- Canada

- /

- Metals and Mining

- /

- TSXV:LEM

Fresh Factory B.C Leads These 3 TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As the Canadian market navigates through a year marked by policy shifts and global uncertainties, investors have found reasons to be thankful, with strong equity gains positioning the TSX for one of its best years since 2009. In this context, identifying promising investment opportunities becomes crucial. Penny stocks, though an outdated term, remain relevant as they often represent smaller or younger companies that can offer unique value and growth potential. We'll explore three penny stocks on the TSX that stand out for their financial strength and potential upside in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.10 | CA$53.09M | ✅ 3 ⚠️ 3 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.22 | CA$243.64M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.42 | CA$143.13M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.43 | CA$3.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.26 | CA$838.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.87 | CA$145.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.09 | CA$197.77M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.80 | CA$10.92M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 391 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Fresh Factory B.C (TSXV:FRSH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: The Fresh Factory B.C. Ltd. engages in the formulation, development, manufacturing, distribution, and sale of fresh and plant-based food and beverage products in the United States with a market cap of CA$56.46 million.

Operations: The company's revenue is primarily derived from its food processing segment, which generated $42.37 million.

Market Cap: CA$56.46M

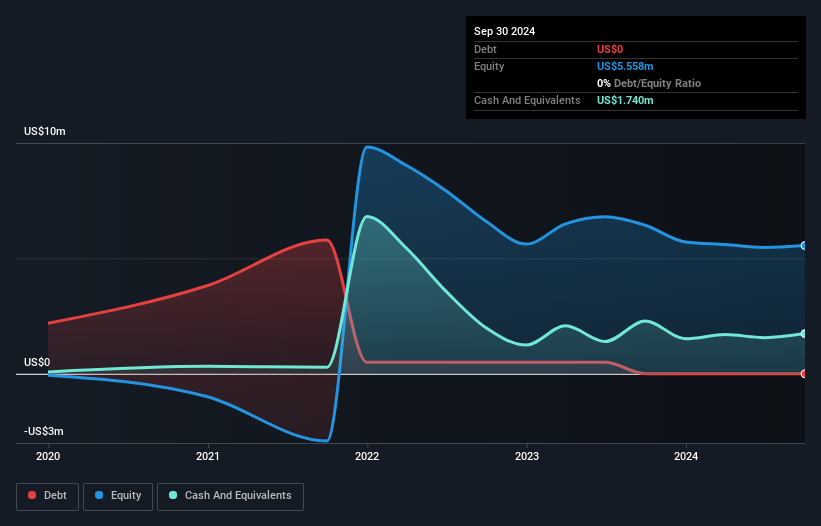

Fresh Factory B.C. Ltd. has shown revenue growth, with third-quarter sales increasing to US$11.7 million from US$8.12 million the previous year, though it remains unprofitable with a net loss of US$0.336 million this quarter. The company is undertaking a share repurchase program to potentially enhance shareholder value and has secured a three-year revolving asset-based lending facility of US$4 million for working capital needs. While its short-term assets cover both short and long-term liabilities, the management team lacks experience with an average tenure of 0.9 years, which may impact strategic execution moving forward.

- Jump into the full analysis health report here for a deeper understanding of Fresh Factory B.C.

- Evaluate Fresh Factory B.C's historical performance by accessing our past performance report.

Leading Edge Materials (TSXV:LEM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Leading Edge Materials Corp. is involved in the exploration and development of resource properties in Sweden and Romania, with a market cap of CA$60.01 million.

Operations: Leading Edge Materials Corp. does not report any revenue segments.

Market Cap: CA$60.01M

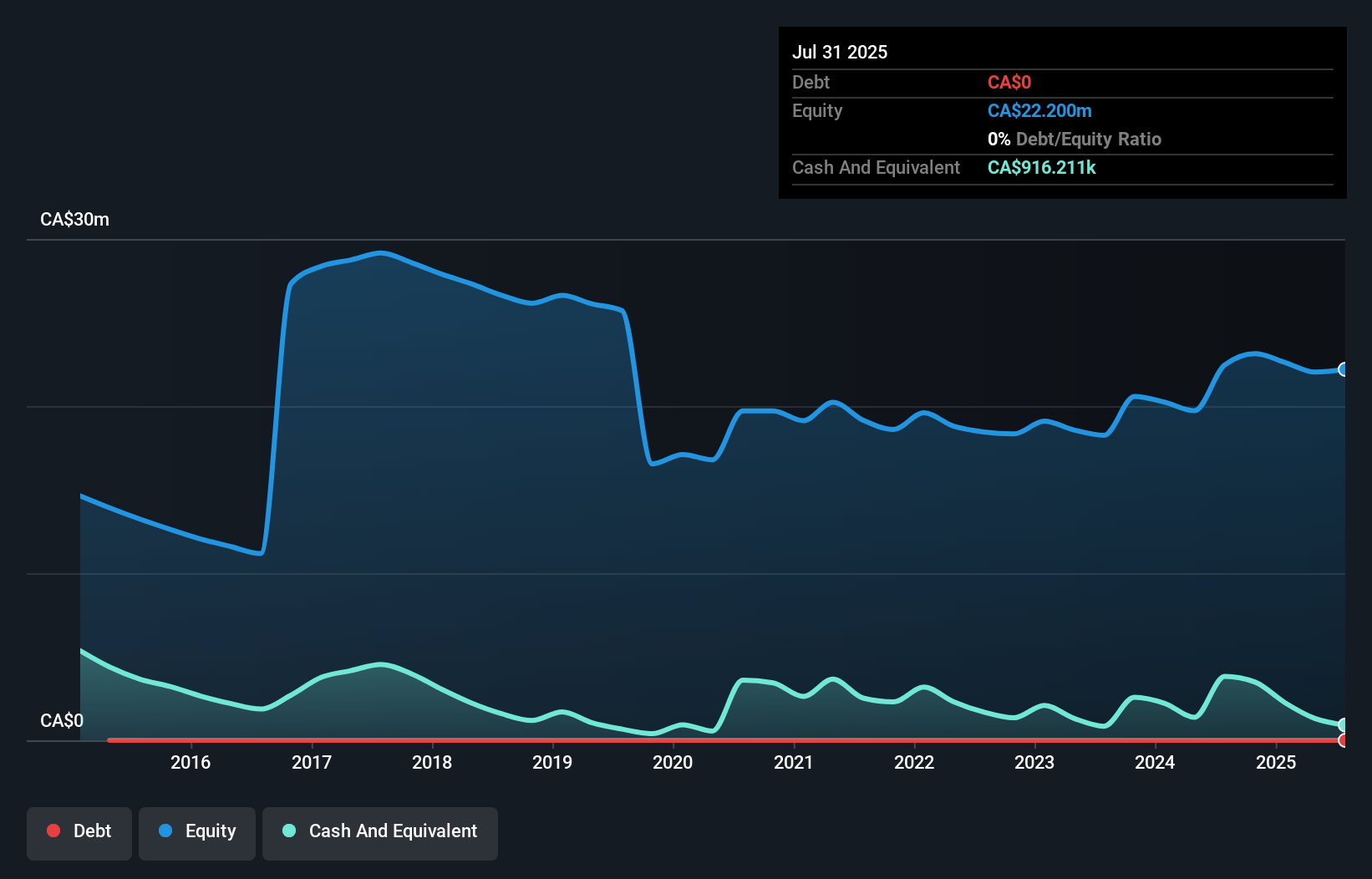

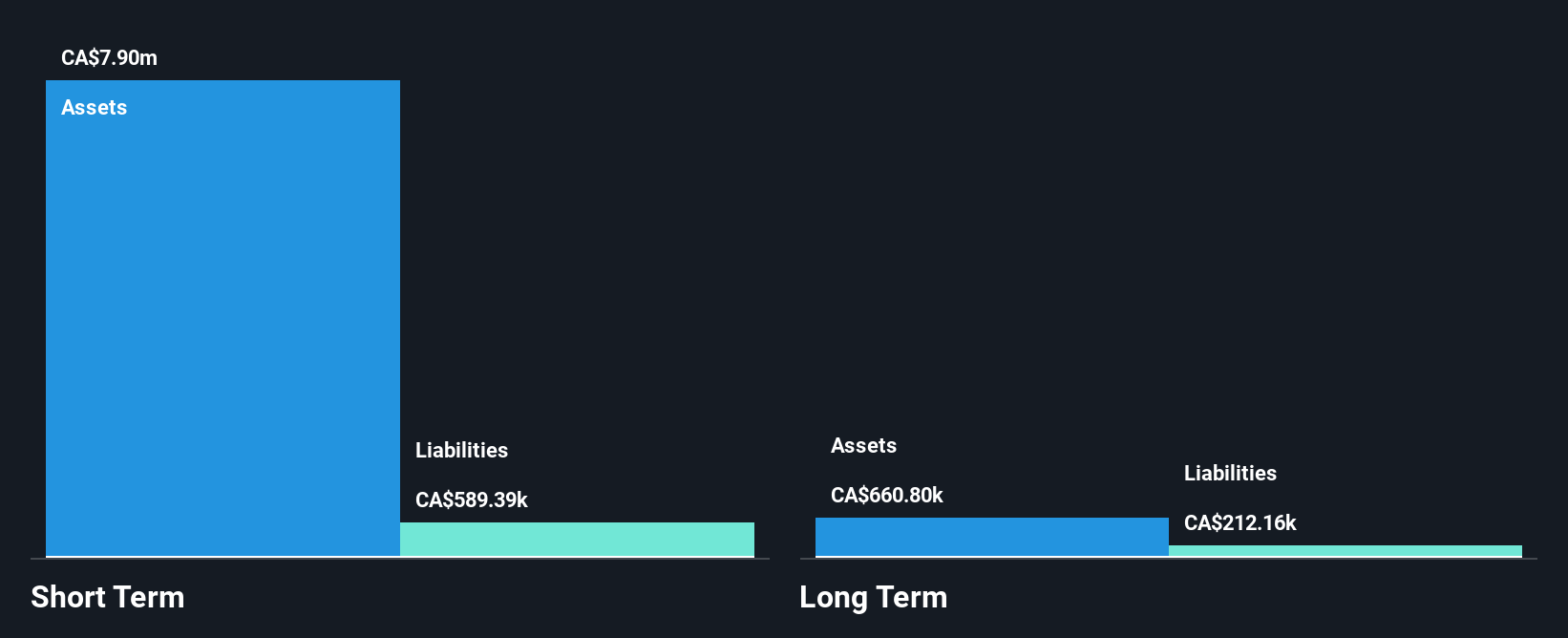

Leading Edge Materials Corp., with a market cap of CA$60.01 million, is pre-revenue and unprofitable but has made strides in reducing losses over the past five years. The company's management and board are experienced, with average tenures of 3.4 and 5.6 years respectively, while shareholders have not faced significant dilution recently. Despite high volatility compared to other Canadian stocks, its short-term assets exceed liabilities by CA$703K; however, long-term liabilities remain uncovered by current assets. The Norra Karr project could address European supply constraints for heavy rare earth elements amidst global geopolitical tensions affecting these critical materials.

- Click here and access our complete financial health analysis report to understand the dynamics of Leading Edge Materials.

- Explore historical data to track Leading Edge Materials' performance over time in our past results report.

SPARQ Systems (TSXV:SPRQ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SPARQ Systems Inc. designs, manufactures, and sells single-phase microinverters for residential and commercial solar electric applications with a market cap of CA$80.69 million.

Operations: SPARQ Systems generates revenue primarily from its Electric Equipment segment, totaling CA$2.52 million.

Market Cap: CA$80.69M

SPARQ Systems, with a market cap of CA$80.69 million, is positioned in the growing solar industry but remains unprofitable despite revenue growth to CA$1.08 million in Q3 2025. The company has developed innovative products like the AI-driven grid-power control device and D1200 Duo Microinverter, enhancing its appeal across residential and commercial markets. Its strategic partnerships for distribution in Africa could expand its market reach. SPARQ's financial health is supported by a debt-free status and short-term assets exceeding liabilities; however, meaningful revenue generation remains a challenge as it continues to operate below its estimated fair value.

- Dive into the specifics of SPARQ Systems here with our thorough balance sheet health report.

- Gain insights into SPARQ Systems' outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Get an in-depth perspective on all 391 TSX Penny Stocks by using our screener here.

- Curious About Other Options? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:LEM

Leading Edge Materials

Engages in the exploration and development of resource properties in Sweden and Romania.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026