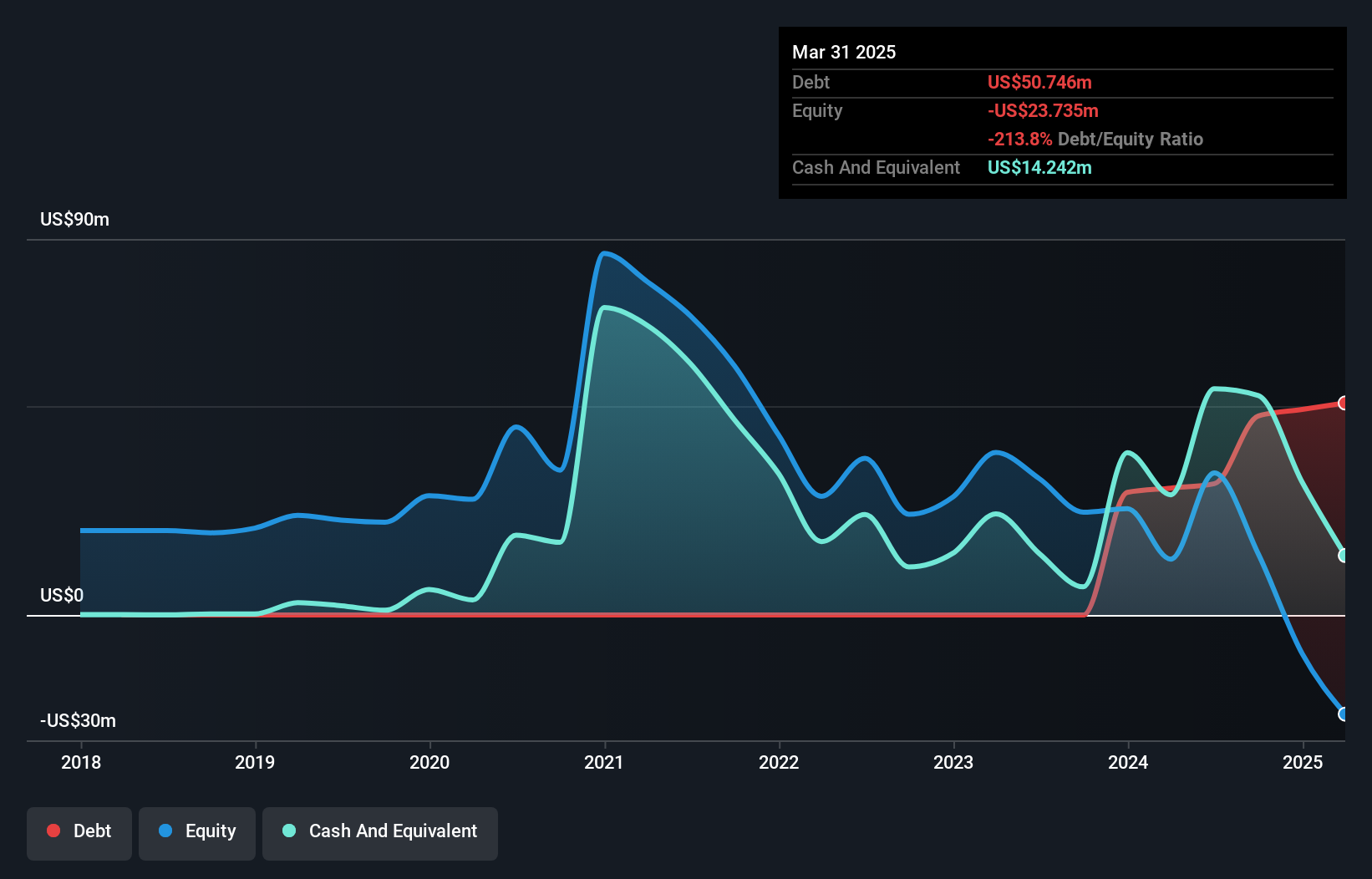

Solaris Resources Inc., with a market cap of CA$721.32 million, remains pre-revenue as it focuses on mineral exploration, particularly at its Warintza Project in Ecuador. The company recently announced executive changes to enhance strategic alignment with Ecuadorian regulators, appointing Matthew Rowlinson as CEO effective January 2025. Despite a net loss of US$20.79 million for Q3 2024 and ongoing shareholder dilution, Solaris maintains more cash than debt and covers both short- and long-term liabilities with current assets. However, earnings are forecasted to decline over the next three years, highlighting potential financial challenges ahead.

- Jump into the full analysis health report here for a deeper understanding of Solaris Resources.

- Assess Solaris Resources' future earnings estimates with our detailed growth reports.

Mawson Gold (TSXV:MAW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mawson Gold Limited focuses on acquiring and exploring mineral properties in Australia and Sweden, with a market cap of CA$303.08 million.

Operations: There are no reported revenue segments for this company.

Market Cap: CA$303.08M

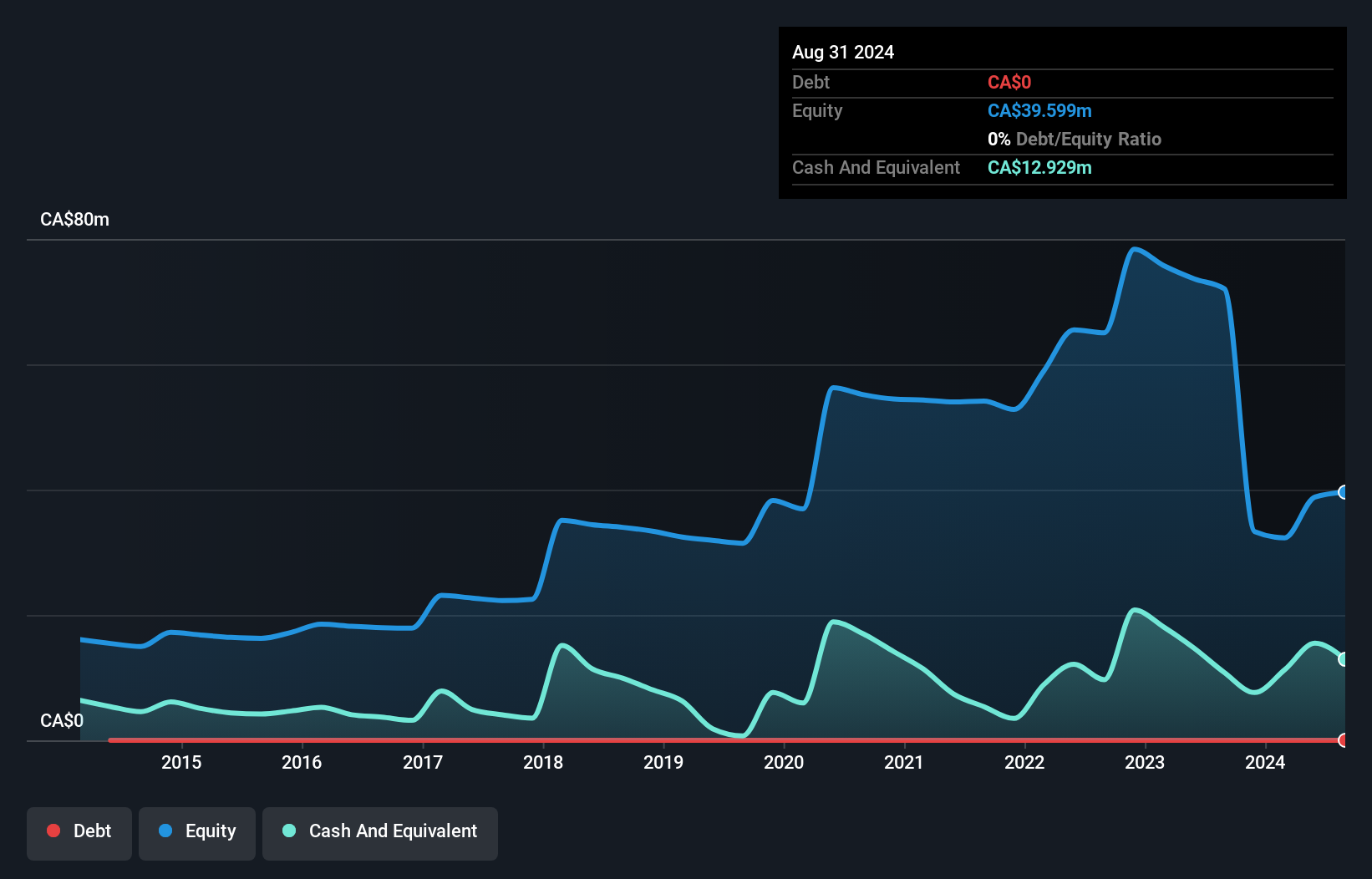

Mawson Gold Limited, with a market cap of CA$303.08 million, is pre-revenue and focuses on mineral exploration in Australia and Sweden. Despite being debt-free, the company faces financial challenges with less than a year of cash runway and ongoing shareholder dilution. Recent earnings reports indicate significant losses, including a net loss of CA$43.82 million for the full year ended May 2024. The company's inclusion in the S&P/TSX Venture Composite Index could enhance visibility among investors. However, auditor concerns about its ability to continue as a going concern underscore potential risks associated with investing in this penny stock.

- Take a closer look at Mawson Gold's potential here in our financial health report.

- Evaluate Mawson Gold's historical performance by accessing our past performance report.

Seize The Opportunity

- Get an in-depth perspective on all 962 TSX Penny Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCM

DATA Communications Management

Provides solution to solve complex marketing and communication workflows primarily in the United States and Canada.

Undervalued with adequate balance sheet.