- Canada

- /

- Metals and Mining

- /

- TSXV:LITH

TSX Penny Stock Highlights: Thinkific Labs And Two More Picks

Reviewed by Simply Wall St

The Canadian market has shown resilience, supported by easing monetary policies and robust economic indicators, which have bolstered financial and material sectors. In this context, penny stocks—often smaller or newer companies—remain an intriguing investment area due to their potential for significant returns when backed by strong financials. This article will explore three such stocks on the TSX that stand out for their balance sheet strength and growth potential, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.36 | CA$157.09M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$280.2M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.47 | CA$12.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$112.45M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$565.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.61 | CA$347.6M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.13 | CA$210.78M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.60 | CA$981.2M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$5.03M | ★★★★★★ |

Click here to see the full list of 916 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Thinkific Labs (TSX:THNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thinkific Labs Inc. develops, markets, and manages a cloud-based platform serving Canada, the United States, and international markets with a market cap of CA$208.23 million.

Operations: The company's revenue is primarily derived from the development, marketing, and support management of its cloud-based platform, totaling $64.95 million.

Market Cap: CA$208.23M

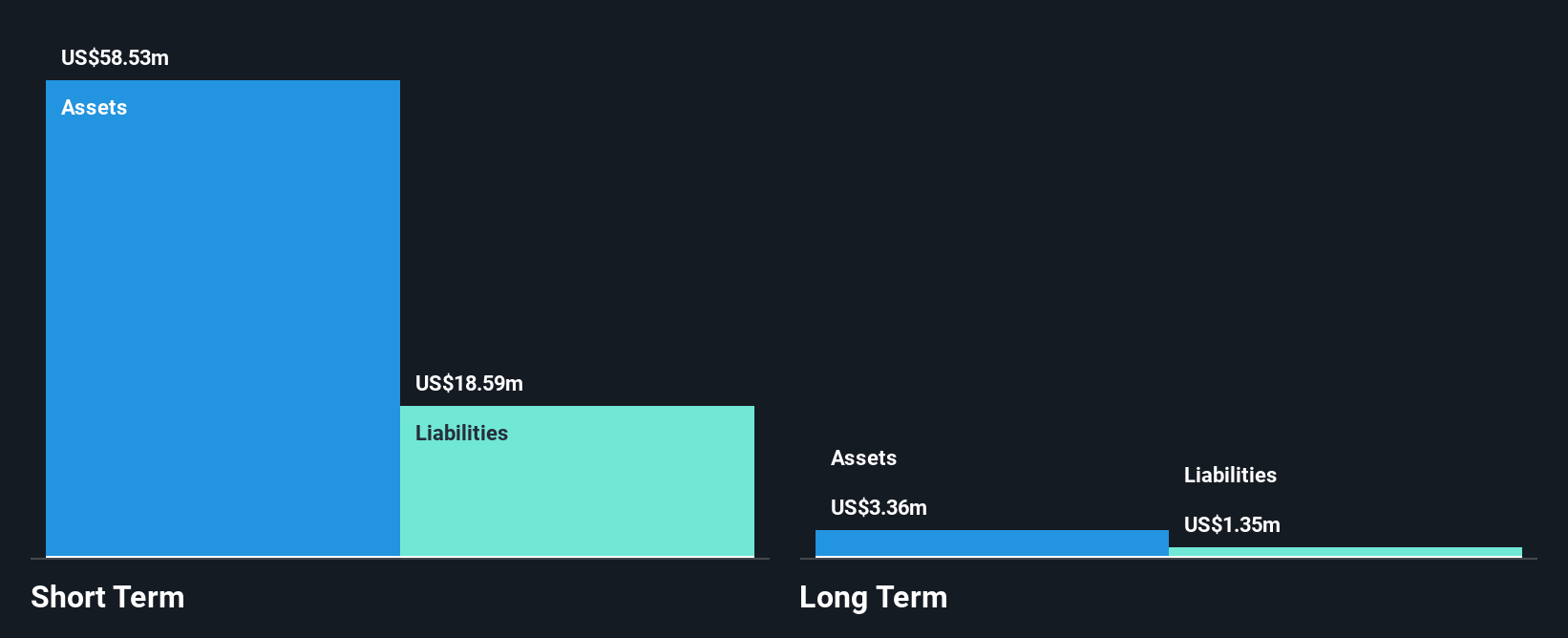

Thinkific Labs Inc. has recently transitioned to profitability, reporting a net income of US$0.579 million for Q3 2024, compared to a loss the previous year. The company remains debt-free, with short-term assets significantly exceeding both short and long-term liabilities, indicating strong financial health. Despite trading below estimated fair value by nearly 50%, its earnings are forecasted to decline significantly over the next three years. Recent board changes and a share repurchase program suggest strategic shifts aimed at enhancing shareholder value amidst potential volatility in returns and low return on equity at 1.7%.

- Unlock comprehensive insights into our analysis of Thinkific Labs stock in this financial health report.

- Learn about Thinkific Labs' future growth trajectory here.

Lithium Chile (TSXV:LITH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lithium Chile Inc. focuses on acquiring and developing lithium properties in Chile and Argentina, with a market cap of CA$127.92 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$127.92M

