- Canada

- /

- Oil and Gas

- /

- TSX:WCP

Top TSX Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we step into 2025, the Canadian market is buoyed by a robust performance in 2024, with the TSX gaining an impressive 18% amid strong economic growth and rising corporate profits. In this context of potential policy uncertainty and continued normalization of central bank policy, dividend stocks remain an attractive option for investors seeking stability and income in their portfolios.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.00% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.54% | ★★★★★★ |

| Russel Metals (TSX:RUS) | 3.98% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.13% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.40% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.60% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.24% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.46% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 4.87% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 3.93% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top TSX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

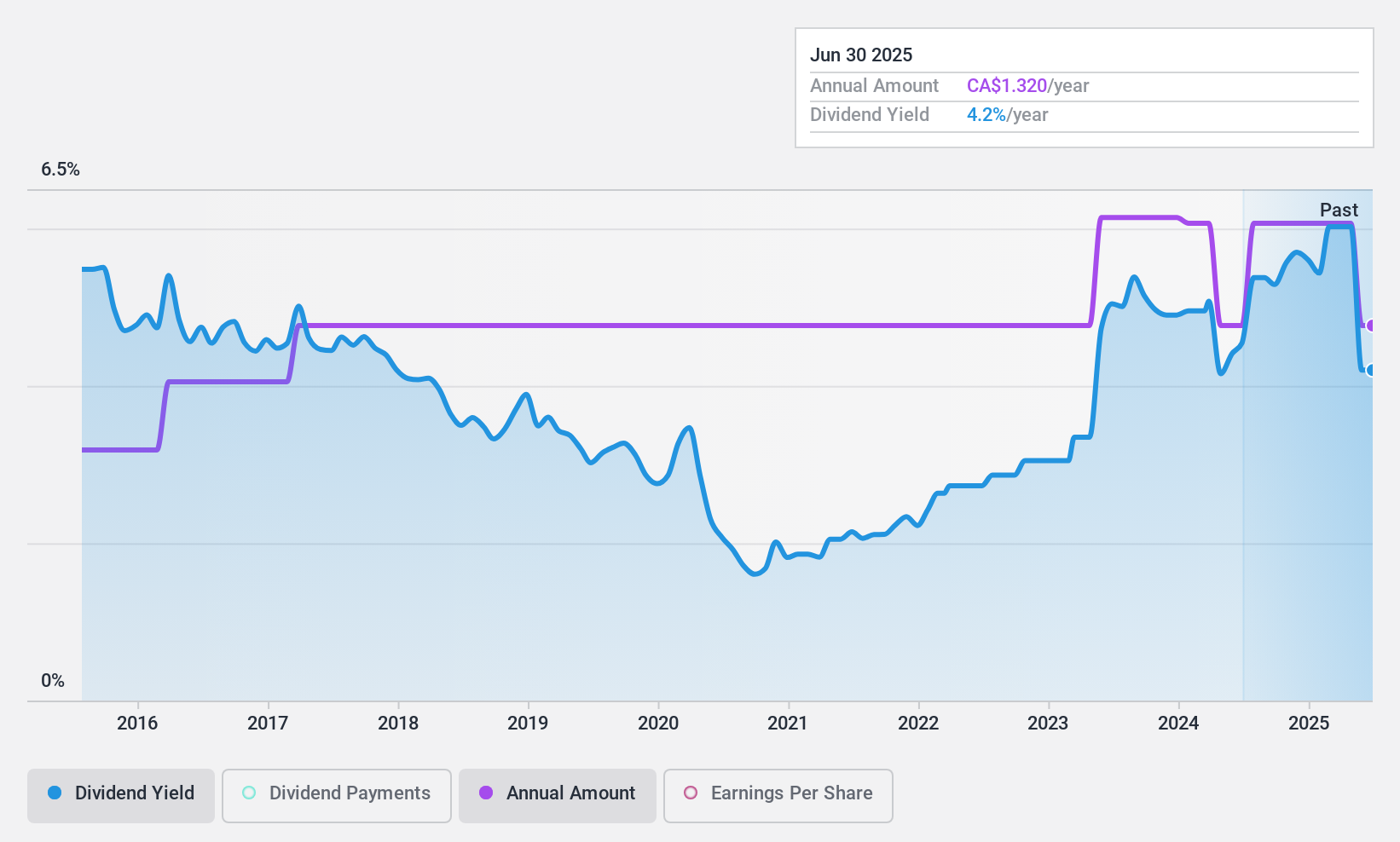

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, along with its subsidiaries, operates in North America by designing, manufacturing, and distributing packaging containers and healthcare supplies and products; it has a market cap of CA$336.87 million.

Operations: Richards Packaging Income Fund generates revenue primarily from its Wholesale - Miscellaneous segment, which amounts to CA$411.82 million.

Dividend Yield: 5.5%

Richards Packaging Income Fund offers a stable dividend track record over the past decade, with a current yield of 5.46%. Its dividends are well-covered by earnings and cash flows, reflected in payout ratios of 38.7% and 32.6%, respectively, indicating sustainability. Despite trading at a significant discount to its estimated fair value, its dividend yield is lower than the top Canadian payers. Recent affirmations maintain consistent monthly distributions of C$0.11 per unit through December 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Richards Packaging Income Fund.

- The analysis detailed in our Richards Packaging Income Fund valuation report hints at an deflated share price compared to its estimated value.

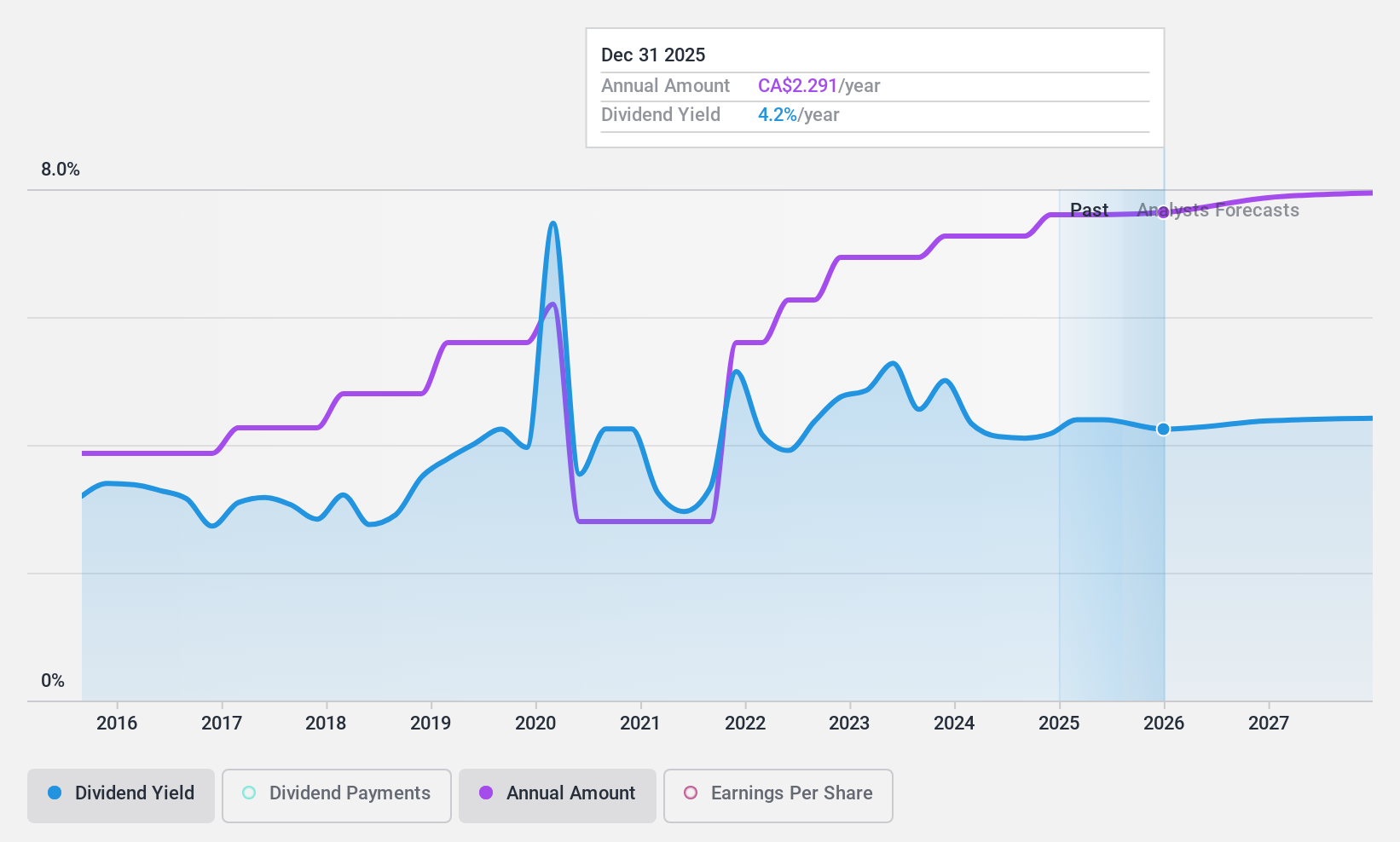

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$66.23 billion.

Operations: Suncor Energy's revenue is primarily derived from its Oil Sands segment at CA$25.24 billion, Refining and Marketing at CA$31.85 billion, and Exploration and Production at CA$2.15 billion.

Dividend Yield: 4.2%

Suncor Energy has increased its quarterly dividend by 5% to C$0.57 per share, yet its dividend history is marked by volatility over the past decade. Despite this, dividends are well-covered with a payout ratio of 34.9% and cash payout ratio of 31.8%. The company is trading at a significant discount to its estimated fair value and has completed substantial share buybacks worth C$2 billion recently, though future earnings are forecasted to decline.

- Unlock comprehensive insights into our analysis of Suncor Energy stock in this dividend report.

- In light of our recent valuation report, it seems possible that Suncor Energy is trading behind its estimated value.

