- Canada

- /

- Metals and Mining

- /

- TSXV:TRO

TSX Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As the Canadian market navigates through economic uncertainties and shifting monetary policies, investors are increasingly focusing on sectors driven by technological advancements and potential interest rate adjustments. Penny stocks, though an older term, remain a relevant investment area for those seeking opportunities in smaller or newer companies. When backed by strong financials, these stocks can offer a blend of value and growth that might be overlooked by larger firms.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.64 | CA$66.74M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.39 | CA$3.26M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.32 | CA$878.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.80 | CA$452.18M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.37 | CA$171.04M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.17 | CA$206M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.71 | CA$8.84M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 406 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

AnorTech (TSXV:ANOR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AnorTech Inc. is involved in the acquisition, exploration, development, and mining of mineral resources in Canada and Greenland, with a market cap of CA$9.99 million.

Operations: AnorTech Inc. has not reported any specific revenue segments.

Market Cap: CA$9.99M

AnorTech Inc., with a market cap of CA$9.99 million, is pre-revenue and unprofitable but has reduced losses significantly over the past five years. The company is debt-free, with sufficient cash runway for nearly two years if free cash flow continues to grow. Recent exploration at the Gronne Bjerg Project in Greenland revealed promising high-purity anorthosite, potentially enhancing its future prospects in aluminum applications and CO2-free cement production. Despite a volatile share price and increased net loss in recent earnings reports, AnorTech's strategic developments could position it for long-term growth opportunities within the mining sector.

- Navigate through the intricacies of AnorTech with our comprehensive balance sheet health report here.

- Evaluate AnorTech's historical performance by accessing our past performance report.

GT Resources (TSXV:GT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GT Resources Inc. is involved in the exploration and development of mineral resource properties in Canada and Finland, with a market cap of CA$15.56 million.

Operations: GT Resources Inc. currently does not report any revenue segments.

Market Cap: CA$15.56M

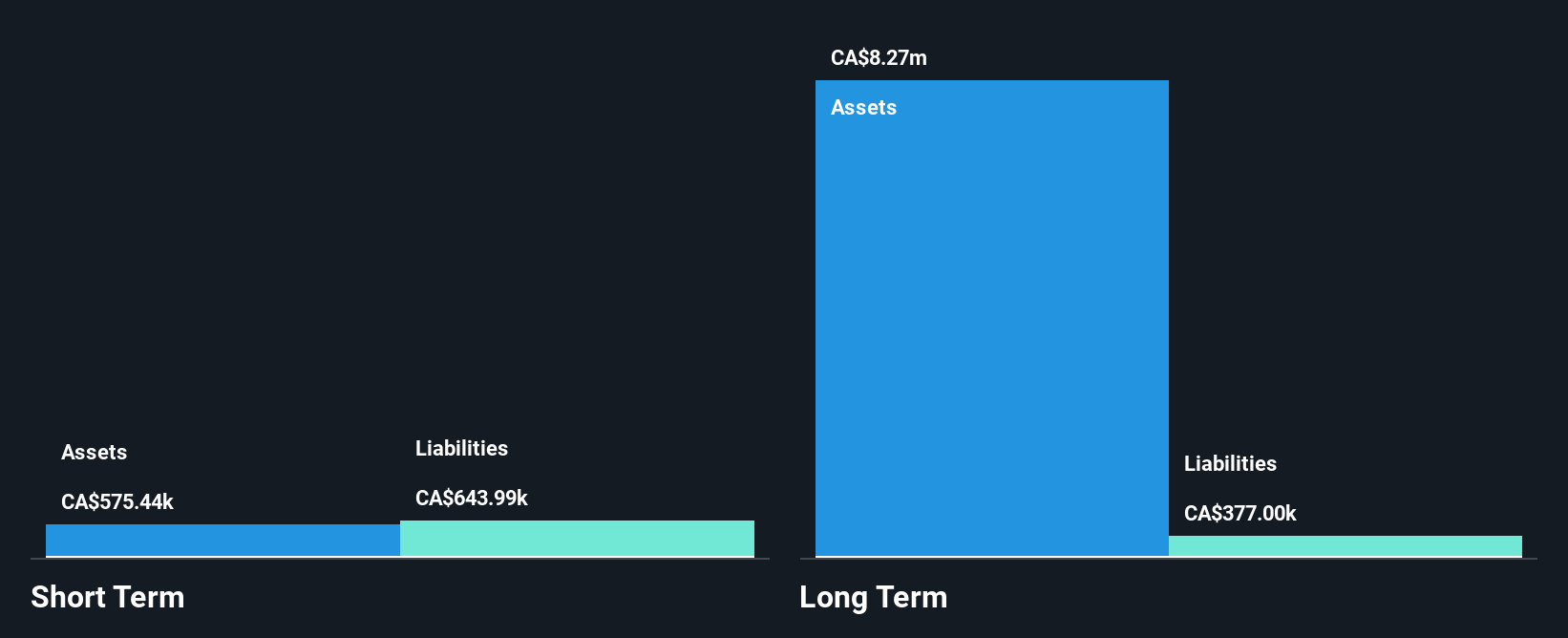

GT Resources Inc., with a market cap of CA$15.56 million, is pre-revenue and unprofitable but has consistently reduced its losses over the past five years by 9.1% annually. The company benefits from a seasoned management team and board, both with over six years of average tenure. It maintains a strong financial position with no debt, ample short-term assets exceeding liabilities, and sufficient cash runway for more than two years even if free cash flow declines at historical rates. Despite high share price volatility, GT Resources' strategic focus on mineral exploration in Canada and Finland offers potential upside in the long term.

- Click here and access our complete financial health analysis report to understand the dynamics of GT Resources.

- Gain insights into GT Resources' past trends and performance with our report on the company's historical track record.

Taranis Resources (TSXV:TRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taranis Resources Inc. is an exploration stage company focused on acquiring, exploring, and developing precious and base metal projects in Canada with a market cap of CA$29.70 million.

Operations: Taranis Resources Inc. does not report any revenue segments as it is currently in the exploration stage, focusing on precious and base metal projects in Canada.

