- Canada

- /

- Metals and Mining

- /

- CNSX:LEO

Lion Copper and Gold (CVE:LEO) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Lion Copper and Gold Corp. (CVE:LEO) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Lion Copper and Gold

How Much Debt Does Lion Copper and Gold Carry?

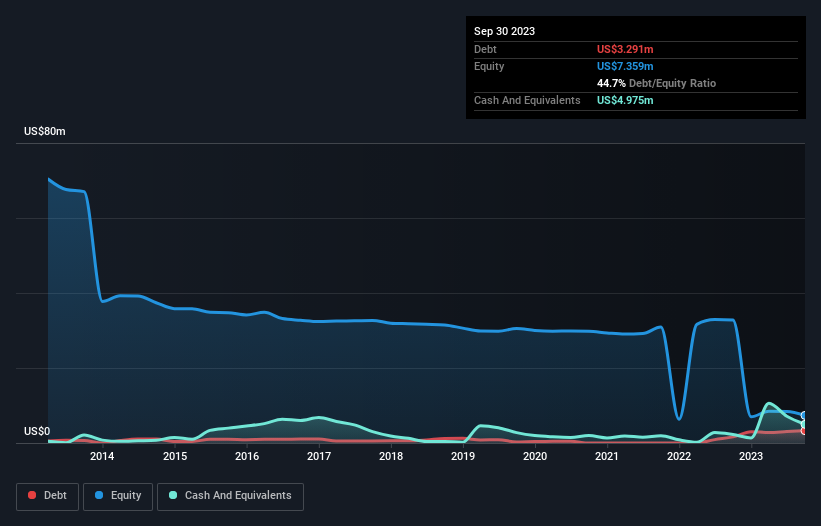

The image below, which you can click on for greater detail, shows that at September 2023 Lion Copper and Gold had debt of US$3.29m, up from US$1.63m in one year. But on the other hand it also has US$4.98m in cash, leading to a US$1.68m net cash position.

A Look At Lion Copper and Gold's Liabilities

Zooming in on the latest balance sheet data, we can see that Lion Copper and Gold had liabilities of US$5.73m due within 12 months and liabilities of US$1.04m due beyond that. Offsetting these obligations, it had cash of US$4.98m as well as receivables valued at US$6.0k due within 12 months. So its liabilities total US$1.79m more than the combination of its cash and short-term receivables.

Given Lion Copper and Gold has a market capitalization of US$17.2m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Lion Copper and Gold boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Lion Copper and Gold's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Since Lion Copper and Gold has no significant operating revenue, shareholders probably hope it will develop a valuable new mine before too long.

So How Risky Is Lion Copper and Gold?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Lion Copper and Gold lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through US$1.6m of cash and made a loss of US$4.7m. While this does make the company a bit risky, it's important to remember it has net cash of US$1.68m. That kitty means the company can keep spending for growth for at least two years, at current rates. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for Lion Copper and Gold (2 are concerning!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:LEO

Lion Copper and Gold

A mineral exploration company, engages in the acquisition, exploration, and development of copper projects in the United States.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026