TSX Penny Stocks Spotlight Arrow Exploration And Two More Hidden Gems

Reviewed by Simply Wall St

As the Canadian market celebrates its third year of a bull run, having gained 67% since October 2022, investors are evaluating where to find opportunities amid ongoing trade tensions and economic shifts. Penny stocks, though an outdated term, still represent a significant area for potential growth as they often involve smaller or newer companies with unique opportunities. In this article, we explore three such penny stocks in Canada that stand out for their financial strength and potential to perform well in the current market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.68 | CA$67.75M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.46 | CA$263.96M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.38 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.15 | CA$798.36M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.03 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$1.90 | CA$838.49M | ✅ 4 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.67 | CA$436.03M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.43 | CA$173.58M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.13 | CA$197.92M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 408 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Arrow Exploration (TSXV:AXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arrow Exploration Corp. is a junior oil and gas company focused on acquiring, exploring, developing, and producing oil and gas properties in Colombia and Western Canada with a market cap of CA$62.89 million.

Operations: The company generates revenue of $79.55 million from its oil and gas exploration and production activities.

Market Cap: CA$62.89M

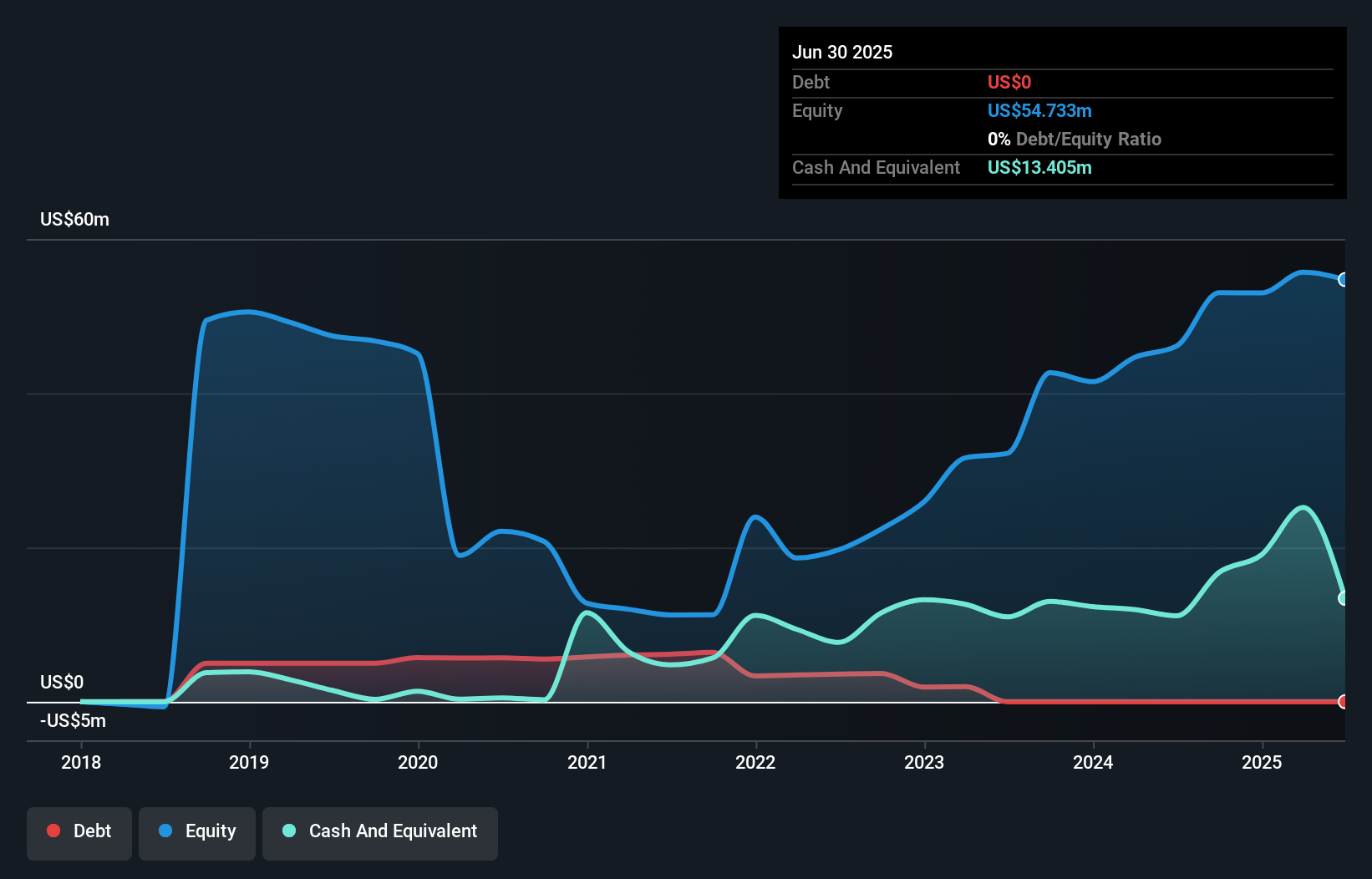

Arrow Exploration Corp. has demonstrated significant earnings growth, with an 865.3% increase over the past year, surpassing industry averages. The company maintains a strong balance sheet with no debt and covers both short-term and long-term liabilities with its assets. Recent drilling activities in Colombia's Llanos Basin have been mixed; while some wells like CN HZ13 are producing at promising rates, others such as Mateguafa Oeste-1 were abandoned due to lack of economic discovery. Despite these challenges, Arrow continues to invest in infrastructure and exploration to bolster production capabilities and reserves base expansion.

- Jump into the full analysis health report here for a deeper understanding of Arrow Exploration.

- Assess Arrow Exploration's future earnings estimates with our detailed growth reports.

Eskay Mining (TSXV:ESK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eskay Mining Corp. is a natural resource company focused on acquiring and exploring mineral properties in British Columbia, Canada, with a market cap of CA$54.10 million.

Operations: Eskay Mining Corp. has not reported any revenue segments, as it is primarily engaged in the acquisition and exploration of mineral properties.

Market Cap: CA$54.1M

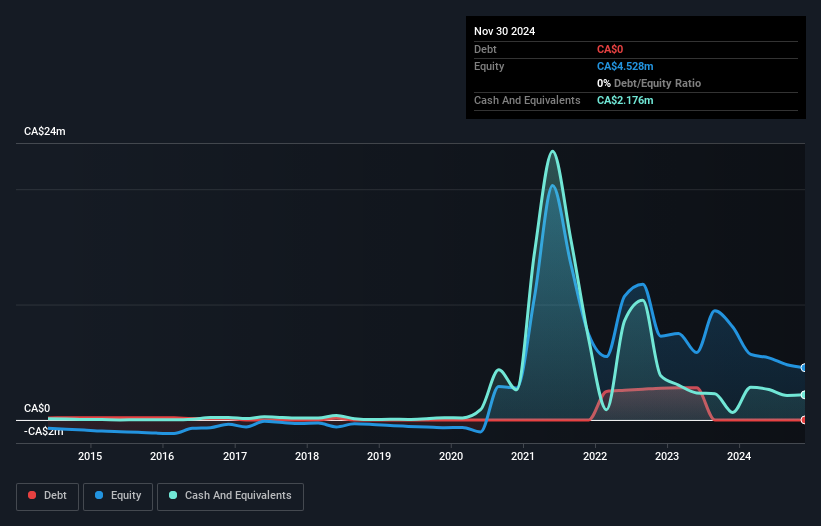

Eskay Mining Corp., with a market cap of CA$54.10 million, is pre-revenue and focuses on mineral exploration in British Columbia. The company has no debt and sufficient cash runway for over three years, though it remains unprofitable with a negative return on equity. Recent exploration efforts at the Consolidated Eskay Project have expanded high-grade gold vein discoveries, showing potential but requiring further development to reach drill-ready status. Despite share price volatility and ongoing losses, Eskay's seasoned management and board provide stability as they continue to explore promising targets within their extensive property holdings.

- Click here to discover the nuances of Eskay Mining with our detailed analytical financial health report.

- Gain insights into Eskay Mining's historical outcomes by reviewing our past performance report.

Pivotree (TSXV:PVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pivotree Inc. designs, integrates, deploys, and manages digital platforms in commerce, data management, and supply chain for retail and branded manufacturers worldwide, with a market cap of CA$39.34 million.

Operations: The company generates revenue from two main segments: Professional Services, which accounts for CA$42.16 million, and Managed & IP Solutions (MIPS) & Legacy Managed Services (LMS), contributing CA$31.33 million.

Market Cap: CA$39.34M

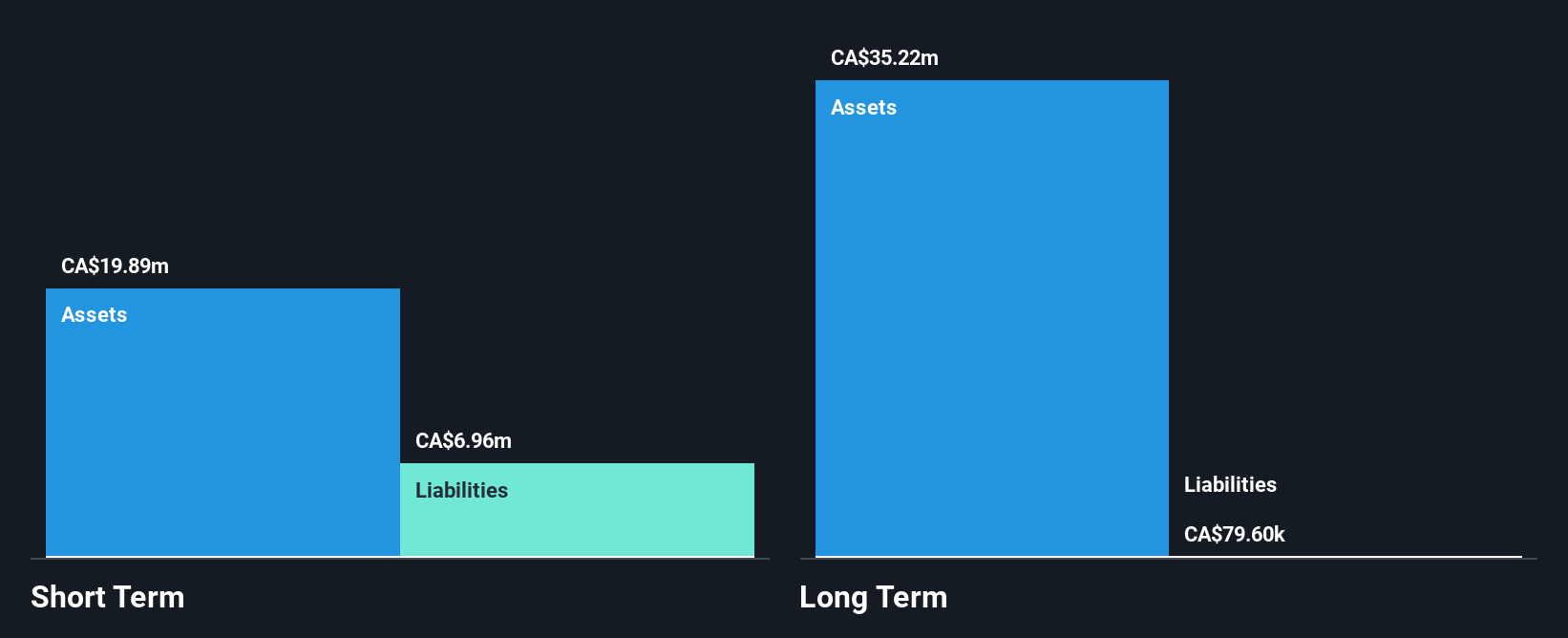

Pivotree Inc., with a market cap of CA$39.34 million, operates in digital platform management and has shown resilience despite being unprofitable. The company reported sales of CA$36.44 million for the first half of 2025, with a net income turnaround to CA$2.77 million from losses the previous year. Pivotree's debt-free status enhances financial stability, while its short-term assets comfortably cover liabilities. Its ongoing share repurchase program reflects confidence in its valuation, trading at good value compared to peers and industry estimates. Though unprofitable, Pivotree maintains a cash runway exceeding three years due to positive free cash flow management.

- Click to explore a detailed breakdown of our findings in Pivotree's financial health report.

- Gain insights into Pivotree's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Investigate our full lineup of 408 TSX Penny Stocks right here.

- Interested In Other Possibilities? The end of cancer? These 27 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PVT

Pivotree

Designs, integrates, deploys, and manages digital platforms in commerce, data management, and supply chain for retail and branded manufacturers worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)