Market Cap: CA$29.7M

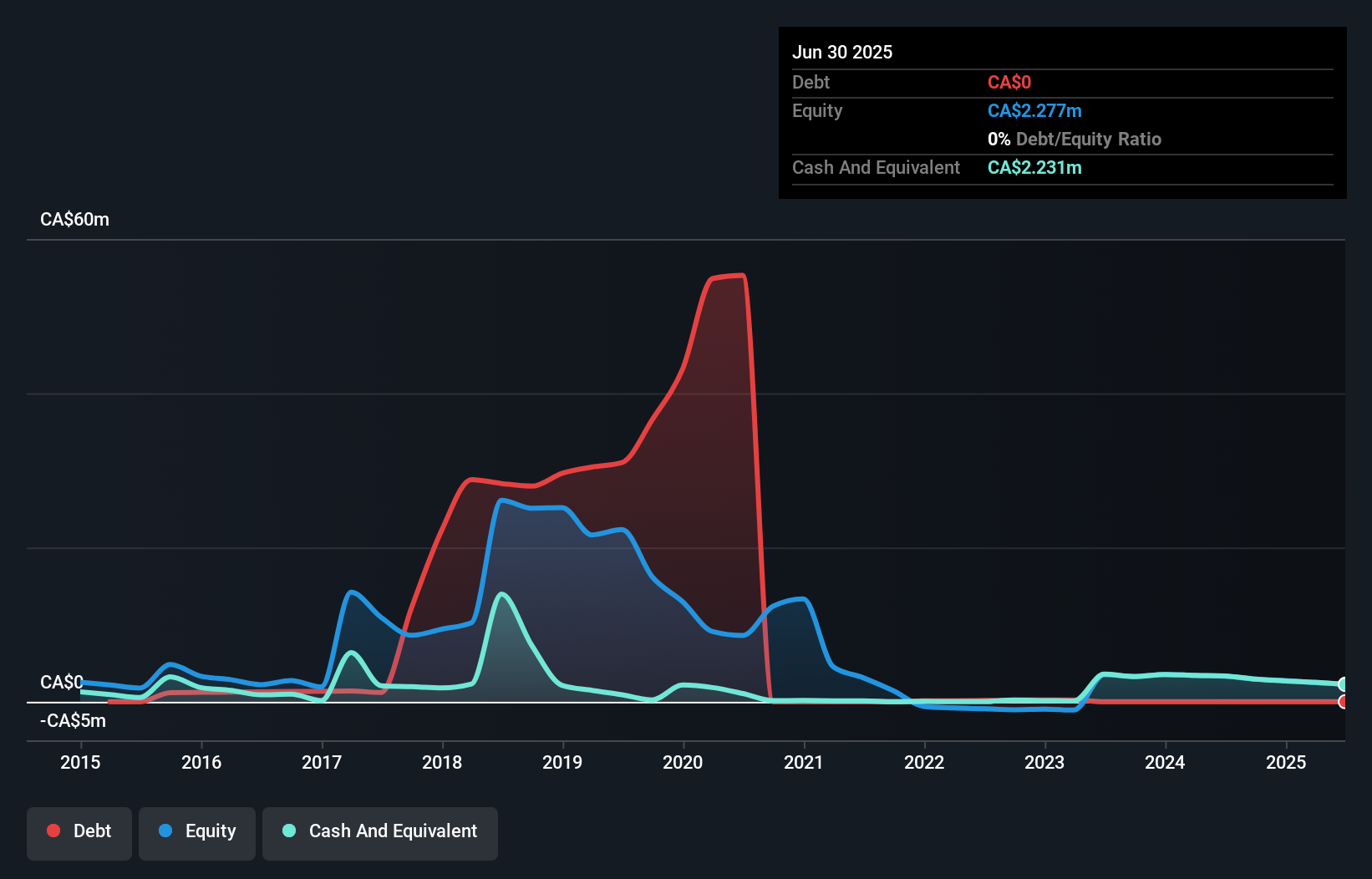

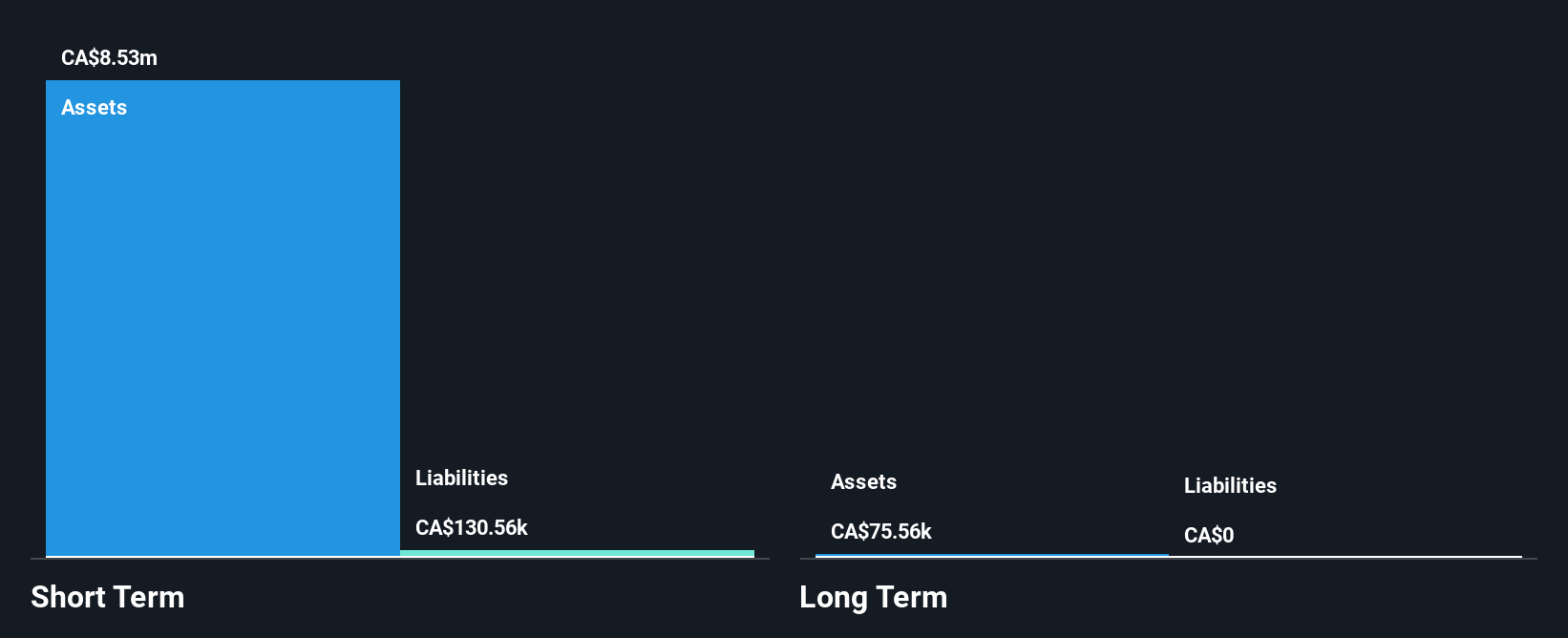

Taranis Resources Inc., with a market cap of CA$29.70 million, is pre-revenue and unprofitable, having increased its losses by 12.1% annually over the past five years. The company recently raised capital through a private placement, enhancing its cash runway to approximately five months based on recent free cash flow estimates. Despite short-term liabilities exceeding assets, Taranis has reduced its debt-to-equity ratio significantly over time and maintains more cash than total debt. Exploration efforts at the Thor project continue to focus on discovering an intrusive body, potentially adding value if successful in uncovering economically viable mineral deposits.

- Click to explore a detailed breakdown of our findings in Taranis Resources' financial health report.

- Explore historical data to track Taranis Resources' performance over time in our past results report.

Key Takeaways

- Dive into all 406 of the TSX Penny Stocks we have identified here.

- Want To Explore Some Alternatives? Uncover 11 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Taranis Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TRO

Taranis Resources

An exploration stage company, engages in the acquisition, exploration, and development of precious and base metal projects in Canada.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)