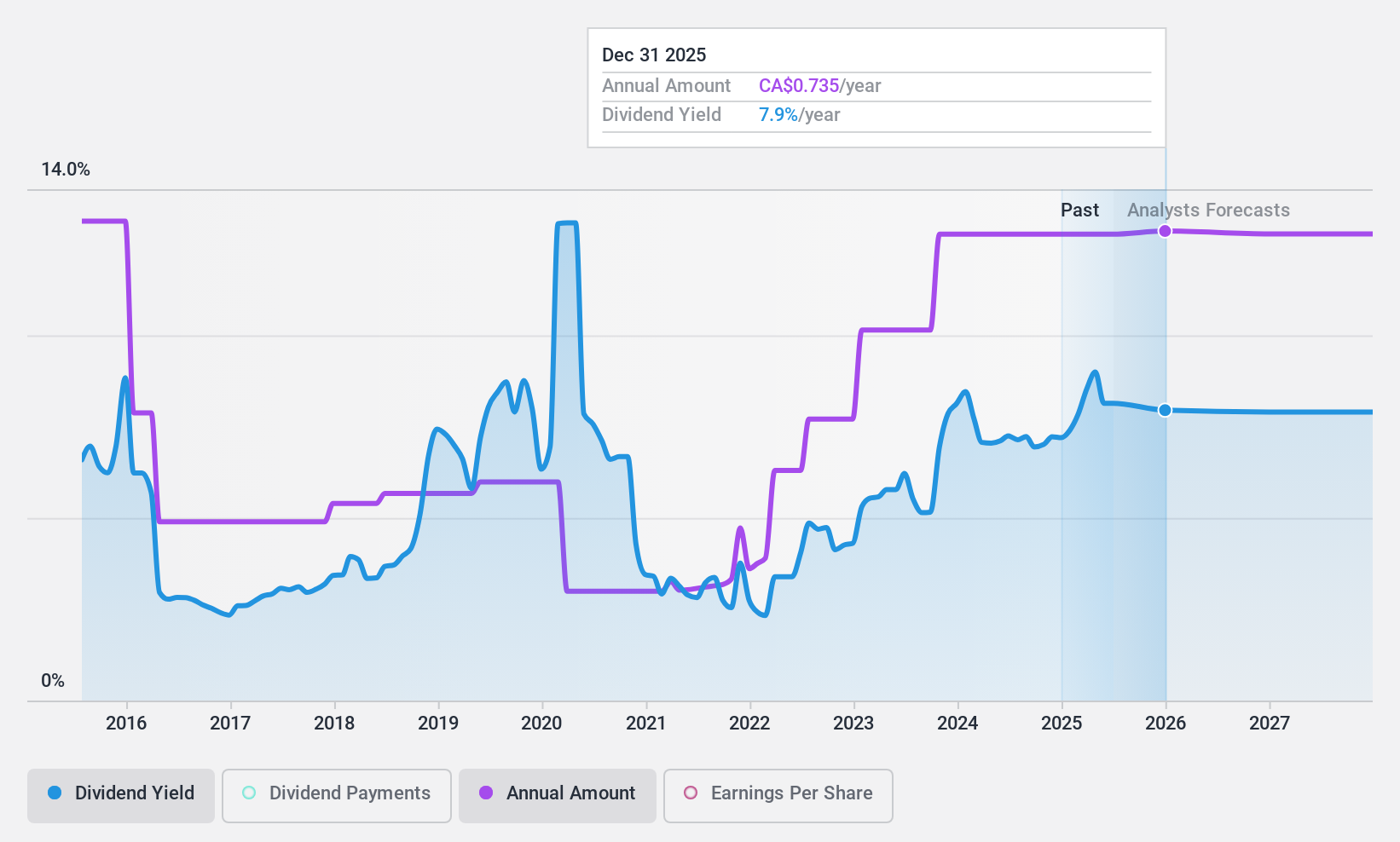

Whitecap Resources (TSX:WCP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Whitecap Resources Inc. is an oil and gas company engaged in acquiring, developing, and producing petroleum and natural gas assets in Western Canada, with a market cap of CA$6.12 billion.

Operations: Whitecap Resources Inc. generates revenue primarily from its Oil & Gas - Exploration & Production segment, amounting to CA$3.31 billion.

Dividend Yield: 7.0%

Whitecap Resources offers a stable dividend yield of 7%, placing it among the top Canadian dividend payers. With dividends reliably growing over the past decade and a payout ratio of 49.3%, payments are well-covered by earnings and cash flows. Recent affirmations confirm consistent monthly dividends, such as CAD 0.0608 per share for December operations, while strategic debt financing supports financial stability despite forecasts of declining earnings in coming years.

- Dive into the specifics of Whitecap Resources here with our thorough dividend report.

- Upon reviewing our latest valuation report, Whitecap Resources' share price might be too pessimistic.

Turning Ideas Into Actions

- Click this link to deep-dive into the 28 companies within our Top TSX Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Whitecap Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WCP

Whitecap Resources

Engages in the acquisition, development, and production of petroleum and natural gas properties and assets in Western Canada.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)