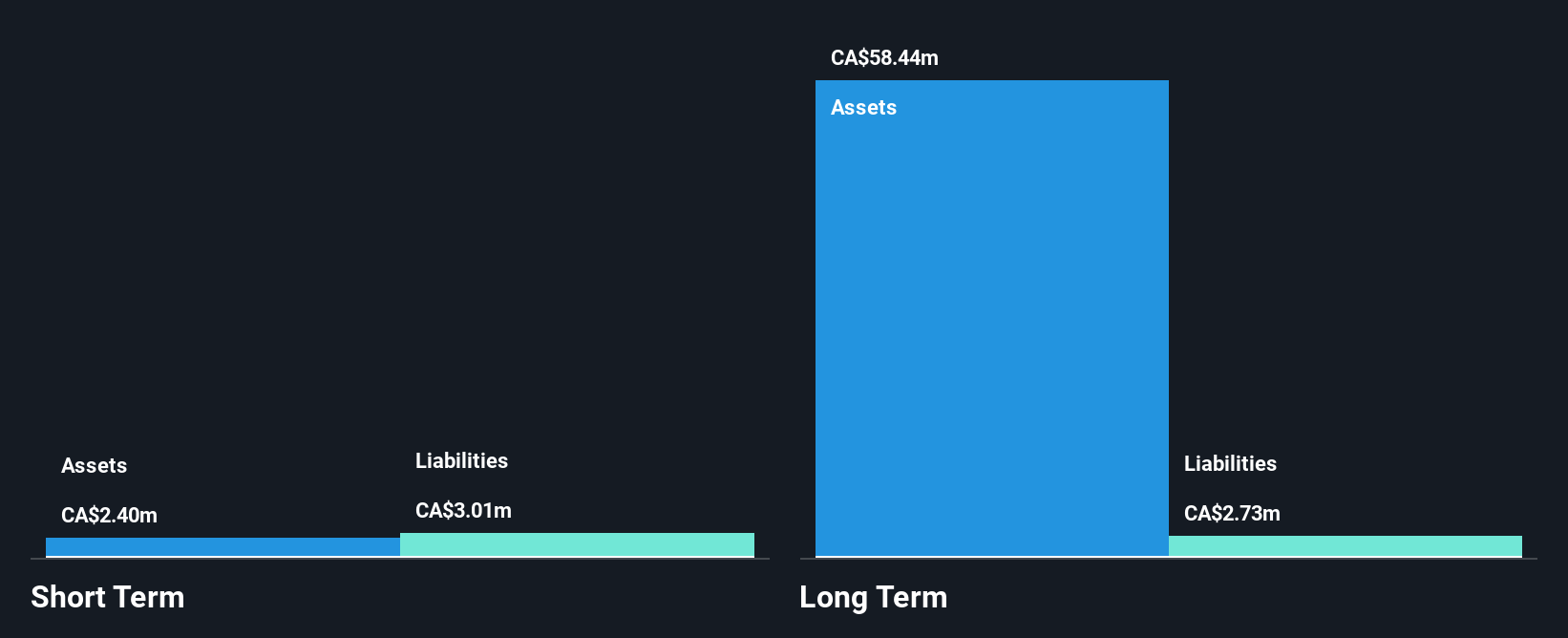

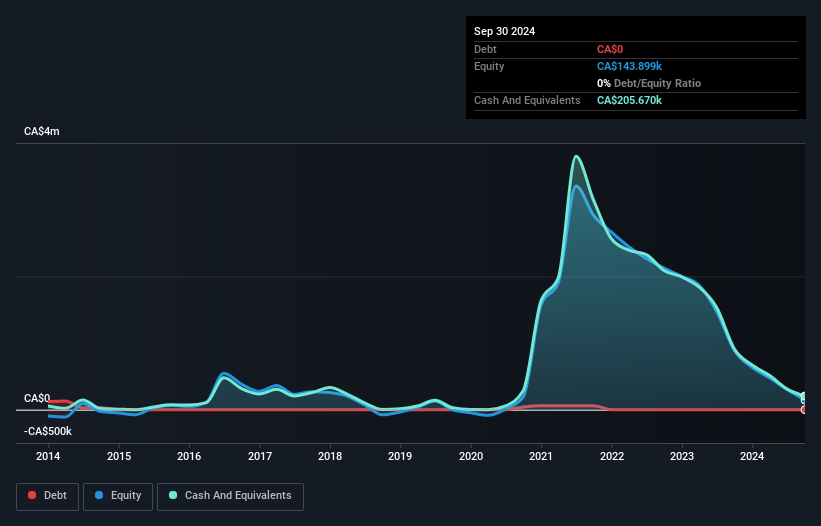

Lithium Chile Inc. has shown significant earnings growth, with a 165.2% increase over the past year, surpassing its five-year average of 42.1% annually. Despite being pre-revenue, the company reported a net income of CA$4.08 million for Q3 2024 and CA$9.91 million for the nine months ending September 30, marking a turnaround from losses in prior periods. The firm is debt-free and maintains strong liquidity with short-term assets covering both short and long-term liabilities comfortably. However, its return on equity remains low at 14.7%, indicating room for improvement in generating shareholder returns.

- Click here and access our complete financial health analysis report to understand the dynamics of Lithium Chile.

- Explore historical data to track Lithium Chile's performance over time in our past results report.

US Copper (TSXV:USCU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: US Copper Corp. is an exploration stage company focused on the exploration and evaluation of mineral properties in Canada and the United States, with a market cap of CA$6.09 million.

Operations: US Copper Corp. has not reported any revenue segments as it is currently focused on the exploration and evaluation of mineral properties in Canada and the United States.

Market Cap: CA$6.09M

US Copper Corp., a pre-revenue exploration stage company, recently announced a significant update to its Moonlight-Superior Copper Project in California, indicating a substantial increase in its Indicated Resource category. Despite this development, the company remains unprofitable with increased losses over the past five years and has less than a year of cash runway. The firm is debt-free and covers short-term liabilities with available assets but has experienced shareholder dilution over the past year. Its board is highly experienced, yet high volatility persists in its share price compared to other Canadian stocks.

- Click here to discover the nuances of US Copper with our detailed analytical financial health report.

- Review our historical performance report to gain insights into US Copper's track record.

Key Takeaways

- Click through to start exploring the rest of the 913 TSX Penny Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LITH

Lithium Chile

Engages in the acquisition and development of lithium properties in Chile and Argentina.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives