- Canada

- /

- Metals and Mining

- /

- TSXV:HSTR

Why Heliostar Metals (TSXV:HSTR) Is Up 7.1% After Drill Program Delivers High-Grade Gold Results and Tier 1 Status

Reviewed by Sasha Jovanovic

- Heliostar Metals recently presented significant initial results from its ongoing 15,000-meter drill program at the Ana Paula gold project, highlighting high-grade gold mineralization and operational milestones such as adding a third drill rig and advancing a feasibility study.

- The company has also secured approval to graduate from Tier 2 to Tier 1 issuer status on the TSX Venture Exchange, reflecting an elevated industry profile and underscoring its mid-tier gold producer ambitions.

- We'll explore how these drilling successes and the transition to Tier 1 status enhance Heliostar Metals' investment narrative and growth prospects.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Heliostar Metals' Investment Narrative?

To be a shareholder in Heliostar Metals, you need to believe in the company’s transformation from a junior gold explorer into a mid-tier producer, underpinned by both operational progress and strong exploration results. The latest news about accelerated drilling success at Ana Paula and the graduation to Tier 1 issuer status feeds directly into the two most important short-term catalysts: conversion of inferred gold resources to higher-confidence reserves and achieving feasibility milestones that could drive a potential mine construction decision. These updates add credibility and may help reduce some uncertainties about resource quality or management’s execution, potentially impacting near-term price momentum and analyst estimates. However, the business still faces risks that haven’t disappeared, among them, the need to maintain funding, optimize cost control as drilling expands, and deliver on ambitious annual output targets by 2028.

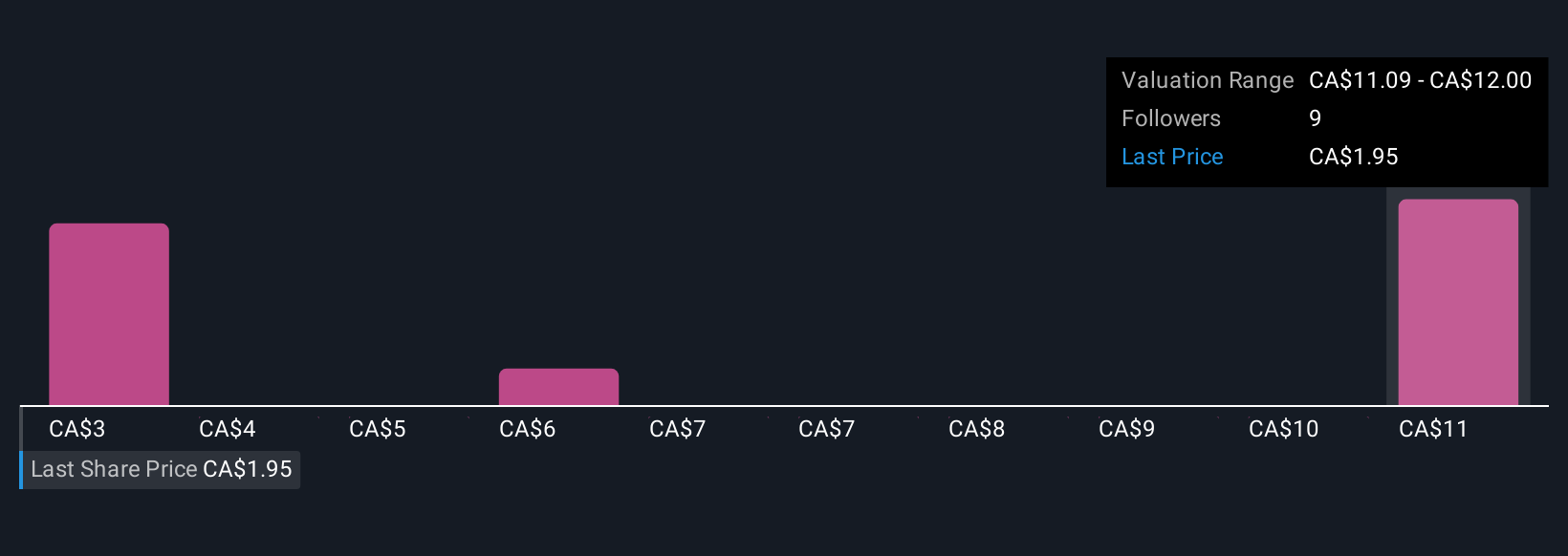

But, crucially, cost pressures from drilling expansion remain a concern for investors. Our valuation report here indicates Heliostar Metals may be undervalued.Exploring Other Perspectives

Explore 3 other fair value estimates on Heliostar Metals - why the stock might be worth over 6x more than the current price!

Build Your Own Heliostar Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Heliostar Metals research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Heliostar Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Heliostar Metals' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heliostar Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HSTR

Heliostar Metals

Engages in the identification, acquisition, evaluation, and exploration of mineral properties in North America.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives